Dow fell 46, advancers modestly ahead of decliners & NAZ dropped 181. The MLP index went up 3+ to the 274s & the REIT index was off 1+ to the 352s. Junk bond funds remained in demand & Treasuries had buying which reduced Treasury yields. Oil tumbled 2+ to the 82s & gold dropped 17 to 2389 (more on both below).

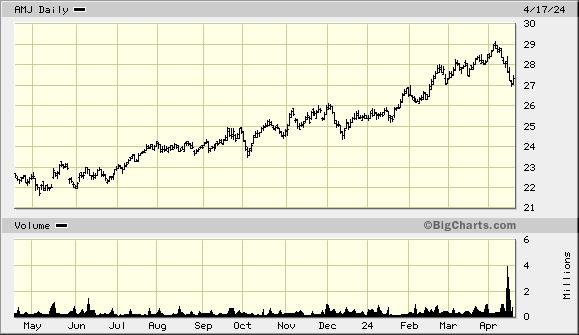

AMJ (Alerian MLP Index tracking fund)

European Central Bank (ECB) policymaker Joachim Nagel said that a Rate cut for the organization looks increasingly likely for Jun, but added that certain parts of the incoming inflation data still looks higher than desired. ″Talking about the June meeting, I think the probability is increasing that we will see a rate cut in June but there are still some caveats,” the chief of Germany's Bundesbank said at the IMF Spring Meetings taking place in DC. ″Core inflation is still high, service inflation is high. For the June meeting we will get our projections, so we will get our news forecasts and if there is a confirmation that inflation is really going down and we will achieve our target in 2025, as I said, the probability is becoming higher that this rate cut is here for the June meeting,” Nagel added. When asked about wage price pressures still lingering in the euro area, he said that in Germany there is still some wage momentum but was that it was broadly still on a downward trajectory. On energy prices, he said a recent uptick in oil prices, compared to last year, was an “uncertainty” in what he described as a volatile environment. “I think we learned a lesson in 2022, we are exposed to all this,” he said regarding an crisis in Europe that was particularly acute for the industrial sector in his homeland. “We are more resilient than maybe we were two years ago. But nevertheless if oil prices, energy prices, are going up this is not only something for Germany — this is for all of us.” Several ECB officials have made remarks about their expectations for interest rates in recent days.

Britain's inflation rate slowed by less than expected in Mar, according to official figures, adding to signs that a first interest rate cut by the Bank of England (BoE) could be further off than previously thought. British consumer prices rose by an annual 3.2%, down from a 3.4% increase in Feb & its lowest in 2½ years, the Office for National Statistics said. But the BoE, which has an inflation target of 2%, & economists had forecast 3.1%. Investors reduced their bets on BoE rate cuts & the £ rose. The slowdown in the fall in Britain's inflation rate follows an acceleration of headline price growth in the US which rose for a2nd month in a row to 3.5% in Mar, according to data published last week. BoE Governor Andrew Bailey, who last month said British inflation was "moving in the right direction" for a rate cut, said on yesterday that different inflation dynamics in the US & Europe could lead to different paths for interest rates. But analysts said today's data served as a reminder that Britain's fight against inflation was not yet won. Ruth Gregory, deputy chief UK economist at Capital Economics, said there was a risk that Britain will follow the trend in the US & see inflation stall. "The chances of interest rates being cut for the first time in June are now a bit slimmer," she said. The BoE is still expected to cut interest rates later this year, but investors today trimmed their bets on the scale of its moves, fully pricing in only one qtr-point cut by the end of 2024, possibly as late as Nov. Federal Reserve Chair Jerome Powell said on yesterday that recent data on inflation had not given US policymakers the confidence needed for them to pivot to rate cuts soon.

Slowdown of UK inflation rate disappoints in March, economists say fight against inflation far from over

Most doses of Eli Lilly's (LLY) highly popular weight loss drug

Zepbound & diabetes counterpart Mounjaro will be in short supply

thru the 2nd qtr of this year as demand jumps, according to an update on the Food & Drug Administration's drug shortage database today. All doses of Zepbound & Mounjaro besides the 2.5-milligram versions of both treatments are in a shortage. A previous update said some doses of both drugs would have limited availability thru Apr. The new update suggests that the insatiable demand for a buzzy class of weight loss & diabetes drugs is still trouncing supply, even as LLY & its main rival, Novo Nordisk (NOVO), work to increase production of those treatments. Many patients injectable treatments,

which have soared in demand for helping them shed significant pounds

over time. Those treatments are sometimes known as incretin drugs, which

mimic gut hormones to suppress appetite & regulate blood sugar. “We recognize this situation may cause a disruption in peoples’ treatment regimens and are working with purpose and urgency to help meet the surge in demand,” a

LLY spokesperson said. The company expects its

investments in manufacturing & supply capacity “to progressively

increase production of our medicines throughout 2024 and beyond,” they

added. LLY stock rose 3.78.

Most doses of Lilly’s Zepbound, Mounjaro in short supply through June, FDA says

Gold prices edged down, but traded near their record high levels hit last week, as pressure from fading US rate cut hopes overshadowed gains from safe haven demand arising out of geopolitical turmoil in the Middle East. Spot gold eased marginally to $2376 per ounce, & was below hitting an all-time high of $2431 on Fri. US gold futures settled 0.8% lower at $2388. Iran said its military was ready to confront any attack by Israel. Iran carried out its first-ever direct attack on Israel last weekend in retaliation for a suspected Israeli strike on an Iranian diplomatic compound in Damascus on Apr 1. Top US central bank officials including Federal Reserve Chair Jerome Powell backed away yesterday from providing any guidance on when interest rates may be cut, saying instead that monetary policy needs to be restrictive for longer. The market is pricing in a 71% chance of a rate cut by Sep. Higher interest rates reduce the appeal of holding non-yielding gold.

Gold Retreats as Dimming Rate Cut Expectations Overshadow Safe Haven Demand

West Texas Intermediate (WTI) crude oil fell for a 3rd-straight day as a report showed an larger than expected rise in US inventories last week, while geopolitical worries continue to moderate. WTI crude oil for May closed down $2.67 to settle at $82.69 per barrel, the lowest since Mar 27, while Jun Brent crude, the global benchmark, was last seen down $2.49 to $87.53. Oil is ceding some of the risk premium awarded the commodity following the failed weekend attack on Israel from Iran, which saw the Persian Gulf country send hundreds of drones & missile towards Israel, with nearly all shot down by aircraft & air defense systems. Israel has promised to retaliate for the attack but has so far restrained from a response amid pressure from the US & other countries even as it continues with its war in Gaza. Oil prices are unwinding some of the war premium that has been priced-in due to the continuing tensions surrounding the Gaza conflict & the subsequent Iranian missile onslaught on Israel. Thus far Israel has adhered to the intl calls of showing restraint. In its weekly survey, the Energy Information Administration said US oil inventories rose by 2.7M barrels last week, well ahead of the estimate for a 1.4M barrel rise.

WTI Crude Oil Falls Again on Easing International Tensions and a Larger than Expected Rise in US Inventories

Rate cuts by central banks are getting a lot of attention around the globe. Their leaders tend to be giving similar messages & are keeping cautious. Gold & Treasury yields remain at elevated levels & investors continue to be very nervous about the future.

Dow Jones Industrials