Successful Journey N… · 20:16 05 May 2024

Zenniereport News · 20:12 05 May 2024

Oakland (Special to ZennieReport.com) – The recent column by Scott Osler in the San Francisco Chronicle and titled “Lawsuit endangers A’s purchase of Alameda County’s… Read More

Investing Into Stock… · 20:00 05 May 2024

Last week, we didn’t have enough votes to have a valid contest. We need at least five people to vote according to rules below to make the contest a valid one. Please vote in the commen… Read More

Patio Productions · 19:55 05 May 2024

Meet Pyromania, a passionate team of artisans dedicated to crafting innovative, fire-centric pieces that elevate outdoor living spaces to new heights of warmth and elegance. In the vibrant h… Read More

Traffic Bot

Bespoke Yacht Charter

Online wholesale shops from China

eMAG BLACK FRIDAY

420 Coupon Codes

Gardening, Home & Wellness

Casino Backlinks

Actors' day

Digital Marketing Blog | Solkri Design | Full Serv

I migliori casino online con slot gratis

SMM Panel

Rent a yacht for Cannes Festivals and Events

London Escorts

Longevity Review

Best Printers Under 10000 in India

https://www.bigjqk.com/

Bespoke Yacht Charter

Online wholesale shops from China

eMAG BLACK FRIDAY

420 Coupon Codes

Gardening, Home & Wellness

Casino Backlinks

Actors' day

Digital Marketing Blog | Solkri Design | Full Serv

I migliori casino online con slot gratis

SMM Panel

Rent a yacht for Cannes Festivals and Events

London Escorts

Longevity Review

Best Printers Under 10000 in India

https://www.bigjqk.com/

Latest Sa Music And … · 19:46 05 May 2024

Yanga Chief Mbali Yam Mp3 Download

Yanga Chief releases this new red hot single which have catapulted with lots of viewers and a talk of the town in SA titled Mbali Yam… Read More

Fakazahiphop · 19:36 05 May 2024

Fiso El Musica & Thee Exclusives Buyisa ft Sims Makoya X Faith Strings Mp3 Download

Fiso El Musica & Thee Exclusives releases this new red hot single which have catapulted wit… Read More

Colorado Outdoor Pic… · 19:36 05 May 2024

Embracing the Warmth: A New Season UnfoldsAfter a stretch of chilly days, Denver is finally basking in the warmer embrace of spring. The sun is out, the wind has settled, and hints of summer… Read More

Travel Beauty Blog · 19:33 05 May 2024

20 stylish ways to wear an Adidas Samba outfit

Continue reading 20 Adidas Samba Outfit Ideas + Easy Styling Tips at Travel Beauty Blog Read More

Urbanmatter Chicago · 19:22 05 May 2024

The Chicago Bears are having a moment right now. There’s no denying that. And unless you’ve been living under a rock since mid-January you’ve felt the hype of this moment… Read More

Dreamers Creative Wr… · 18:54 05 May 2024

Congratulations to the winners of the Dreamers 2024 Place and Home Contest, based on the theme of migration, place & home Read More

Carpet Cleaning Nyc … · 18:17 05 May 2024

When cleaning for allergies, My Home Carpet Cleaning NYC recommends utilizing microfiber cloths to trap dust. Damp cloths should be used to prevent allergens from spreading. Dusting should b… Read More

Keywordluv - Niche L… · 18:11 05 May 2024

The Power Of Educational Technology https://t.co/MO5YaJ95qY #education #technology #PlaceToFindInfo— placetofind.info via Brand X Read More

Dancehallmag · 18:07 05 May 2024

Dancehall artist Pamputtae is responding to month-long claims of being a callous, stingy boss.

