Five Of This Year's Pulitzer Finalists Are AI-powered

March 11, 2024, 10:31 a.M.

Two of journalism's most prestigious prizes — the Pulitzers and the Polk awards — on how they're thinking about entrants using generative AI.

Five of the 45 finalists in this year's Pulitzer Prizes for journalism disclosed using AI in the process of researching, reporting, or telling their submissions, according to Pulitzer Prize administrator Marjorie Miller.

It's the first time the awards, which received around 1,200 submissions this year, required entrants to disclose AI usage. The Pulitzer Board only added this requirement to the journalism category. (The list of finalists is not yet public. It will be announced, along with the winners, on May 6, 2024.)

Miller, who sits on the 18-person Pulitzer board, said the board started discussing AI policies early last year because of the rising popularity of generative AI and machine learning.

"AI tools at the time had an 'oh no, the devil is coming' reputation," she said, adding that the board was interested in learning about AI's capabilities as well as its dangers.

Last July — the same month OpenAI struck a deal with the Associated Press and a $5 million partnership with the American Journalism Project — a Columbia Journalism School professor was giving the Pulitzer Board a crash course in AI with the help of a few other industry experts.

Mark Hansen, who is also the director of the David and Helen Gurley Brown Institute for Media Innovation, wanted to provide the board with a broad base of AI usage in newsrooms from interrogating large datasets to writing code for web-scraping large language models.

He and AI experts from The Marshall Project, the Harvard Innovation Labs venture Newsroom Robots, and Center for Cooperative Media created informational videos about the basics of large language models and newsroom use cases. Hansen also moderated a Q&A panel featuring AI experts from Bloomberg, The Markup, McClatchy, and Google.

Miller said the board's approach from the beginning was always exploratory. They never considered restricting AI usage because they felt doing so would discourage newsrooms from engaging with innovative technology.

"I see it as an opportunity to sample the creativity that journalists are bringing to generative AI, even in these early days," said Hansen, who didn't weigh in directly on the new awards guideline.

While the group focused on generative AI's applications, they spent substantial time on relevant copyright law, data privacy, and bias in machine learning models. One of the experts Hansen invited was Carrie J. Cai, a staff research scientist in Google's Responsible AI division who specializes in human-computer interaction.

The George Polk Awards consider AIThe George Polk Awards are also looking to learn more as they plan to adapt contest rules for an increasingly AI-integrated industry. While too late for this year's cycle, awards curator John Darnton said the organization will begin formally developing an AI disclosure policy this spring, after this year's awards are presented.

The Polk awards are reckoning with whether generative AI aligns with the spirit of the accolade, which recognizes "not the news organizations or publishers, but investigative reporters themselves." The award's namesake is George Polk, a journalist who was murdered in 1948 while covering the Greek Civil War. The prize was established to recognize the intrepid nature of investigative reporters for work that requires perseverance and resourcefulness.

An iconic part of the annual Polk awards ceremony is very human. During the spring luncheon, winners are invited on stage to talk about the rigorous investigative process and the aftermath of the story, with reporters often sprinkling in moving anecdotes about interactions with sources.

"If [generative] AI is an essential part of the whole project, I would look askance at it as an entry," Darnton said. "Most investigative projects rely on some kind of moral judgment. And I wouldn't trust [generative] AI to make that judgment."

As an example, he pointed to one of this year's winners: a joint investigation from The Pittsburgh Post-Gazette and ProPublica about medical device company Philips hiding CPAP complaints. While generative AI may be able to identify and list the laws Philips was allegedly breaking, Darnton said he's doubtful its limited language abilities can convey the nuances of corporate malevolence as skillfully as reporters can.

But Darnton and the Polk awards have not completely written off the technology. Right now, Darnton is leaning towards requiring entrants to disclose in their cover letters whether they used AI, generative or not, and to what extent. Judges can then follow-up with questions specific to the entry, if needed.

That way, each entry is addressed on a case-by-case basis instead of a one-size-fits-all rule.

