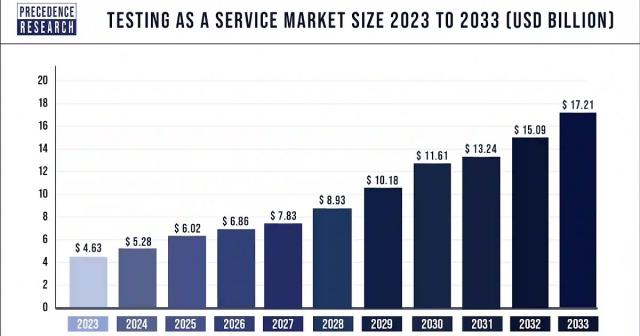

The global testing as a service market size reached USD 4.63 billion in 2023 and is expected to hit around USD 17.21 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033.

Key Takeaways

- North America led the market with holding a 40% of market share in 2023.

- Asia Pacific is expected to witness significant growth during the forecast period.

- By test type, the functionality segment has generated more than 28% of market share in 2023.

- By test type, the security segment is expected to grow the fastest during the forecast period.

- By deployment type, the public segment held a significant share of the market in 2023.

- By deployment type, the private segment is poised to grow at a significant rate during the forecast period.

- By end use, in 2023, the IT & telecommunication segment led the market.

- By end use, the healthcare segment is expected to grow the fastest during the forecast pe

The Testing as a Service (TaaS) market has emerged as a pivotal component in the software development lifecycle, offering businesses a scalable and efficient solution for testing their applications, systems, and software products. TaaS refers to the outsourcing of testing activities to specialized third-party service providers, thereby enabling organizations to focus on their core competencies while ensuring the quality and reliability of their digital assets. The TaaS market encompasses a wide array of testing services, including functional testing, performance testing, security testing, and compatibility testing, among others. This market has witnessed significant growth in recent years, driven by the increasing complexity of software systems, the rising demand for faster time-to-market, and the adoption of agile and DevOps methodologies across various industries.

Get a Sample: https://www.precedenceresearch.com/sample/4043

Growth Factors:

Several factors contribute to the growth of the Testing as a Service market. Firstly, the proliferation of digital transformation initiatives across industries has led to a surge in the development and deployment of software applications and systems, thereby fueling the demand for comprehensive testing services. Additionally, the globalization of businesses and the widespread adoption of cloud computing have necessitated the need for testing solutions that can ensure the seamless performance and reliability of applications across diverse environments and platforms. Furthermore, the growing emphasis on quality assurance and risk management in software development processes has prompted organizations to seek specialized testing expertise from third-party service providers, driving the expansion of the TaaS market.

Region Insights:

The Testing as a Service market exhibits a global presence, with key regional markets including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market, owing to the presence of leading technology companies, robust IT infrastructure, and a high level of awareness regarding the benefits of TaaS adoption. Europe follows closely, propelled by the increasing adoption of agile and DevOps methodologies in software development and the stringent regulatory requirements pertaining to data privacy and security. The Asia Pacific region is anticipated to witness rapid growth in the TaaS market, driven by the burgeoning IT outsourcing industry, the growing focus on digitalization initiatives, and the rising investments in software testing infrastructure.

Drivers:

Several drivers contribute to the expansion of the Testing as a Service market. One of the primary drivers is the escalating demand for cost-effective and scalable testing solutions, particularly among small and medium-sized enterprises (SMEs) that seek to optimize their testing processes without incurring significant capital expenditures. Moreover, the increasing complexity of software applications, driven by factors such as cloud computing, mobile technologies, and IoT (Internet of Things), has necessitated the adoption of advanced testing methodologies and tools, thereby driving the demand for TaaS solutions. Additionally, the rising awareness regarding the benefits of outsourcing testing activities, such as improved time-to-market, enhanced quality, and access to specialized expertise, is further propelling market growth.

Opportunities:

The Testing as a Service market presents numerous opportunities for expansion and innovation. One such opportunity lies in the integration of artificial intelligence (AI) and machine learning (ML) technologies into testing processes, enabling predictive analytics, intelligent automation, and adaptive testing capabilities. Furthermore, the increasing adoption of containerization and microservices architectures presents opportunities for TaaS providers to offer specialized testing solutions tailored to these environments. Moreover, the emergence of new technologies and platforms, such as blockchain and edge computing, creates demand for testing services that can ensure the security, reliability, and interoperability of applications in these domains. Additionally, the growing focus on compliance testing, particularly in highly regulated industries such as healthcare and finance, presents opportunities for TaaS providers to offer specialized compliance testing solutions.

Challenges:

Despite the promising growth prospects, the Testing as a Service market faces several challenges that could impede its expansion. One such challenge is the reluctance of some organizations to fully embrace outsourcing testing activities, citing concerns related to data security, confidentiality, and control over the testing process. Moreover, the lack of standardized testing methodologies and tools across different industries and regions poses a challenge for TaaS providers in delivering consistent and reliable services. Additionally, the increasing complexity of software systems and the rapid pace of technological advancements necessitate continuous upskilling and training of testing professionals, which can pose challenges in terms of resource management and talent acquisition for TaaS providers. Furthermore, the commoditization of testing services and the intensifying competition among TaaS providers could exert downward pressure on pricing and margins, thereby impacting profitability and sustainability in the market.

Recent Developments

- In January 2024, Capgemini SE introduced the "CLOUD DE CONFIANCE" platform. This platform provides the specific cloud needs of the French State, public agencies, hospitals, regional authorities, Vital Importance Operators (OIVs), and Essential Service Operators (OSEs), enabling them to use Microsoft 365 and Microsoft Azure services.

- In December 2023, IBM Corporation took over Software AG, a German multinational software corporation. Through this acquisition, IBM would enhance its business portfolio by creating hybrid cloud and cutting-edge AI solutions for enterprises with a distinct and compelling appeal.

- In November 2023, Accenture PLC came into partnership with Vodafone Group Plc, a British multinational telecommunications company. Through this partnership, Accenture PLC would enhance its technology and transformation services business.

- In November 2023, DXC Technology Company entered into a partnership with Amazon Web Services, Inc., an IT Services and IT Consulting company. Through this partnership, DXC Technology Company would expedite the transfer of its fundamental enterprise systems to cloud infrastructure.

Testing as a Service Market Companies

- Accenture

- Atos SE

- Capgemini

- DeviQA Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- IBM Corporation

- Infosys Limited

- TATA Consultancy Services Limited

- Qualitest Group

Segments Covered in the Report

By Test Type

- Functionality

- Performance

- Compatibility

- Security

- Compliance

- Others

By End-use

- IT & telecommunication

- Healthcare

- BFSI

- Automotive

- Manufacturing

- Retail & Consumer Goods

- Energy & Utilities

- Others

By Deployment Type

- Public

- Private

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: [email protected]

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

This post first appeared on Healthcare BPO Market Size At Around US$ 755.76 Bn In 2030, please read the originial post: here