Junior Mining Networ… · 19:45 09 May 2024

Aaz Farma - Farmácia… · 19:40 09 May 2024

O que é? Effaclar é um sérum desenvolvido especialmente para tratar e prevenir acne, as marcas deixadas pela acne e poros visíveis, evitando o acúmulo de… Read More

Daily Themed Crosswo… · 19:40 09 May 2024

Welcome to our website for all “Zoo hopper slangily. Since you are already here then chances are that you are looking for the Daily Themed Crossword Solutions. Look no further because… Read More

Sports Betting News … · 19:34 09 May 2024

Last Updated on May 9, 2024 1:39 pm by Erwin Noguera

Women’s soccer in Mexico is in full swing, as the derby between the two biggest institutions in the country takes place… Read More

Traffic Bot

Bespoke Yacht Charter

Online wholesale shops from China

eMAG BLACK FRIDAY

420 Coupon Codes

Gardening, Home & Wellness

Casino Backlinks

Actors' day

Digital Marketing Blog | Solkri Design | Full Serv

I migliori casino online con slot gratis

SMM Panel

Rent a yacht for Cannes Festivals and Events

London Escorts

Longevity Review

สมัคร gclub เว็บตรง, สมัครจีคลับ, gclub เว็บตรง

Diagnostics

Best Printers Under 10000 in India

https://www.bigjqk.com/

Bespoke Yacht Charter

Online wholesale shops from China

eMAG BLACK FRIDAY

420 Coupon Codes

Gardening, Home & Wellness

Casino Backlinks

Actors' day

Digital Marketing Blog | Solkri Design | Full Serv

I migliori casino online con slot gratis

SMM Panel

Rent a yacht for Cannes Festivals and Events

London Escorts

Longevity Review

สมัคร gclub เว็บตรง, สมัครจีคลับ, gclub เว็บตรง

Diagnostics

Best Printers Under 10000 in India

https://www.bigjqk.com/

Realimagess · 19:22 09 May 2024

Already Google have released Pixel 8 and 8 Pro few months ago, Pixel 8a added to the series like the Pixel 7a. Google Pixel 8a official stock wallpapers for your phone are here for you to do… Read More

Bespoke Yacht Charte… · 19:06 09 May 2024

The post LADY ISABELLA appeared first on Bespoke Yacht Charter Read More

Sports Brackets · 19:01 09 May 2024

The UEFA European (Euro) Championship winners list consists of ten countries to date. More commonly referred to as the UEFA Euros, the major soccer tournament occurs every four years offset… Read More

Blog | Irish Heating… · 18:40 09 May 2024

When it comes to keeping retail properties cool and comfortable, selecting the right air conditioning system is crucial. Not only does it affect the comfort of customers and employees, but i… Read More

Exploring Caribbean · 18:40 09 May 2024

Jamaica is a popular Caribbean destination with plenty of fascinating and fun places to visit. You’ll find everything from historic sites and cultural hotspots to breathtaking beaches… Read More

Xiaomi Pad 6S Pro La… · 18:29 09 May 2024

Ferrari Daytona SP3 specifications and interior: The Ferrari Daytona SP3 is a limited-production mid-engine sports car built by Italian automaker company Ferrari and owned by Piero Ferrari… Read More

Daily Market News · 18:20 09 May 2024

Two unexpected companies now announce layoffs in Georgia according to WARN (Worker Adjustment and Retraining Notification) notices.

It’s important to note that under the Worker Adju… Read More

Don Steve Blog · 18:19 09 May 2024

A. explanation B. communication C. revelation ✓ D. information In Islamic theology and Quranic studies, the term “wahy” holds significant importance… Read More

Carpet Cleaning Nyc … · 18:17 09 May 2024

When it comes to keeping your home clean, My Home Carpet Cleaning NYC recommends having essential tools like:

Vacuum cleaners for dust and dirt

Wet mops for spills

Sponge cloths for wiping s… Read More

Sports News Internat… · 18:02 09 May 2024

Excitement is brewing among New York Yankees fans as they eagerly await the return of star player D.J. LeMahieu. Since the beginning of the season, the team has been missing his skillful pla… Read More

