Junior Mining Networ… · 19:39 13 May 2024

Atlanta Web Design B… · 19:30 13 May 2024

To enhance security and improve deliverability, Google has introduced new requirements for Sender Policy Framework (SPF) and DomainKeys Identified Mail (DKIM).

The post Google’s New S… Read More

The Natchez Trace Tr… · 19:23 13 May 2024

Imagine yourself laying low in the tall grass, waiting to hear the faint rustle of wings and the unmistakable gobble of a wild turkey.

If you are new to turkey hunting, we’re here to… Read More

Wild About Travel · 18:59 13 May 2024

Sleepy in winter and crowded in summer, Portofino is one of Italy’s most sought-after destinations and a favorite by celebrities. This charming village is close to the Cinque Terre and… Read More

Gardening, Home & Wellness

Best Printers Under 10000 in India

Digital Marketing Blog | Solkri Design | Full Serv

London Escorts

https://www.bigjqk.com/

I migliori casino online con slot gratis

สมัคร gclub เว็บตรง, สมัครจีคลับ, gclub เว็บตรง

Longevity Review

SMM Panel

Rent a yacht for Cannes Festivals and Events

Diagnostics

briquet pas cher

Tem Teknoloji - Online Alışveriş Platformu

Bespoke Yacht Charter

Actors' day

Online wholesale shops from China

Traffic Bot

Casino Backlinks

eMAG BLACK FRIDAY

Best Printers Under 10000 in India

Digital Marketing Blog | Solkri Design | Full Serv

London Escorts

https://www.bigjqk.com/

I migliori casino online con slot gratis

สมัคร gclub เว็บตรง, สมัครจีคลับ, gclub เว็บตรง

Longevity Review

SMM Panel

Rent a yacht for Cannes Festivals and Events

Diagnostics

briquet pas cher

Tem Teknoloji - Online Alışveriş Platformu

Bespoke Yacht Charter

Actors' day

Online wholesale shops from China

Traffic Bot

Casino Backlinks

eMAG BLACK FRIDAY

What's Good Calgary · 18:57 13 May 2024

A woman from Calgary, Michele McWilliam, recently won $100,000 in the lottery. She expressed that she is “still shocked” by the win. Michele won the mone… Read More

كلمات اغاني… · 18:55 13 May 2024

كلمات اغنية معالم حنيني برهان ف… Read More

Hotelescape · 18:50 13 May 2024

Traveling can be an incredibly romantic experience. So much so that you don’t even have to be on a romantic trip with someone else… Read More

Your Life Matters Em… · 18:44 13 May 2024

nurse vests are a crucial garment in the healthcare industry. They provide not only functionality but also professionalism to the nurse’s uniform. These vests come in various styles, c… Read More

Cryptocurrency News … · 18:43 13 May 2024

The cryptocurrency world has experienced a surge in activity following the reappearance of Keith Gill, better known as “Roaring Kitty,” o… Read More

Rock And Blues Muse · 18:29 13 May 2024

Blues Legend Barry Goldberg Battling Cancer--GoFundMe Established Barry Goldberg, the Chicago-born bluesman and keyboard master celebrated for backing Bob Dylan at Newport, founding The Elec… Read More

Lifestyle Clotheslin… · 18:28 13 May 2024

How High Should a Clothesline Be? And Other Clothesline FAQs Answered Wondering how high should a clothesline be? To ensure ease of use and practicality, aim for a height… Read More

Dancehallmag · 18:23 13 May 2024

Attorneys representing Dancehall artist Vybz Kartel have submitted a habeas corpus application to the Supreme Court, advocating for his and other men’s immediate release, the Gleaner h… Read More

Supermommy.io · 18:22 13 May 2024

As a parent, one of the most important decisions you will make for your baby is what to feed them. With so many options available on the market, it can be overwhelming to choose the best nu… Read More

Dreamers Creative Wr… · 18:20 13 May 2024

This article will break down objective vs subjective in an easy-to-understand manner, guiding you through their meanings and uses in writing Read More

Carpet Cleaning Nyc … · 18:17 13 May 2024

When it comes to embracing green cleaning, My Home Carpet Cleaning NYC prioritizes a healthier home and environment by reducing chemical exposure, using eco-friendly products, adopting susta… Read More

Daily Market News · 18:12 13 May 2024

A famous restaurant now files for bankruptcy in Florida after reporting massive dept compared to their available assets.

