Ever wondered how Financial institutions make those lightning-fast decisions? How do they analyze mountains of data to predict market trends accurately? Finances are the heartbeat of any economy, fueling growth and prosperity. But understanding the ins and outs of money matters can be daunting. That’s where Financial Analytics Software steps in —a game-changer in the realm of finance.

In today’s fast-paced financial world, everyone’s racing to stay ahead. Investment firms, banks, you name it – they’re all hungry for that competitive edge. And guess what’s helping them stay ahead of the curve? Yep, you got it – robust Financial Analytics software.

So, what exactly is financial analytics software? Simply put, it’s a sophisticated tool that harnesses the power of data to help businesses make informed decisions, mitigate risks, and optimize their financial strategies.

Finance is no longer just about numbers on a balance sheet; it has become the lifeblood of economies, influencing everything from investments to global trade.

Whether it’s a multinational corporation steering through strategic investments or navigating personal finances, the power to assess risks, predict trends, and optimize portfolios is the key to success. Enter financial analytics software – equipped with advanced algorithms and intuitive data visualization tools – empowering users to make informed decisions in the blink of an eye.

The demand for such digital transformation services is skyrocketing, especially in industries like hedge funds and banking where precision in decision-making is crucial. Whether you’re an experienced finance expert or just starting out as an entrepreneur, mastering financial analytic software can open doors to countless opportunities.

So, dive in with us to get a clear understanding of insights, why finance analytics software development a best decision, necessary features to add, the process and more.

Understanding Financial Analytics and What does the Software do?

In the fast-paced world of finance, navigating through complexities can feel like a wild ride. But fear not, because financial analytics software is here to show the routes- in deciphering market trends, assessing risks, and optimizing your financial strategies.

This software isn’t just another tool; it’s a powerhouse tailored to fit the unique needs of different industries. From banking to investment management, this software can analyze market trends, assess risk exposure, optimize investment portfolios, and even detect fraudulent activities.

One of the key features of financial analytics software is its ability to generate insightful reports and visualizations. These reports not only provide a snapshot of the current financial landscape but also offer predictive analytics, allowing users to anticipate future market movements and make proactive decisions.

So, what does the software do? Well, it’s like having a team of expert analysts at fingertips, working tirelessly to sift through mountains of data, spot trends, and predict market movements. It helps businesses and individuals alike make informed decisions by providing clear, actionable insights.

Financial analytics software isn’t just about crunching numbers; it’s about visualizing data in a way that’s easy to understand and act upon. With intuitive dashboards and interactive reports, users can quickly grasp the big picture and drill down into the details that matter most.

Understanding the importance of financial analytics tools is just the beginning. With the increasing complexity of financial markets and the demand for real-time insights, the need for robust software solutions is greater than ever. Fintech Software Development in today’s time isn’t just a technical challenge; it’s a gateway to unlocking endless possibilities in finance, from optimizing investments to mitigating risks and beyond.

So, if you’re ready to take your financial game to the next level, hop on board the financial analytics software train. Trust me, you won’t regret it!

Financial Analytics Software Market Statistics

The Financial Analytics Software Market is experiencing significant growth, driven by the increasing demand for data-driven decision making in finance. Here’s a breakdown of some key statistics and figures:

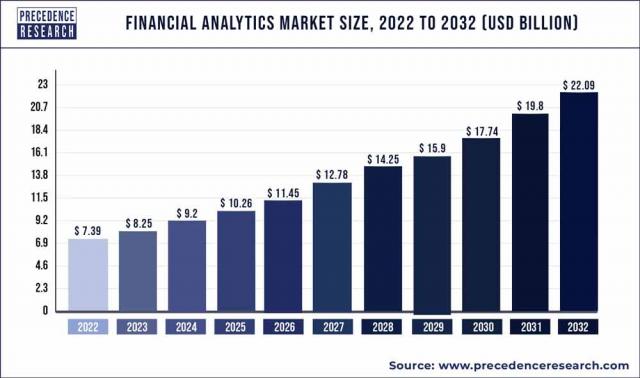

The size of the financial analytics market is projected to be USD 10.83 billion in 2024 and USD 19.31 billion by 2029, with a compound annual growth rate (CAGR) of 12.25% from 2024 to 2029.

By 2023, the size of the global financial analytics market had grown to US$ 11.5 billion. The IMARC Group projects that by 2032, the market will have grown to US$ 26.4 billion.

Source: Precedence Research

Why is the Financial Analytics Software Market Growing Fast?