Resep Kue Dan Roti T… · 18:00 09 May 2024

Sekarang sudah banyak kreasi cake yang terbuat dari bahan-bahan yang menghasilkan cita rasa tradisional. Mulai dari penggunaan ekstrak air pandan suji, gula aren, hingga tepung ketan yang te… Read More

يلافوتبولTv · 18:00 09 May 2024

مباراة الأهلي ضد بلدية المحلةع… Read More

Windowthroughtime | … · 18:00 09 May 2024

Nimbyism is one thing, existing residents objecting to a proposal that will affect their peace and quiet, but having the audacity to move into an area and then complain about what you fi… Read More

Epic Nomad Life Solo… · 17:39 09 May 2024

If you’re a solo female traveler seeking travel adventures and breathtaking nature experiences like me, look no further than the stunning Lofoten Islands – one of my favorite and… Read More

Swimming Lesson Club… · 17:31 09 May 2024

Panduan Bermain Poker IDN Play untuk Pemula

Halo para pemula yang ingin belajar bermain poker online! Jika Anda sedang mencari panduan bermain poker IDN Play untuk pemula, Anda berada di te… Read More

Daily Crossword Solv… · 17:22 09 May 2024

Here you may find all the Newsday Crossword May 10 2024 Answers. You can play today's puzzle either online or in the print version at the Newsday Crossword newspaper Read More

Amw Blog · 17:21 09 May 2024

A strong personal brand is essential for succeeding in today’s competitive professional world.

Your personal brand comprises your unique skills, experiences, that differe… Read More

The Dating Advice · 17:19 09 May 2024

In the age of digital communication, the language of love has undergone a radical transformation. Gone are the days of poetic love letters and grand romantic gestures; today, seduction happe… Read More

Ai Gpt Journal · 17:13 09 May 2024

In the world of paid media, where every click and impression matters, AI (artificial intelligence) is changing the game. AI paid media tools are helping marketers become more strategic, effi… Read More

World Music Views® · 17:11 09 May 2024

Wisin, Anitta, Shaggy and Producer Mafio link up for a Reggaeton- Dancehall collaboration titled “Peligrosa.”

The song, set for release May 9, is from Wisin’s upcoming albu… Read More

What's Good Calgary · 16:36 09 May 2024

Calgary has emerged as the most popular city for Canadians planning their summer travels, according to a recent report by Kayak. The 2024 summer travel trends report… Read More

Web Development Comp… · 16:29 09 May 2024

Our team is delighted to announce that we have passed our ISO 27001 Certification!

Over the last year, we have been working diligently to ensure our commitment to security, and we are proud… Read More

Travel To Morocco · 15:57 09 May 2024

The Saadian Tombs are among the most visited places in Marrakech. They were opened to the public in 1917, the year of their discovery.

The Saadian Tombs are closely linked to the Saadian… Read More

Gadget Rumours | Gad… · 15:48 09 May 2024

MSI, a world leader in information technology, has unveiled the MS-C903, a versatile and powerful industrial PC designed to meet the needs of various industries, including manufacturing, tra… Read More

The Pittsburgh Mom · 14:57 09 May 2024

Do you smooch on the Old Mill? @Kenny_Kangaroo #smoochinginthedark #kissykissy #kissinginthedark Read More

Rangeinn · 14:34 09 May 2024

Boeing disclosed on Wednesday that the cybercriminals had demanded a $200 million ransom payment from the firm after using the LockBit ransomware platform to target it in October 2023.

The a… Read More

Mediablog · 14:00 09 May 2024

Psy Post talks about research in which people were given a free subscription to the online version of their closest regional daily newspaper, in both Pennsylvania and North Carolina.Note tha… Read More

The Philosophy Of Th… · 14:00 09 May 2024

Armageddon: What the Bible Really Says about the End by Bart D. Ehrman

My rating: 1 of 5 stars

With a much fuller review of this book now, I can say that each time I think that Bart Ehrman c… Read More

Viaggrego - Rassegne… · 13:58 09 May 2024

Possiamo in qualche maniera tentare di definire un'alfabetizzazione sull'uso dell'Intelligenza Artificiale per i nostri studenti?