Brocato’s Sandwich Shop has filed for Chapter 11 bankruptcy… Read More

Realimagess · 18:08 13 May 2024

Polestar Phone was the EV giant first mobile device, which was launched with Polestar 4. Polestar Phone official stock wallpapers for your phone are here for you to download and apply. The h… Read More

Windowthroughtime | … · 18:00 13 May 2024

A review of Triple Quest by E R Punshon – 240409

The thirty-fourth and penultimate novel in Punshon’s long running Bobby Owen series was originally published in 1955 and h… Read More

Yve.ro · 18:00 13 May 2024

Horoscop 14 Mai 2024: Astăzi, nativii Taur se vor ocupa de trecut, iar nativii din zodia Rac sunt dispuși să acorde o mână…

Citeste articolul complet AICI … Read More

Tampa Bay Parenting … · 17:57 13 May 2024

LEGOLAND Florida Resort is about to kick off an EPIC summer season with its annual Summer Brick Party! This three-month-long celebration will feature new shows, characters, seasonal treats… Read More

Vpn · 17:54 13 May 2024

Volgens The Information zal OpenAI hoogstwaarschijnlijk maandagavond een nieuwe, multimodale AI-assistent aankondigen tijdens een livestream. De nieuwe assistent kan o.a. tegen mensen praten… Read More

Thinkjr - Leader In … · 17:54 13 May 2024

Engaging in art activities has numerous benefits for children, from enhancing their creativity and imagination to improving their cognitive and motor skills. While many parents may think of… Read More

Xiaomi Pad 6S Pro La… · 17:46 13 May 2024

Realme GT 6T Price and Launch Date in India: Realme has announced a new phone for the Indian market.which has already been launched in China by the name of Realme GT Neo 6 SE. This will be t… Read More

Visigistics Blog · 17:45 13 May 2024

Today's businesses prioritize optimizing supply chains to stay competitive and profitable. Achieving this requires expertise in dynamics and emerging technologies. Read More

Website Design Dayto… · 17:27 13 May 2024

Boosting Visibility:

When considering “what does SEO do for my website,” the primary benefit is enhancing its visibility on search engines. SEO techniques optimize various aspect… Read More

Fiction From K Brown · 15:59 13 May 2024

I poured a lot of myself into this 'prequel.' Actually, Jane, the Early Years, and Jane, were a single story, of which the second part just happened to be published first. … Read More

Techbit · 15:45 13 May 2024

Os modelos Ultra da Samsung integram, por hábito, 4 câmaras. No entanto, surgiu agora um rumor que indica que o novo Samsung Galaxy S25 Ultra poderá chegar com apenas 3 c… Read More

Helder Barros · 15:27 13 May 2024

«DAVID ARAÚJO SAGRA-SE CAMPEÃO NACIONAL DE BOCCIA 13 DE MAIO DE 2024 11:17FC Porto apresentou nove atletas e obteve cinco pódios.O portista David Araúj… Read More

Atleticanotizie - · 15:22 13 May 2024

Venerdì 17 maggio, segnatevi questa data sul calendario. Alle ore 15.00, la Sala Conferenze dello Stadio Olimpico (ingresso Curva Nord – Largo Ferraris IV) si trasformer… Read More

Home - Cherry Tree C… · 15:15 13 May 2024

A country check shirt isn’t just an ordinary piece of clothing; it’s a symbol of outdoor adventure and timeless style. With its classic check pattern and rugged charm, it stands… Read More

Viaggrego - Rassegne… · 15:11 13 May 2024

Oggi vi mostro come, grazie all'Intelligenza Artificiale, è possibile costruire un proprio logo o quello della classe, senza dover investire una marea di ore o ingenti somme di… Read More

Mind Of A Lonely Guy · 15:04 13 May 2024

How On God's Green Earth Did A Dragon Fall In Love With A DonkeyFeel free to check it out! Read More