The Financial Analytics Software Market is flourishing due to a confluence of key market drivers:

Increasing Complexity: Financial markets are becoming more intricate, with numerous variables impacting decision-making, necessitating advanced analytics for clarity.

Regulatory Compliance: Stricter regulations require financial institutions to adopt sophisticated software to ensure compliance and mitigate risks effectively.

Data Explosion: The explosion of data volume requires powerful analytics tools to extract valuable insights efficiently, driving the demand for more advanced software solutions.

Competitive Edge: Businesses recognize the importance of gaining a competitive edge in the market, leading to a surge in the adoption of financial analytics software to make informed decisions swiftly.

Technological Advancements: Continuous advancements in technology, such as AI and machine learning, enable more accurate predictions and analysis, fueling the growth of the financial analytics software market.

Why Businesses Must Consider Investing in Financial Analytics Software Development?

We all agree how essential it is to stay ahead of the curve today, and investing in financial analytics software development is the key to achieving that competitive edge. Picture this: with the right software in hand, businesses can navigate the complexities of financial data effortlessly, gaining invaluable insights to drive strategic decisions. From identifying market trends to optimizing resource allocation, financial analytics software empowers businesses to make informed choices that maximize profitability and mitigate risks.

Moreover, in an era where data is king, having robust analytics capabilities is non-negotiable. Think of financial analytics software as your trusted advisor, unlocking hidden opportunities and guiding you towards smarter financial decisions. Whether you’re a multinational corporation or a budding startup, investing in Financial Planning Software Development isn’t just a choice; it’s a strategic imperative for success in today’s dynamic marketplace.

What challenges does financial analytics software development resolve?

Let’s find out!

| Challenges Before Financial Analytics Software | Solutions After Financial Analytics Software |

| Limited Data Visibility and Accessibility | Comprehensive data aggregation and integration for a holistic view. |

| Manual Data Analysis and Reporting | Automation for error reduction and increased efficiency. |

| Reactive Decision-Making based on Intuition | Proactive decisions driven by data-driven insights. |

| Inability to Identify Trends and Patterns | Advanced algorithms for trend identification and strategic planning. |

| High Risk of Errors in Financial Forecasting | Accurate forecasting models and scenario analysis tools. |

| Compliance and Regulatory Challenges | Compliance management tools for adherence to regulations. |

| Inefficient Resource Allocation | Optimization tools for maximizing efficiency. |

| Lack of Real-Time Insights | Real-time data processing and visualization tools. |

| Difficulty in Identifying Fraudulent Activities | Fraud detection algorithms and anomaly detection techniques. |

| Limited Scalability of Financial Operations | Scalable software architecture and modular design. |

Features to Add to Your Financial Analytics Software Development

Looking to supercharge your financial analytics software? Dive into these must-have features that will revolutionize the way you analyze and manage your finances:

Customizable Dashboards:

Adding this feature to your software will empower users to personalize their dashboards, displaying the most relevant metrics and KPIs for their specific needs. With customizable layouts and widgets, users can tailor their dashboard to suit their unique preferences, enhancing usability and efficiency.

Real-Time Data Updates:

Incorporating real-time data updates into your software will enable users to access the latest financial information instantaneously. Say goodbye to stale data and hello to dynamic insights, ensuring that decisions are based on the most up-to-date information available, leading to faster and more accurate decision-making processes.

Scenario Analysis Tools:

Integrating financial analytics tools like scenario analysis into your software will allow users to simulate various hypothetical scenarios and assess their potential impact on financial outcomes. By exploring “what-if” scenarios, users can anticipate risks, evaluate alternatives, and devise contingency plans, bolstering resilience and preparedness in the face of uncertainty.

Budgeting and Forecasting Modules:

Incorporating budgeting and forecasting modules into your software will streamline the budgeting process, enabling users to create accurate budgets and forecasts with ease. With robust modeling capabilities and scenario planning tools, users can anticipate future financial performance, identify potential gaps, and make proactive adjustments to optimize their financial strategies.

Advanced Reporting Capabilities:

Enhancing your software with advanced reporting capabilities will empower users to generate comprehensive reports with ease. From standard financial statements to custom analytics reports, users can access actionable insights and share vital information with stakeholders effortlessly, fostering transparency and accountability across the organization.

Collaboration Features:

Adding collaboration features to your software will facilitate seamless communication and collaboration among team members. From shared dashboards to commenting and annotation tools, users can collaborate in real-time, share insights, and work together towards common goals, promoting synergy and teamwork within the organization.