The allegations started with dancer-turned-artist Pretty D, who worked with the deejay… Read More

Resep Kue Dan Roti T… · 18:00 05 May 2024

Biasanya rasa kue tergantung bahan-bahan yang digunakan pada proses pembuatan misalkan nastar yang terasa selai nanasnya atau cheese stik yang berasa kejunya. Namun ada juga salah satu kue y… Read More

Jobs And Latest News · 17:40 05 May 2024

உலகின் முதல் 6ஜி சாதனம் ஜப்பானி… Read More

Daily Crossword Solv… · 17:33 05 May 2024

Here you may find all the Newsday Crossword May 6 2024 Answers. You can play today's puzzle either online or in the print version at the Newsday Crossword newspaper Read More

Atoz Healthy Benefit… · 17:31 05 May 2024

Building muscle and losing fat simultaneously requires a strategic approach to your diet. You need to

consume the right nutrients in the right amounts to fuel muscle growth while creating a… Read More

Ipl 2024 News & Drea… · 17:03 05 May 2024

CricreadsMI vs SRH Dream11 Prediction Today Match IPL 2024 Match 55

Mumbai Indians (MI) vs Sunrisers Hyderabad (SRH) Dream11 Prediction Match 55 of IPL 2024 is covered here… Read More

Demetri Welsh: Disco… · 17:01 05 May 2024

In the quiet corners of our lives, beneath the layers of our busiest days, there often lingers a shadow—subtle, persistent. It is the feeling of abandonment, a silent whisper that we… Read More

The Next Summit · 17:00 05 May 2024

GLENWOOD SPRINGS, COLORADO — The Hanging Lake Trail, a cornerstone of Colorado’s outdoor allure, is set to undergo a comprehensive $4.5 million reco… Read More

Honeysuckle Media · 16:57 05 May 2024

Spannabis, Barcelona's premier international cannabis festival, has been called "the mother of all cannabis expos." Given the abundance of innovative brands, breeders, cultivators, and commu… Read More

Yve.ro · 16:55 05 May 2024

Horoscop 6 Mai 2024: Vărsătorii ar trebui să se apropie mai mult de cei din jurul lor astăzi, Racii sunt ...

Citește mai mult

Citeste articolul complet AICI -> H… Read More

Millionaire Apprenti… · 16:52 05 May 2024

GM CEO Reveals Game-Changing Engine! [2024]

In 2024, the automotive industry buzzed with excitement as GM’s CEO unveiled a groundbreaking engine poised to revolutionize the market. T… Read More

Latest Cryptocurrenc… · 16:30 05 May 2024

When the markets closely observe Solana (SOL) and Avalanche (AVAX) downturns. BlockDAG continues to make waves in the cryptocurrency world with its X1 Mining App, which promises a staggering… Read More

Pharmacy Near Me · 16:17 05 May 2024

Gainesville, Florida — The University of Florida College of Pharmacy has hit a high, climbing to the No. 4 slot in the U.S. News & World Report list of top pharmacy schools. This h… Read More

Dailytrendz · 16:17 05 May 2024

Da Capo Land Of Kush (Dub Mix) Mp3 Download

Da Capo just released a top-notch hit single that is super amazing. It will have you up in seconds, dancing to its tune. This song is capti… Read More

Benfica Glorioso · 15:54 05 May 2024

Vitória por 6-3 no dérbiO Benfica venceu este domingo o Sporting por 6-3, no jogo de atribuição do terceiro lugar da Liga dos Campeões de futsal, cuj… Read More

The Pittsburgh Mom · 14:11 05 May 2024

Moms 10 Favorite Active Day Trips Read More

Gabriel Maciel · 13:12 05 May 2024

Saiba mais sobre a origem e história do American Bulldog, uma raça de cão originária dos Estados Unidos. Descubra suas características físicas Read More

The Computer Basics · 12:59 05 May 2024

In the digital age we live in, secure file sharing isn’t just a convenience—it’s a necessity. Whether you’re sending a photo to a friend or transferring sensitive doc… Read More

Ja News Mix · 12:43 05 May 2024

American rapper and record executive Jim Jones found himself embroiled in a heated physical altercation at Fort Lauderdale-Hollywood International Airport in Florida, USA. The incident, whic… Read More