All About Gsm Soluti… · 14:52 13 May 2024

Vivo v23E pd2150f NV and RPMB file for repair Corrupted NV data and damaged imei and network.Download : LINK

Plz Note: Paid File

Payment Methods: USDT, Bk… Read More

Pastor Miquéias Tiag… · 14:46 13 May 2024

Introdução: Em Provérbios 12:17, somos confrontados com uma poderosa verdade: “Quem fala a verdade manifesta a justiça, mas a testemunha falsa, a… Read More

..::that Grape Juice… · 14:31 13 May 2024

Rihanna has a reason to celebrate, because her son RZA has reached a major milestone.

More details below…

The “Umbrella” songstress hosted a private party at Color Facto… Read More

In Defense Of Commun… · 14:30 13 May 2024

With a written question addressed to the Greek Foreign Minister G. Gerapetritis, the Parliamentary Group of the Communist Party of Greece (KKE) demands the immediate recognition of a Palesti… Read More

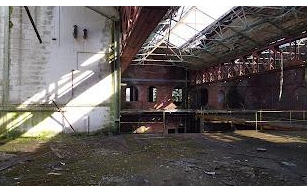

Derelictmanchester · 14:30 13 May 2024

Constructed in 1897, the Old Drill Hall on Rifle Street in Oldham's St. Mary's district served as a significant training facility for local volunteer forces. The building's distinctive caste… Read More

Picking Up Nickels · 14:23 13 May 2024

Here are my current financial assets as of the market close on May 10th, 2024:

Asset

Apr 2024

May 2024

Change

Checking

1,960

2,984

1,024… Read More

The Estetic Of Sense… · 14:06 13 May 2024

Adore Charlotte - Pa… · 14:02 13 May 2024

Are you searching for the perfect middle name complementing Aurora’s radiant first name? I’m glad you’ve found this blog post. I’ve chosen the most beautiful middle n… Read More

Socraticgadfly · 14:00 13 May 2024

A month ago, I offered my critical thoughts ("critical" in the more technical, more than psychological) on Mondoweiss claiming that President Biden's knee-jerk support of Bibi Netanyahu and… Read More

Jill Of All Trades · 13:19 13 May 2024

Good morning. It's another wet morning here but should clear a bit later. It had better because I have errands to run. The photo is the dam at our cabin area. Last we… Read More

Das Grüne Archiv · 13:11 13 May 2024

Das alte Wissen der keltischen Druiden wird noch heute von vielen sehr geschätzt. Ihr Handwerk inspiriert gerade Kräuterliebhaber, aber auch Historiker, Maler, Mystiker und Naturwi… Read More

The Movie Waffler · 13:10 13 May 2024

A young girl discovers a terrifying secret as her body goes through

puberty.Read more >>> Read More

Arrojada Mix · 13:00 13 May 2024

Olá pessoal, vamos de resenha capilar?Resenha Spray Revitalizante Cachos da Onda DaBelleSabe aquele dia que precisa de um up nos cabelos? Já precisou revitalizar os cachos no d… Read More

Clásicos Para Aprend… · 12:40 13 May 2024

Esta entrevista tuvo lugar en 1.927, y en ella Arthur Conan Doyle

se refiere a cómo llegó a inventar a su famoso personaje Sherlock Holmes

y defiende el espiritismo, una

activi… Read More

Battleroyalewithchee… · 12:03 13 May 2024

Ain’t No Back To A Merry-Go-Round: Review. By Richard Schertzer. In the early 1960s, there was a park called Glen Echo and it was a nice respite from the daily activities of life. It&r… Read More

Gadget Rumours | Gad… · 12:02 13 May 2024

In the beginning: Are vCard files leaving your possession? And you’re attempting to organize your VCF (vCard) files. Don’t worry; we’ll cover what you need to know to &ldqu… Read More

Gravetapping · 12:00 13 May 2024

This profile of Noah Beery Jr., which appeared

in the June 24, 1979 issue of the Salt Lake Tribune, is a pleasure to

read. I love that Beery and his family lived in an old mot… Read More

Updated Daily Free H… · 11:50 13 May 2024

The post Wordscapes Answers Daily Puzzle May 14 2024 (5/14/24) appeared first on Your Crossword Answers Read More