Ci hanno provato i promotori di Air For Education, una… Read More

Techbit · 13:53 09 May 2024

Se for hoje comprar uma televisão já é raro não adquirir uma SmartTV que integra com a internet e as várias aplicações disponíveis par… Read More

Ah! E Por Falar Niss… · 13:33 09 May 2024

Trocando as complexas maquiagens dos anos de 1960 e 70, por CGI e captura de movimentos extremamente realista. Planeta dos Macacos ganhou vida nova em 2011. Criando uma nova origem para… Read More

Diário Sobralense - … · 13:15 09 May 2024

Um piloto de parapente teve um incidente na Praia do Farol, em Camocim, no Litoral-Oeste do Ceará. Créditos: Ridyele Oliveira / Sistema ParaísoReproduç&atild… Read More

The Movie Waffler · 13:07 09 May 2024

New trailer for the horror comedy.Read more >>> Read More

James Doan - My Corn… · 13:00 09 May 2024

David Sax’s book, “The Revenge of Analog,” shows how analog experiences have made a surprising comeback. This resurgence is not just about nostalgia; it’s about disco… Read More

Arewaone - Best Fina… · 12:39 09 May 2024

Pastor Miquéias Tiag… · 12:35 09 May 2024

À medida que o Rio Grande do Sul enfrenta o desafio dos desastres naturais, mais de 80% dos municípios foram afetados e, até terça-feira, pelo menos 95 pessoas pe… Read More

Heavy Metal Rarities · 12:32 09 May 2024

Posted by Strappado — 18 minutes ago — Replies 0 — Views 59Artist: Headline►Read More Read More

..::that Grape Juice… · 12:29 09 May 2024

Taylor Swift is making history once again.

More details below…

On Swift’s latest Spotify update, her songs ‘So Long, London’ and ‘Down Bad’ have crosse… Read More

Now Allpress · 12:27 09 May 2024

ENGLISH lessons FOR KIDS

5 + ετων

(Download),

Αγγλικά μαθήματα γ&io… Read More

In Defense Of Commun… · 12:17 09 May 2024

The MEPs of the Communist Party of Greece (KKE) denounce the new anti-communist vileness of the

European Parliament with the distribution of a pre-election

advertisement for participation… Read More

Infinitividades · 12:10 09 May 2024

Os oito vídeos dessa matéria nos ajudam a entender muitos dos fatores que afetam os nossos sistemas climáticos e o clima na Terra

O post 8 Vídeos para entender co… Read More

Atleticanotizie - · 11:59 09 May 2024

L’Athletics Integrity Unit (AIU) ha sospeso provvisoriamente la maratoneta keniana Josephine Chepkoech in seguito ad accuse di doping che coinvolgono la sostanza proibita, il te… Read More

Updated Daily Free H… · 11:50 09 May 2024

The post Wordscapes Answers Daily Puzzle May 10 2024 (5/10/24) appeared first on Your Crossword Answers Read More

Gavin Aleogho's Worl… · 11:13 09 May 2024

-Pst. Gavin Aleogho Recently, something bad happened in my

neighbourhood that made me sad and angry for some days, now. Before I tell you

about what happened, let me give you some… Read More

The Wakefield Doctri… · 11:12 09 May 2024

Welcome to the Wakefield Doctrine (the theory of clarks, scotts and rogers)

This is the Wakefield Doctrine’s contribution to the Six Sentence Story bloghop.

It is hosted by Denise and… Read More

Spiritual Prozac · 11:05 09 May 2024

Health enough to make work a pleasure.Wealth enough to support your needs.Strength enough to battle with difficulties and overcome them.Grace enough to confess your sins and forsake them.Pat… Read More

News24×7 · 10:57 09 May 2024

Russia’ President Vladimir Putin was giving a speech to mark the anniversary of the Soviet victory over Nazi Germany in World War II.

from World News: Top International Headlines Today… Read More

Liberia World News · 10:53 09 May 2024

County Meet 2024: River Gee County Crown Champions for the First Time.