Drill-Down Functionality:

Incorporating drill-down functionality into your software will enable users to explore detailed information underlying summary data points. With the ability to drill down into specific transactions or line items, users can uncover hidden insights, diagnose issues, and gain a deeper understanding of their financial performance, driving more informed decision-making.

Mobile Compatibility:

Ensuring mobile compatibility for your software will enable users to access critical financial information anytime, anywhere, from any device. Whether in the office or on the go, users can stay connected and make informed decisions on the fly, enhancing flexibility and productivity in today’s dynamic business environment.

Data Security Measures:

Implementing robust data security measures into your software will safeguard sensitive financial information from unauthorized access or breaches. From encryption and access controls to audit trails and compliance monitoring, users can trust that their data is protected, ensuring confidentiality, integrity, and availability.

Scalability and Flexibility:

Designing your software with scalability and flexibility in mind will future proof your solution and accommodate growth and evolving business needs. Whether scaling up to support increased data volumes or adapting to changing regulatory requirements, users can rely on your software to grow and adapt alongside their business, ensuring long-term success and sustainability.

Integration with Third-Party Systems:

Facilitating seamless integration with third-party systems will enhance interoperability and extend the functionality of your software. Whether integrating with ERP systems, CRM platforms, or external data sources, users can leverage the full spectrum of their technology stack, maximizing efficiency and productivity across the organization.

Interactive Data Visualization:

Enhancing your software with interactive data visualization capabilities will transform complex financial data into intuitive charts, graphs, and diagrams. Users can explore trends, identify patterns, and gain deeper insights with just a few clicks, fostering a deeper understanding of their financial performance and driving informed decision-making.

From customizable dashboards that empower users to personalize their experience, to real-time data updates ensuring decisions are based on the latest information available, and interactive data visualization that transforms complex data into intuitive insights – these features will take your financial analytics to the next level.

So, why wait? Elevate your financial analytics game with essential financial analytics tools and unlock the full potential of your enterprise. Further, you can experience custom enterprise software development for your business and stay ahead of the curve in today’s competitive market.

Transform Your Financial Analytics. Contact Us to Discuss Tailored Features Driving Business Growth!

Technological Trends to Follow for Financial Analytics Software Development

make your software the best of all. Here are some of the majorly used trends which you can consider adding to your financial analytics software:

Cloud Computing:

Embracing cloud computing revolutionizes infrastructure scalability and accessibility. It offers seamless data storage, processing, and analytics capabilities, eliminating the need for bulky on-premises hardware. With the cloud, you can unlock unparalleled flexibility and agility, adapting effortlessly to evolving business needs.

Edge Computing:

Harnessing edge computing brings data processing closer to the source, accelerating analysis and decision-making. This trend is especially beneficial for real-time financial analytics applications, ensuring lightning-fast insights at the edge of your network. By leveraging edge computing, you can gain a competitive edge in today’s fast-paced market landscape.

Natural Language Processing (NLP):

Integrating NLP capabilities empowers your software to decipher unstructured data from diverse sources. From news articles to social media chatter, NLP enables you to extract invaluable insights for informed financial decision-making. With NLP, you can uncover hidden trends and sentiments buried within vast amounts of textual data.

Also Read: NLP In Finance: Advancement That Your Business Needs!

Blockchain Technology:

Incorporating blockchain technology enhances the security and transparency of financial transactions and data management. Whether you’re delving into cryptocurrency trading or implementing smart contracts, blockchain ensures trust and integrity throughout the process. By embracing blockchain, you can revolutionize the way financial transactions are conducted, paving the way for a more secure and efficient future.

Quantum Computing:

Although still in its infancy, quantum computing holds immense potential for revolutionizing financial analytics. With its unparalleled processing power, quantum computing enables complex calculations and simulations at unprecedented speeds. This opens up new frontiers in risk assessment, portfolio optimization, and beyond, propelling financial analytics into uncharted territory.

Explainable AI (XAI):

Implementing XAI techniques ensures transparency and accountability in AI-driven decision-making processes. This is crucial for regulatory compliance and building trust in automated financial analytics models. With AI development services, you can demystify the black box of AI algorithms, empowering users to understand and trust the insights derived from their data. AI-based financial analytics software enhances this transparency further, offering clear explanations for AI-driven decisions and fostering confidence in the accuracy and reliability of financial insights.