Learn India : Digihi… · 11:31 13 May 2024

Table of Contents Introduction Color Selection Room Specific Ideas Accent Walls Patterns and Textures Paint Finishes Eco-Friendly Options Tools and Techniques FAQs Conclusion Introduction In… Read More

Contentment Acres · 11:27 13 May 2024

We're back. We had a WONDERFUL time! We saw the Corolla horses multiple times a day every day we were there. Clint enjoyed the downtime and beautiful scenery. Emily and Hannah fell in love w… Read More

News24×7 · 10:48 13 May 2024

By Livia Albeck-Ripka from NYT U.S. https://ift.tt/UMtCKvD Read More

Comic Book And Movie… · 10:42 13 May 2024

Bee Lab Creations has published a 64-page sci-fi graphic novel called 'Urlan, Cosmic Cat', which revolves around the titular character's thrilling adventures in space. It was written by the… Read More

Wings Of Dreams Onli… · 10:24 13 May 2024

Color plays a significant role in interior design, as different colors can evoke various emotions and affect the overall mood of a room. By understanding the psychology of color, you can cre… Read More

Now Allpress · 10:24 13 May 2024

TΗΕ ENGLISH GRAMMAR TODAY DOWNLOAD με 8 τάξεις, από A ω&sigm… Read More

Escafandrista Musica… · 10:00 13 May 2024

@niluferyanya Gènere: #rockalternatiu #cançódeldia Nilüfer Yanya torna amb el seu nou single i videoclip Like I Say (I runaway).

La entrada Nilüfer Yanya… Read More

Discover · 09:38 13 May 2024

Paintings, ceramics, photography, fashion, furniture and more: The Victoria and Albert Museum is a treasure trove of art and design. Here’s one besotted visitor’s plan for takin… Read More

Teknoplug.com · 09:28 13 May 2024

ASUS kembali menghadirkan produk baru dari seri Republic of Gamers atau yang sering dikenal sebagai ASUS ROG. Para gamer mungkin sangat menantikan keluarnya ROG Strix Scar 18 karena digadang… Read More

Ppq · 09:00 13 May 2024

Der Absturz des Halleschen FC, der sich seit Jahren ankündigte, hat sich jetzt vollendet.Es hat diesmal einfach alles perfekt gepasst, von Anfang an. Die Zeichen an der Wand waren un&uu… Read More

Menoopiù Blog · 08:53 13 May 2024

Sergej Shoigu licenziato

Putin licenzia dopo 12 anni il ministro della Difesa Sergej Shoigu, impantanato in Ucraina, sostituito con l'economista Belousov, e dopo 16 anni il capo del C… Read More

Headline News Online · 08:35 13 May 2024

As the population grows and ages, new cancer cases and deaths from the disease in Canada are increasing, the authors of the CMAJ study say.

* This article was originally published here

The… Read More

The Art Of Living ..… · 08:28 13 May 2024

Three women with eczema describe how they combat nighttime flare-ups.

https://www.webmd.com/

from Be Healthy

Always Read More

Gorebalance · 08:03 13 May 2024

2024年5月9日(木)開催の、re.Balance会員限定Zoom会議の録画が&#… Read More

Blog Info Jasa Revie… · 08:02 13 May 2024

PurbaIingga - Polda Jateng | Seorang pria warga Kecamatan Mrebet, Kabupaten Purbalingga meninggal dunia akibat gantung diri. Pria tersebut ditemukan gantung diri pada pohon durian di belakan… Read More

Der Wikifolio - Mana… · 07:30 13 May 2024

Ich habe keinerlei Meinung, wo der Markt in 12 Monaten steht. Ich konzentriere mich auf das hier und jetzt. Meine geplante Aufteilung des angelegten Vermögens (wieviel % des… Read More

The 1001 Albums You … · 07:18 13 May 2024

Captain Beefheart, born Don Van Vliet, is an emblematic figure of experimental rock. Known for his avant-garde works and radical approach to music, Beefheart and his group, The Magic Band, h… Read More

Objektmöbel Journal … · 07:00 13 May 2024

Wenn es schnell gehen muss und trotzdem gesund sein soll, dann bietet sich ein Kombidämpfer in der Küche an. Doch

Der Beitrag Kombidämpfer: Ein Muss in der Küche oder nur… Read More

Reel Naija · 06:42 13 May 2024

Convicted felons should be made to serve long jail terms, while their vessels and trucks are forfeited to the government.