River Gee County clinches the 2024 County Meet football championship, marking the completion of all 15 counties achi… Read More

Harpies Crafty Corne… · 10:32 09 May 2024

This Artist Trading Card was made for a Challenge sponsored by 'Crafty Individuals' over on UK Stampers Forum in the theme of 'Wild Animals' .... I used a set of magazine stamps designed by… Read More

Innovate · 10:08 09 May 2024

Our columnist spent the past month hanging out with 18 A.I. companions. They critiqued his clothes, chatted among themselves and hinted at a very different future.

Kevin Roose | NYTimes Te… Read More

Escafandrista Musica… · 10:00 09 May 2024

@IANSWEEEEET Gènere: #rockalternatiu #popalternatiu #cançódeldia Vint-i-dos anys després del seu llançament, Anthems for a Seventeen Year-Old Girl del… Read More

Discover · 09:38 09 May 2024

The Canadian comedian, known for “American Pie,” “Schitt’s Creek” and now, “The Reluctant Traveler,” isn’t at all reluctant to share what he… Read More

Finest Kind Clinic A… · 09:29 09 May 2024

RFK Jr said he had a brain tapeworm. He did not say what kind of a worm it was, but these doctors thought it was a pork tapeworm.Medical treatment usually consists of a two-d… Read More

Helder Barros · 09:13 09 May 2024

«Cientistas alertam para a “extinção tripla” que irá erradicar toda a vida da TerraOs cientistas previram o momento em que a humanidade assistirá… Read More

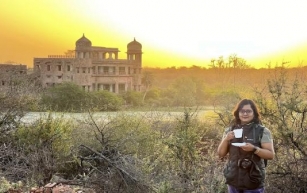

Planet Warrior · 09:11 09 May 2024

At Van Vihar Sanctuary, Rajasthan. Image credit: Arijit NagI woke up to the songs of the birds. I checked the clock. It was just 5:30 am. I had set the alarm to 6 am, but I guess my exciteme… Read More

Carl Jung Depth Psyc… · 09:07 09 May 2024

1. Carl Jung: This Buddha is a parallel to the medieval inner Christ.: Buddha Read More

Ppq · 09:00 09 May 2024

Je brutaler die Meinungsfreiheit genutzt wird, desto wichtiger sind entschiedene Gegenmaßnahmen. Diese um sich greifende selbstgefällige Arroganz ist moralisch offerierter Gesinnu… Read More

Contemporary-Establi… · 08:43 09 May 2024

În lumea muzicii, vestea tragică a trecerii în neființă a lui Steve Albini a îngrijorat și marcat profund fanii muzicii alternative. Albini, celebrul pr… Read More

Reel Naija · 08:42 09 May 2024

The Nigerian Army assessment team said the visit to Gombe to assess the state of barracks infrastructure was crucial to boosting the morale of troops as well as impact positively on their l… Read More

Timomalum.com · 07:21 09 May 2024

"Offended by everything, ashamed of nothing."

And the genocide continues:

At least 34,735 Palestinians have been killed in Israel’s ongoing offensive on the Gaza Strip since las… Read More

Battleroyalewithchee… · 06:32 09 May 2024

Mufasa: The Lion King – Trailer Talk Despite the remake of the beloved classic ‘The Lion King’ looking emotionless and stale, with nothing new to say, it was extremely succ… Read More

Gorebalance · 05:48 09 May 2024

2024年5月15日(水)『オンラインKannaway事業説明会』は諸事情に|… Read More

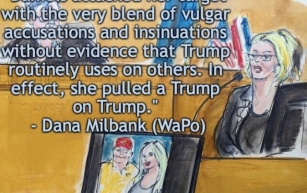

Jobsanger · 05:00 09 May 2024

Hindu God And Goddes… · 04:25 09 May 2024

Akshapada is another name of Gautama, the founder of Nyaya School (300 BCE). He is referred to in tarka vidya (science of argument) and vada vidya (science of discussion). Akshapada was in t… Read More

