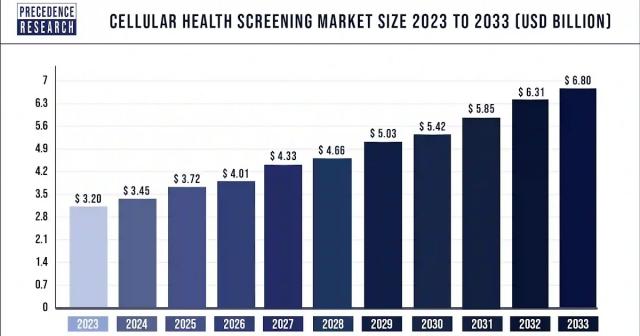

The global cellular health screening market size accounted for USD 3.20 billion in 2023 and is predicted to rake around USD 6.80 billion by 2033, growing at a CAGR of 7.82% from 2024 to 2033.

Key Takeaways

- North America led the global cellular health screening market in 2023 and accounted for a 50% revenue share.

- Asia Pacific is anticipated to be the fastest-growing region in the forecast period.

- By test type, in 2023, the single test panels segment accounted market share of around 79.20%.

- By sample type, in 2023, the blood samples segment held the majority share of over 47.85%.

- By collection site, the hospital segment accounted for the largest share of 39.50% in 2023.

The Cellular Health Screening market is witnessing significant growth propelled by advancements in healthcare technology and growing awareness among individuals regarding the importance of preventive healthcare. Cellular health screening involves the assessment of cellular function and integrity to identify potential health risks at an early stage. This proactive approach to healthcare enables individuals to take preventive measures and make informed decisions about their lifestyle choices. The market encompasses a wide range of screening techniques and technologies aimed at evaluating cellular health indicators, such as mitochondrial function, oxidative stress levels, and DNA integrity, among others.

Get a Sample: https://www.precedenceresearch.com/sample/4079

Growth Factors:

Several factors are driving the growth of the cellular Health Screening Market. One of the primary growth drivers is the increasing prevalence of chronic diseases worldwide. Conditions such as cardiovascular diseases, diabetes, and cancer are major contributors to morbidity and mortality, necessitating the need for early detection and intervention. Additionally, advancements in diagnostic technologies, including high-throughput screening methods and molecular assays, have enhanced the accuracy and efficiency of cellular health assessment. Moreover, rising healthcare expenditure, coupled with growing demand for personalized medicine and preventive healthcare solutions, is fueling market growth.

Region Insights:

The cellular health screening market exhibits regional variations influenced by factors such as healthcare infrastructure, regulatory environment, and socioeconomic factors. North America holds a significant share of the market, driven by the presence of well-established healthcare systems, increasing adoption of advanced diagnostic technologies, and proactive health-conscious population. Europe follows closely, characterized by a robust regulatory framework supporting preventive healthcare initiatives and a growing emphasis on personalized medicine. In the Asia-Pacific region, rapid urbanization, changing lifestyles, and increasing healthcare spending are driving market growth, especially in emerging economies such as China and India.

Drivers:

Several drivers contribute to the expansion of the cellular health screening market. Technological advancements play a pivotal role in enhancing the accuracy, sensitivity, and accessibility of cellular health screening tests. Innovations such as point-of-care testing devices, miniaturized diagnostic platforms, and artificial intelligence-driven analysis algorithms are revolutionizing the landscape of cellular health assessment. Furthermore, the shift towards value-based healthcare models and preventive medicine paradigms is driving healthcare providers and policymakers to prioritize early detection and intervention strategies, thereby boosting demand for cellular health screening services.

Opportunities

The cellular health screening market presents numerous opportunities for growth and innovation. Expansion into untapped geographical markets, particularly in developing regions with burgeoning healthcare needs, offers significant growth prospects for market players. Additionally, collaborations and strategic partnerships between healthcare providers, diagnostic laboratories, and technology developers can facilitate the development of integrated screening solutions and expand market reach. Furthermore, investments in research and development aimed at discovering novel biomarkers and improving screening methodologies hold promise for the development of next-generation cellular health screening technologies.

Challenges:

Despite its promising outlook, the cellular health screening market faces several challenges that may impede growth. High costs associated with advanced screening technologies and tests pose a barrier to widespread adoption, particularly in resource-constrained settings. Moreover, concerns regarding the interpretation and clinical relevance of cellular health indicators require validation through robust clinical studies and evidence-based research. Regulatory hurdles and reimbursement issues also present challenges for market players seeking to commercialize cellular health screening products and services. Additionally, public awareness and education regarding the benefits of cellular health screening may be limited, necessitating targeted marketing efforts and educational campaigns to drive adoption.

Recent Developments

- In July 2023, Regenerus Labs launched the TruAge Complete test, a sophisticated epigenetic test that provides an accurate, complete, and actionable study of a patient's biological aging and health insights.

- In April 2023, Virtua Health introduced a mobile health and cancer screening unit to increase accessibility to crucial cancer diagnostics.

- In January 2023, Atomo Diagnostics, an Australian diagnostic company, established a long-term partnership with NG Biotech SAS to produce and distribute rapid blood-based pregnancy tests for both home and professional usage in prominent markets.

- In May 2022, QIAGEN NV unveiled the QIAstat Dx Rise and enhanced panels, which feature a closed system for hands-off sample preparation and processing, offering improved convenience for users.

Cellular Health Screening Market Companies

- Life Length

- SpectraCell Laboratories, Inc.

- RepeatDx

- Cell Science Systems

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- OPKO Health, Inc.

- Genova Diagnostics (GDX)

- Immundiagnostik AG

- DNA Labs India

Segments Covered in the Report

By Test Type

- Single Test Panels

- Telomere Tests

- Oxidative Stress Tests

- Inflammation Tests

- Heavy Metals Tests

- Multi-test Panels

By Sample Type

- Blood

- Saliva

- Serum

- Urine

By Collection Site

- Home

- Office

- Hospital

- Diagnostic Labs

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: [email protected]

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

This post first appeared on Healthcare BPO Market Size At Around US$ 755.76 Bn In 2030, please read the originial post: here