The post EDITORIAL: Massive Oil Theft: Calling for greater maritime… Read More

View From The Ambo · 06:30 13 May 2024

Thou in toil art comfort sweet, Pleasant coolness in the heat, solace in the midst of woe.The Gift of FortitudeThe Gift of Fortitude By the gift of Fortitude the soul is strengthened against… Read More

Put aside the all-new iPad Air 6: Amazon just dropped the price of the iPad Air 5 to an all-time low

Techkip.com · 06:28 13 May 2024

A touching farewell for the iPad Air 5.

Apple unveiled the iPad Air 6 earlier this week, opening up enticing deals on previous models like the iPad Air 5. For a limited time, Amazon is of… Read More

Beyond Sleep · 06:09 13 May 2024

The Savvy Nº5 – A Bespoke Haven for Living, Dreaming, and Embracing Real Life Good sleep is not just a necessity; it’s an experience that can transform our physical and ment… Read More

Rangeinn · 06:07 13 May 2024

The University of Edinburgh is offering the Edinburgh Global Masters Scholarship for the 2024-25 academic year. This prestigious scholarship is available to international students who wish t… Read More

Sri Lanka Travel Blo… · 05:58 13 May 2024

Sigiriya, a UNESCO World Heritage Site, stands as an awe-inspiring testament to the ingenuity and grandeur of ancien… Read More

Crypto News Online H… · 05:56 13 May 2024

He also reiterated his proposal for an international safety agency aimed at safeguarding against existential threats associated with AI.

OpenAI CEO and Tools for Humanity Chairperson Sam… Read More

Foxton News · 05:52 13 May 2024

Officials stated that the pilot of the twin-turboprop Beechcraft Super King Air raised the alarm shortly after it had taken off from Newcastle Airport, located north of Sydney.

In Melbour… Read More

Carpe Librum · 05:47 13 May 2024

Thanks to everyone who entered my giveaway last week to win a copy of Suddenly Single At Sixty by Jo Peck thanks to Text Publishing. All entrants correctly identified the book is an 'inspiri… Read More

Nz Warriors 2017 Sea… · 05:38 13 May 2024

After their frustrating loss to the Knights, the Warriors remained across the ditch to face the Sydney Roosters. After a barnstorming 20 minutes, the Roosters held a dominant lead and, despi… Read More

Zivilrecht Verstehen · 05:00 13 May 2024

Eine neue Entscheidung des Bundesgerichtshofs beschäftigt

sich mit der Schwarzgeldabrede. Alle Studierenden im Jurastudium dürften die

Problematik aus dem Werkvertragsrecht kennen… Read More

Jobsanger · 05:00 13 May 2024

Hindu God And Goddes… · 04:25 13 May 2024

Amaru Shataka, also written as Amarusataka, is a poem consisting of a hundred love lyrics. It is a collection of hundred verses on the subject of love, composed by Amaru or Amaruka, about wh… Read More

Profitfromai - Unloc… · 04:09 13 May 2024

[Collection]

In the competitive US job market, some major firms stand out by offering new starters salaries above the average local wage.

Based on data collected from Indeed, this latest… Read More

Just Minding My Own … · 04:01 13 May 2024

Website design is constantly evolving. Staying ahead of the curve with modern aesthetics and functionality is paramount. We can understand the importance of creating a website that looks vis… Read More

Shoeography · 03:52 13 May 2024

This year, let's honor Earth Month not just this April, but year-round, by championing sustainable and ethical footwear brands like Saucony, Merrell, Chaco Sandals, and CAT Footwear. With th… Read More

One Page Is All · 03:24 13 May 2024

That is if you care.love-driven schizoaffective depressive-type abuse Read More