An Artful Mom · 04:08 09 May 2024

A happy home environment is a good part of any winning lifestyle and we all want to unlock the full potential of our properties. However, while many simply follow interior design trends, tru… Read More

The Art Of Living ..… · 03:28 09 May 2024

Kidney care in the U.S. is at a watershed moment of moving past a deeply entrenched, institutionally racist equation.

https://ift.tt/3uySFBk

from Be Healthy

Always Read More

Articledir Blog · 03:06 09 May 2024

Shield your online presence with VPNs. Enhance Facebook security by encrypting your connection and masking your IP address. VPNs thwart data breaches, tracking, and geographic restrictions… Read More

Penainside.com - Tem… · 03:04 09 May 2024

penainside.com | penainside.com - Tempat berbagi informasi seputar kuliner, traveling, kesehatan dan kecantikan. - Induksi Persalinan: Kapan dan Bagaimana Dilakukannya?

Pernahkah Anda menden… Read More

Profitfromai - Unloc… · 02:52 09 May 2024

The Indian Initial Public Offering (IPO) market continues to buzz with activity, and Aadhar Housing Finance Limited (Aadhar Housing Finance IPO), a prominent player in the affordable housin… Read More

Headline News Online · 02:44 09 May 2024

The south parking lot of Franklin Station, along Memorial Drive in Calgary’s southeast, has been identified by city officials as a site suitable for transit-oriented development.

* Th… Read More

ई-अभिव्यक्ति - साहित… · 02:20 09 May 2024

डॉ राकेश ‘ चक्र’

(हिंदी साहित्य क… Read More

Tom Fuszard, Content… · 00:58 09 May 2024

An avid reader, I’ve stumbled across numerous writing errors over the years. And I’ll admit to making my share. But I still try for error-free copy. Other writers will attest to… Read More

Gabriel Maciel · 23:43 08 May 2024

Saiba mais sobre o Bearded Collie, uma raça de cão de origem escocesa com uma história fascinante. Descubra suas características Read More

Dulce Relato · 22:50 08 May 2024

Soy originario de un pueblito muy pequeño de México, toda mi infancia se desarrolló en él sin mayores acontecimientos que los chismes de los amigos. Al paso del [… Read More

Doggy Tidbits · 22:27 08 May 2024

Sipcyp Blog · 22:17 08 May 2024

Dim lights, ditch screens & unwind! Nighttime habits to boost brainpower, improve memory & sleep soundly. #BrainHealth #SleepHygiene Read More

Wizkid And Davido En… · 21:45 08 May 2024

Introduction "Welcome to your ultimate Amazon shopping guide curated specifically for active women! Whether you're hitting the gym, heading outdoors, or simply running errands, we've ha… Read More

Lcbo Vintages Wine P… · 21:41 08 May 2024

Tonight's red wine review is a fully and completely delicious Bordeaux-varietal red blend from Niagara that returned to the LCBO last month in the April 27 LCBO VINTAGES New Release Collecti… Read More

Foodpackstore Blog · 21:00 08 May 2024

While the exact origins of Pumpkin Chili are unclear, its roots can be traced back to the rich culinary traditions of North America. Pumpkins, a staple of Indigenous American cuisine, have b… Read More

The Latest Popular C… · 20:52 08 May 2024

線上看: 不可告人

主演: 歐豪 / 李一桐 / 楊玏 / 張國強 / 胡連&#… Read More

Shopping And Offers · 20:19 08 May 2024

Timberland Coupon Code, Promo Codes & Deals. Save up to 80% off verified Timberland Discount code On footwear, clothing, accessories & more.

About Timberland

Site h… Read More

![Six Sentence Story -the Wakefield Doctrine- ‘…of Heroes and the MisUnderstood’ [Cyrus-Lou-Anya] Six Sentence Story -the Wakefield Doctrine- ‘…of Heroes and the MisUnderstood’ [Cyrus-Lou-Anya]](http://cdn.blogarama.com/images/posts_thumbs_site_id/1922/192212-811006238.w307.h193.jpg)