Polk awards faculty coordinator Ralph Engelman said the flexibility and openness comes from the Polk awards having a legacy of recognizing non-traditional work, which at one point included the now-ubiquitous "computer assisted reporting." In fact, the Polk awards recognized work published on a website and audio reporting before the Pulitzers did.

But it may take a while for the broader industry to modify awards policies given how rapidly the AI landscape is changing. Developments in the New York Times' lawsuit against OpenAI or the release of new tools like OpenAI's video generator Sora may prevent organizations from setting hard rules.

And there's always the question of whether awarding work produced with the help of AI will be giving the technology more credit than is due. For awards that emphasize the human sacrifice behind reporting, this'll be a challenge they face.

"I'm old fashioned in a lot of ways, as are the Polk awards," Darnton said. "After all, our symbol is a quill. It's not even a typewriter."

Alex Perry is a core news products intern at The Washington Post and an incoming technology reporting intern at The Wall Street Journal.

Five Key Questions For Ensuring Responsible AI In Financial Services

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

How AI Can Be Used In Your Investing In 2024

Ever since the launch of ChatGPT, the business world has been captivated by artificial intelligence (AI), so it shouldn't be a surprise that investors are looking for new ways to use AI in investing.

The applications for generative AI and other forms of the emerging technology are opening up new ways for its use in investing. Now, investors are not only looking for companies that could make a fortune from AI but also for ways to use AI to become better investors and improve their returns.

Image source: The Motley Fool.

In this look at AI and investing, we'll review the definition of artificial intelligence, discuss several ways that AI is being applied in investing, and explore how artificial intelligence could affect the future of investing.

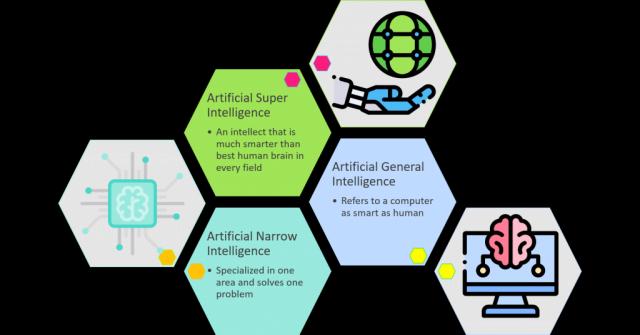

What is AI? What is AI?In the real world, artificial intelligence takes shape in a number of different ways. The most common application of AI is machine learning, which describes the way in which computers can be trained with data to make inferences that would typically require human thinking. This is the kind of AI that allows computers to recognize images like faces or identify a specific species of plant.

Other commonly used forms of AI include computer vision, which is critical for applications like autonomous vehicles, and natural language processing, which underpins technology like ChatGPT and other generative AI tools.

There's also robotics, which has a wide range of applications, including industrial robots that can be used for painting or welding and domestic robots like robot vacuum cleaners that are used for cleaning or home security functions.

Finally, neural networks are another example of AI that mimics the connectivity of the human brain and underpins technologies like speech recognition and natural language processing.

Keep reading to see five ways that AI is used in investing.

Five applications of AI in investing Five applications of AI in investing 1. Algorithmic trading 1. Algorithmic tradingAlgorithmic trading might be the most direct way in which AI is used in investing.

Traders use AI algorithms to analyze large datasets and trade at high speeds, making trades based on market trends and patterns.

Computers have the ability to analyze data much faster than humans can, giving them an advantage in high-frequency trading. Algorithms also aren't subject to human biases, which range from loss aversion to anchoring to framing, none of which affect AI algorithms.

Algorithmic trading often focuses on taking advantage of price discrepancies such as the bid-ask spread, and the gains are often small enough that it only works in high volume.

Algorithmic trading does work, but no trading strategy works 100% of the time since market conditions and traders adjust to new information quickly.