Der Wikifolio - Mana… · 12:30 05 May 2024

Ich habe keinerlei Meinung, wo der Markt in 12 Monaten steht. Ich konzentriere mich auf das hier und jetzt. Das Portfolio bei FollowMyMoney ist im Moment wie folgt… Read More

Atleticanotizie - · 12:30 05 May 2024

Yeman Crippa per la seconda edizione consecutiva, vince nei 10 chilometri su strada della DKRace di Monza. Stavolta il crono finale è di 28:24 per il trentino delle Fiamme Oro… Read More

Cryptocurrency Miner… · 12:27 05 May 2024

The cryptocurrency market of 2024has witnessed a surge in the popularity of meme tokens, digital assets inspired by internet memes and viral trends. These tokens often lack inherent value or… Read More

Updated Daily Free H… · 11:50 05 May 2024

The post Wordscapes Answers Daily Puzzle May 6 2024 (5/6/24) appeared first on Your Crossword Answers Read More

Los Libros Del Villa… · 11:48 05 May 2024

CONCURSO LITERARIO

Desde 2013, Palabras+ y la AFIE (Asociación

de Funcionarios Internacionales Españoles), en colaboración con la

Facultad de Traduc… Read More

Helder Barros · 11:35 05 May 2024

«CAMINHO ABERTO COM CHAVE MESTRA 4 DE MAIO DE 2024 22:29Francisco Conceição, Evanilson e Mehdi Taremi assinaram o triunfo do FC Porto em Trás-os-Montes (3-0)… Read More

Heavy Metal Rarities · 11:27 05 May 2024

Posted by 121 — 3 minutes ago — Replies 0 — Views 3Artist: Metal Warriors

►Read More Read More

Dziennikarskie News · 11:17 05 May 2024

Kiwi.com, firma specjalizująca się w technologii podróżniczej oraz

wyszukiwaniu tanich lotów i tras, ogłasza nową rundę rekrutacji na

stanowisko… Read More

The Movie Waffler · 11:06 05 May 2024

A trip to a local store turns into a quest for a trio of mischievous

children.Read more >>> Read More

Philip Spires Common… · 10:39 05 May 2024

“Such stuff as dreams are made on, we are all spirits

and are melted into air” are words that ought to remind us of the ephemeral,

temporal nature of human life, that such good t… Read More

Brains And Eggs · 10:35 05 May 2024

Celebrating graduates the 1968 way, with stomp and circumstance.

As Rob Rogers points out, the crackdown on free speech and assembly being seen on college campuses is at least partly the… Read More

Mac's Opinion · 10:16 05 May 2024

Looking for the perfect Mother's Day gift in 2024? Check out our list of the top 10 best gifts that any mom would love to receive! From sentimental to practical, we've got you covered Read More

In Defense Of Commun… · 10:02 05 May 2024

Another Soviet-era monument, which glorifies the friendship between Ukrainian and Russian people, is being dismantled on orders of the Kyiv city government in the latest stage of derussifica… Read More

Escafandrista Musica… · 10:00 05 May 2024

@subpop Gènere: #rockalternatiu #cançódeldia L’àlbum debut de Girl and Girl, “Call A Doctor”, atenent els avançaments, es preveu

La entra… Read More

Carl Jung Depth Psyc… · 09:55 05 May 2024

She is the earth, I am the vessel of heaven.: heaven Read More

All U Post - Post An… · 09:37 05 May 2024

Grape juice isn’t just a tasty beverage; it’s a powerhouse of nutrients that offer a myriad of health benefits. From its pulpy texture to its delicious taste, grape juice has bee… Read More

Finest Kind Clinic A… · 09:12 05 May 2024

So yesterday, the staff was busy scrubbing the courtyard behind our house, and cleaning up the fish pond/fountain so the water is now clear and all the water plants were removed.Here i… Read More

Zainwestuj W Siebie! · 09:01 05 May 2024

5 maja 2024 roku na żywo na YouTube i na Facebooku odbędzie się bezpłatny webinar ONLINE na temat zarządzania czasem. Czego się nauczysz podczas szkolenia: … Read More

