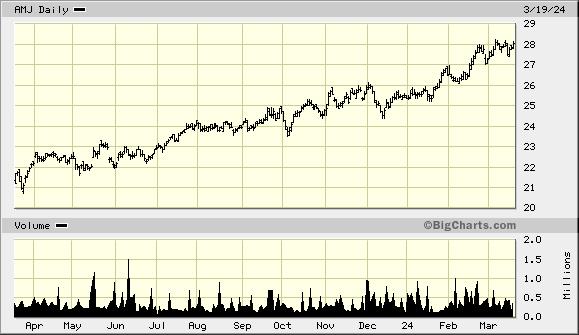

AMJ (Alerian MLP Index tracking fund)

Congress announces government funding deal, readies to end monthslong government shutdown battle

Nordstrom (JDS) shares jumped following a report that the department store chain is attempting to go private. The retailer's founding family is working with investment bank Centerview Partners to determine if private equity firms have interest in a deal according to sources. However a deal still might not happen. A previous effort to take JDS private fizzled out in 2018. JDS

has struggled to drive sales in a competitive retail landscape where

consumers squeezed by inflation have been watching their spending on

apparel & other discretionary goods. Earlier this month, the company

gave a gloomy sales outlook for 2024. JDS expects full-year revenue to range from a 2% decline to a 1% increase from 2023. The stock rose was up 1.60 on the news.

Microsoft hires DeepMind co-founder Mustafa Suleyman as CEO of new AI unit

Gold closed lower with the $ strengthening as the 2-day meeting of the Federal Reserve's policy committee began. Gold for Jun closed down $4 to settle at $2181 per ounce. The Federal Open Markets Committee meeting began today & is widely expected to leave interest rates unchanged when the meeting ends tomorrow with a press conference by Fed chair Jerome Powell. The central bank is ignoring pleas from traders to begin cutting rates as a number of inflation measures show it remains above the Fed's 2% target. However the market will be watching closely for hints on when cuts could begin. The $ was sharply higher with rates high. The ICE dollar index was last seen up 0.4 points to 103.83, making gold more expensive for intl buyers. Treasury yields weakened, bullish for the precious metal since it offers no interest. The 2-year note was last seen paying 4.704%, down 4.3 basis points, while the yield on the 10-year note was down 3.3 basis points to 4.301%.

Gold Closes Down as the Dollar Moves Higher with the Fed Expected to Leave Interest Rates Unchanged

Oil prices settled higher, driven by optimism about tighter markets this year following softer exports from Iraq & Saudi Arabia. The US crude futures (WTI) settle 0.9% higher at $83.47 a barrel & the Brent contract rose 0.6% to $87.38 a barrel. Oil prices have surged over the past week as signs of increased US refinery activity, improved Chinese demand & persistent disruptions in the Middle East presented a tight outlook for oil markets. This notion was furthered by Iraq, the 2nd biggest producer in the Organization of Petroleum Exporting Countries, stating that it will cut crude exports to compensate for higher production so far in 2024. The move is primarily to absorb the oversupply from Jan 2024-Feb 2024 & to showcase the nation's commitment to stick to its voluntary oil cuts as part of the OPEC+ agreement. Recent OPEC+ numbers showed that Iraq pumped 0.2m b/d of oil above its agreed quota of 4m b/d last month. Data from Saudi Arabia also showed crude exports from OPEC's biggest producer fell for a 2nd straight month in Jan. In Russia, Ukrainian attacks put a key fuel refinery out of commission.

Oil Prices Settle Higher on Tight Supply Outlook; Fed Decision Eyed

It appears that Congress has agreed to fund the gov for the balance of the year ending on Sep 30, a sign of relief for some investors. Dow has been going sideways for more than a month (see below), looking for some reason for the bulls to take it to new heights. Meanwhile safe heaven gold is also in record territory. Tomorrow the Fed & its post meeting report will be the center of attention for everybody.Dow Jones Industrials