Also Read: Redefine Transparency: Explore The Diverse Explainable AI Use Cases for Your Business

Internet of Things (IoT):

Integrating IoT devices and sensors into your financial analytics software enables real-time data collection from physical assets and environments. Whether monitoring operational efficiency or assessing supply chain risks, IoT provides invaluable insights for informed decision-making. By embracing IoT, you can unlock a wealth of actionable data, driving efficiency and innovation across your organization.

Robotic Process Automation (RPA):

Leveraging RPA streamlines repetitive tasks and workflows within financial analytics software. This improves operational efficiency and reduces human error in critical processes such as data entry and reconciliation. With RPA, you can automate mundane tasks, freeing up valuable time and resources for more strategic endeavors.

Augmented Analytics:

Embracing augmented analytics combines AI and machine learning techniques with human intuition. This empowers users with advanced data visualization, natural language querying, and automated insights discovery capabilities. With augmented analytics, you can unlock deeper insights from your data, driving smarter decision-making and unlocking new opportunities for growth.

Data Privacy and Security Technologies:

Prioritizing data privacy and security technologies safeguards sensitive financial information from unauthorized access or breaches. By implementing encryption, multi-factor authentication, and secure data transmission protocols, you ensure compliance with regulatory requirements and protect your organization from cyber threats. With robust data privacy and security measures in place, you can instill trust and confidence in your financial analytics software, fostering long-term success and resilience.

Stay Ahead of the Curve! Let Our Experts Guide You Through the Latest Technological Trends.

Most Popular Applications of Financial Analytics Software

Financial analytics software isn’t just a tool; it’s your secret weapon for success. Let’s dive into some of the most popular applications of this game-changing technology:

Banking Sector:

In the fast-paced world of banking, every decision counts. Financial analytics software revolutionizes the banking sector by providing real-time insights into customer behavior, risk assessment, and fraud detection. With this technology, banks can optimize loan portfolios, personalize customer experiences, and mitigate risks effectively. From detecting fraudulent transactions to predicting customer churn, financial analytics software empowers banks to stay ahead of the competition and deliver exceptional value to their customers.

Investment Management:

For investment managers, staying ahead of market trends is essential. Financial analytics software equips investment firms with the tools they need to analyze market data, assess risk, and make informed investment decisions. By leveraging predictive analytics and advanced modeling techniques, investment managers can identify lucrative opportunities, optimize portfolio allocations, and maximize returns for their clients. With financial analytics software, investment managers can navigate the complexities of the market with confidence and precision.

Retail Industry:

In the competitive world of retail, understanding customer behavior is key to success. With financial analytics tools, retailers can analyze sales data, track inventory levels, and optimize pricing strategies. By identifying trends and patterns in consumer spending, retailers can tailor their marketing efforts, optimize product assortments, and enhance customer satisfaction. From predicting demand for seasonal products to optimizing promotional campaigns, financial analytics software enables retailers to make data-driven decisions that drive growth and profitability.

Healthcare Sector:

In the healthcare sector, efficiency and accuracy are paramount. Financial analytics software enables healthcare organizations to analyze patient data, track healthcare costs, and optimize resource allocation. By leveraging predictive analytics and machine learning algorithms, healthcare providers can identify cost-saving opportunities, improve patient outcomes, and enhance operational efficiency. From optimizing supply chain management to reducing healthcare fraud, with financial analytics tools healthcare organizations can deliver high-quality care while maximizing cost savings.

Manufacturing Industry:

In the manufacturing industry, optimizing production processes is essential for success. Financial analytics software enables manufacturers to analyze production data, track inventory levels, and optimize supply chain operations. By identifying inefficiencies and bottlenecks in the production process, manufacturers can reduce costs, improve productivity, and enhance profitability. From forecasting demand for raw materials to optimizing production schedules, financial analytics software enables manufacturers to streamline operations and stay competitive in today’s fast-paced market.

Real Estate Sector:

In the dynamic world of real estate, staying ahead of market trends is crucial. Financial analytics software empowers real estate professionals to analyze property data, track market trends, and make informed investment decisions. By leveraging predictive analytics and market modeling techniques, real estate professionals can identify lucrative investment opportunities, assess property values, and optimize portfolio allocations. From predicting property appreciation to optimizing rental yields, financial analytics software enables real estate professionals to maximize returns and minimize risks in today’s competitive market.

Whether it’s about Banking, Agriculture, Healthcare or any, financial analytics software is revolutionizing the way we do business across most of the sectors. So why wait? Unlock its power and take your finances to new heights today!

Financial Analytics Software Development Process

Developing financial analytics software is not as