लो क सं घ र्ष !… · 08:49 05 May 2024

मध्य प्रदेश हाई कोर्ट

ने एक व्यक… Read More

Yashpath · 08:34 05 May 2024

उभरे मन में लेकिन, समझे न गएशब्द &#… Read More

Contemporary-Establi… · 08:27 05 May 2024

La finalul anului trecut, trupa Heriot a anunțat că au semnat cu Century Media și au sărbătorit vestea cu un single incredibil de heavy, de tip Godfleshian, numit &b… Read More

Navigamus Blog A Vel… · 08:21 05 May 2024

Entra nel vivo la 30° edizione de La Duecento, regata offshore organizzata dal Circolo Nautico Santa Margherita in collaborazione con la Città di Caorle, la Darsena dell&rsqu… Read More

Curioson · 08:19 05 May 2024

Te contamos nuestra reciente visita al Museo-Taller Herminio Revilla. El lunes 25 de marzo organicé una visita al Museo de Herminio Revilla, declarado por la Junta de Casti… Read More

Technology & Ai Blog · 08:00 05 May 2024

Boiling chicken thighs is a popular cooking method because it's quick, simple,

and produces tender, flavorful results. If you're wondering how long to boil

chicken thighs, you've com… Read More

Menoopiù Blog · 07:02 05 May 2024

fotogramma delle violenze subite da Matteo Falcinelli

Il giovane Matteo Falcinelli negli USA ha subìto l'orrore della tortura criminale da parte della polizia US… Read More

Sl Destinations R Us · 06:57 05 May 2024

Showcasing the amazing new works available now from some

awesome designers.

So what are you waiting for, come take a walk to our

destinations for today:-

Destinations:

FaME… Read More

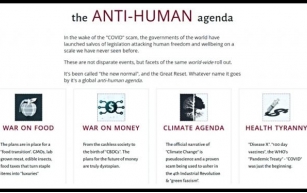

Timomalum.com · 06:42 05 May 2024

We're in a war, but I'm not talking about Ukraine or Palestine. I'm talking about the war on humanity being waged against us by the wealthy parasite class and their technocratic partners wh… Read More

Reel Naija · 05:42 05 May 2024

Minister of Women Affairs and Social Development, Uju Kenneth-Ohanenye says she prefers “sustainable empowerment” of women to organising conferences and workshops.

The post INTE… Read More

Ppq · 05:00 05 May 2024

Das Fake-News-Portal Correctiv würde es zweifellos schaffen, aus diese Kurve wegzuerklären. Derzeit verzichten die Spezialisten darauf allerdings ebenso wie die ARD-Faktenerfinder… Read More

Orlando Espinosa | K… · 05:00 05 May 2024

Be a leader who is guiding and empowering, instead of criticizing and belittling. Lead with compassion, conviction, and integrity. Lead by example, demonstrating the values and principles yo… Read More

Jobsanger · 05:00 05 May 2024

Avargal Unmaigal · 04:28 05 May 2024

சன் தொலைக்காட்சியில் ராமாயணத… Read More

Hindu God And Goddes… · 04:25 05 May 2024

The symbolism of the bindu, or dot or point, in Hinduism is deeply rooted in various philosophical and religious traditions. In Shaiva Siddhanta philosophy, the bindu holds profound signific… Read More

La Historia De La Mu… · 04:14 05 May 2024

Do you know Cream's "Mother's Lament?" It was the last song on Disraeli Gears, it didn't on inspection seem to feature any instruments at all, and the fadeout to the song is basically that… Read More

Diecast Connections · 03:57 05 May 2024

The salient features of this Nissan Motorsports International (Nismo) R34 include metal body + chasis, alloy wheels, opening hood and designed in Los Angeles by Jun Imai of Kaido House LLC.T… Read More

Headline News Online · 02:32 05 May 2024

The goal the event Saturday at Vancouver International Airport was to increase accessibility and break down barriers for people who are on the autism spectrum.

