Dow plummeted 422 (above session lows), decliners over advancers 7-1 & NAZ retreated 136. The MLP index fell 2 to the 282s & the REIT index collapsed, falling 15+ to the 368s on the Treasury yield rally. Junk bond funds remained weak & Treasuries were very heavily sold, raising Treasury yields sharply. Oil rebounded about 1 to the 86s & gold dropped 16 to 2345 (more on both below).

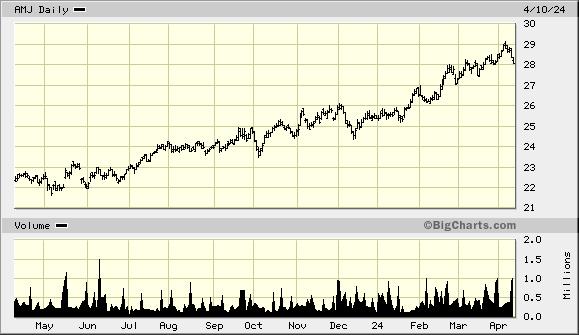

AMJ (Alerian MLP Index tracking fund)

Fed wants more confidence that inflation is moving toward 2% target, meeting minutes indicate

Hot inflation data pushes market’s Rate cut expectations to September

Delta Air Lines (DAL) swung to a profit in the first qtr & CEO Ed Bastian said

bookings for both leisure & business travel are strong as the peak

travel season approaches, despite persistent inflation. “Consumers continue to prioritize travel as a discretionary investment in themselves,” Bastian added. DAL

forecast 2nd-qtr EPS of $2.20 - $2.50, while

analysts forecast $2.23. Revenue in the current period

could rise as much as 7%, ahead of estimates. DAL also

reiterated its full-year EPS forecast for $6-7 & free cash

flow of $3-4B. Business travel

improved in the last qtr & solid demand is likely to continue,

execs said, citing 14% growth in corp travel sales. They

called out the technology, consumer & financial services sectors as

particularly strong. DAL has slowed hiring, like other carriers, after a massive spree in the wake of the pandemic & is focusing more on efficiency. Bastian said that the company's headcount will likely be up low single digits this year compared with 2023. EPS was 6¢ in the first 3 months of the year, up from a loss of 57¢

per share, in the year-earlier period. Adjusted EPS of 45¢ rose from 25¢ in the first qtr of 2023. Revenue

of $12.6B, adjusted to strip out refinery sales, was up 6% from

last year, slightly below expectations. “Growth is normalizing and we are in a period of optimization, with a

focus on restoring our most profitable core hubs and delivering

efficiency gains,” CFO Dan Janki said. The stock fell 1.08.

Delta forecasts quarterly earnings ahead of expectations, focuses on efficiency

Gold slipped after a key inflation report bolstered speculation the Federal Reserve will be in no rush to cut interest rates. A measure of underlying US inflation topped forecasts in Mar for a 3rd month, signaling a bumpier path to taming price pressures. The core consumer price index, which excludes food & energy costs, increased 0.4% from Feb, according to gov data out today & from a year ago, it advanced 3.8%, holding steady from the prior month. Treasury yields & the $ advanced after the print, sending bullion as much as 1.1% lower to $2327 an ounce.

Gold Slumps After US Inflation Print Curbs Fed Rate Cut Bets

Oil futures finished sharply higher, buoyed by speculation that Iran will soon wage an attack on Israel following Israel's strike on Iran’s embassy in Syria earlier this month. Traders have been concerned that more direct confrontation between Israel & Iran would likely have a significant impact in the oil-rich Middle East. US oil prices had been spending part of the session trading lower after official data from the Energy Information Administration revealed a larger-than-expected weekly rise in US crude supplies. West Texas Intermediate crude for May rose 98¢ (1.2%) to settle at $86.21 a barrel & Jun Brent crude, the global benchmark, climbed $1.06 (1.2%) at $90.48 a barrel.

Oil prices finish higher on talk of potential for Iran strike on Israel

All 3 of the stock major indices fell precipitously after

the Mar Consumer Price Index report showed prices rose more than

expected last month. Prices rose 0.4% from Feb & 3.5% from last

year. Both measures were higher than had been expected. The

data largely led traders to rule out a rate cut at the Fed's Jun meeting. In addition, minutes from the FOMC meeting lacked any uplifting message.

Dow Jones Industrials