Bid and AskBid and ask are two points of a price quote. Bid is the price investors will pay for an asset, while ask is the price they'll sell it for.

2. Sentiment analysis 2. Sentiment analysisAnother way AI is used in investing is for sentiment analysis. Markets move according to a variety of factors, such as macroeconomic data, earnings reports, geopolitical issues, interest rates, and market sentiment.

Sentiment is difficult to quantify, but investor feelings often dictate the direction of the stock market more than any other data.

Artificial intelligence programs can help traders assess market sentiment by collecting news articles, social media posts, and other online activity to measure market sentiment and predict movements.

Sentiment can also have a significant impact at the sector level, driving booms in industries like electric vehicles, cannabis, cryptocurrency -- and now, artificial intelligence stocks.

3. Portfolio optimization 3. Portfolio optimizationPortfolio management is another bedrock concept in investing. Money managers try to maintain a balance around diversification, risk, and factors like income and growth. AI can help fund managers optimize their portfolios to balance between these goals and prioritize any one of them.

There could also be a future where generative AI technologies like ChatGPT are used in portfolio management; one research team found that ChatGPT can be effective as a co-pilot when putting together a portfolio. Such a tool can be especially useful for retail investors who may not be as experienced at managing their own investments.

AI investing bots can also advise money managers on what's missing in their portfolios, informing them on how to better balance them.

4. Risk management 4. Risk managementAI can also play a role in risk management, helping money managers and companies by analyzing historical market data, volatility, and any correlations that could affect returns.

Machine learning techniques are also used in risk management to help improve efficiency and reduce costs.

In some ways, the technology can replace human labor since it's able to analyze large datasets at fast speeds with relatively little need for human intervention.

These models have demonstrated better forecasting accuracy than traditional regression models and are able to capture nonlinear relationships between risk factors and other variables.

5. Personalized investment advice 5. Personalized investment adviceThanks to the innovation behind ChatGPT and generative AI, AI programs are starting to be able to offer personalized investment advice.

One such app is called Magnifi, which uses ChatGPT and other AI tools to provide real-time investment advice.

Magnifi acts like something of an AI-powered Robinhood (HOOD -4.14%), functioning as a trading platform that can answer questions with a chatbot interface like ChatGPT.

Although Magnifi only recently launched, we'll likely see more such AI investing platforms as investors are eager to take advantage of the new technology.

Mainstream trading platforms like Robinhood and others could also start to incorporate some of these AI trading tools soon.

Related investing topics Is artificial intelligence the future of investing? Is artificial intelligence the future of investing?There's no single way to invest, and investing can't be neatly categorized like other industries.

However, investors are likely to embrace any new technology that can improve performance and alleviate some of the labor of investing, and artificial intelligence fits both criteria.

Although there will always be a human component in investing, picking stocks, and managing a portfolio, artificial intelligence is likely to play a greater role in investing as the technology develops.

If you're interested in getting exposure to artificial intelligence in your own portfolio, consider looking at AI stocks or an AI ETF to gain broad exposure to this emerging technology.

FAQ AI in investing FAQHow is AI being used in investing?

AI is being used in investing in a number of ways, including algorithmic trading, sentiment analysis, and chatbot interfaces to help investors analyze data and ensure that their portfolios are diversified.

Can I use AI for stock trading?

There isn't an AI that will fully automate stock trading for retail investors, but there are tools like Magnifi, an AI chatbot, that can help you invest better.

What is the best AI to invest in?

There are number of different AI stocks that have emerged as early winners in the AI boom, including GPU maker Nvidia (NASDAQ:NVDA), and AI server pro Super Micro Computer (NASDAQ:SMCI). As the generative AI revolution evolves, we're likely to see more winners.

Can AI really predict the stock market?

Some professional traders use algorithmic trading tools to help them beat the market or predict trends, but no human or computer can accurately predict the stock market all the time.

Market prices move according to a wide range of unpredictable and news-driven inputs, and there's no formula that dictates stock movements, although there are patterns.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.