* This article was originally… Read More

ई-अभिव्यक्ति - साहित… · 02:25 05 May 2024

श्री प्रदीप केळुस्कर

जीवनरंग

a… Read More

Foxton News · 01:28 05 May 2024

Khan garnered just over a million votes, accounting for almost 44% of the total, leading his main rival, Conservative Party’s Susan Hall, by over 11 percentage points

In London, Sad… Read More

Doggy Tidbits · 01:24 05 May 2024

Legion Abstract: Leg… · 01:21 05 May 2024

…for reasons that will be opaque to most of you. Don’t worry about it. Read More

..::that Grape Juice… · 00:39 05 May 2024

Dua Lipa finally unlocked her third studio album ‘Radical Optimism’ on the masses this week.

Arriving on the towering heels of hit-filled sophomore LP ‘Future Nostalgia,&r… Read More

Art+Science Designs … · 00:00 05 May 2024

Follow Art+Science Designs On Social Media Too!

Related posts:

What Type of Gift Giver Are You?

Making Recycled Art with Everyday Items

Holidays’ Best: Vegan Gingerbread Cookie Re… Read More

Best Online Stuff On… · 00:00 05 May 2024

Entdecke Deutschlands größte Escort-Community: Orhidi.com.

Erlebe die größte Escort-Community Deutschlands: Orhidi.com — egal, ob Du nach einem stilvollen Date… Read More

Mydespacho Por Ci De… · 23:44 04 May 2024

Fotografía del cierre de la lectura de poemas: (Arriba) Coord. Daniel Fernando Martínez; (medio) Pablo Félix Jiménez, Oscar Acosta Andrada, Karina Tapia y Alfredo… Read More

Basil's Blog · 23:30 04 May 2024

Meowvellous Sunday greetings furiendsWelcome to another BBHQ selfie selection, and this week we dedided to bip north in the TTTB to Aberdeenshire in Scotland to visit this rather special sto… Read More

Dulce Relato · 22:50 04 May 2024

A las cinco de la tarde cerré la tienda y me dirigí al videostore de siempre. La colección de películas para adultos ahí era impresionante. Como no ten&iac… Read More

Tizycharts - Swing A… · 22:10 04 May 2024

Comments and updated performance

Weekly Summary

$FDX (short) in at $261, out at $262 (3 stakes) [-0.38%] $FROG in at 39.17, out at 40.38, 40.10, 40.10 [+2.61%] $ALAB in at 75.62 out at 78… Read More

Profitfromai - Unloc… · 20:58 04 May 2024

SofanMax - Ad blocker is the enemy of all website owners! As small-time bloggers, we

rely heavily on ad revenue to get income. Unfortunately, nowadays, visitors

often enable ad bloc… Read More

Travel To Morocco · 20:14 04 May 2024

Come along on our well-rounded journey through Al Hoceima Morocco. This captivating seaside town offers a mix of stunning nature, deep-rooted culture, and lively adventur… Read More

Fiction From K Brown · 19:58 04 May 2024

I have a lot of problems with DA; that's no secret. But recently, there was an image of a buxom elf, oozing pulchritudinous, and the caption was: Qualified Elf Looking for a Party.Qual… Read More

Artisan Book Reviews… · 19:49 04 May 2024

Girl’s Guide to Growing Up: Decoding Teen Psychology for a Better You by Chloe Elizabeth Taylor Published by Turtle Tomes Publishing Buy on Amazon Goodreads Girl’s Guide to Growi… Read More

Living On The Edge · 19:30 04 May 2024

We get it. You've envisioned the perfect wedding venue, a space overflowing with love, joy, and elegance. But when it comes to backdrops, those Pinterest-worthy displays can come with a heft… Read More

Margarite Elaine · 19:30 04 May 2024

We get it. You've envisioned the perfect wedding venue, a space overflowing with love, joy, and elegance. But when it comes to backdrops, those Pinterest-worthy displays can come with a heft… Read More

Defend-A-Bull Blog · 19:30 04 May 2024

We get it. You've envisioned the perfect wedding venue, a space overflowing with love, joy, and elegance. But when it comes to backdrops, those Pinterest-worthy displays can come with a heft… Read More