Dow retreated 190, advancers over decliners 5-4 & NAZ was off 155. The MLP index added 2+ to the 277s & the REIT index fell 1+ to the 378s. Junk bond funds fluctuated & Treasuries had very limited selling which raised yields slightly. Oil slid back to below 81 & gold was off 4 to 2162 (more on both below).

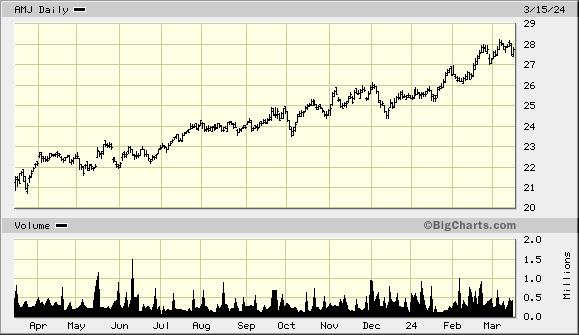

AMJ (Alerian MLP Index tracking fund)

Under Armour's (UA) shares plunged after the retailer announced that CEO Stephanie Linnartz would be stepping down after barely a year on the job & Plank would replace her on Apr 1. Following the announcement UA was downgraded & analysts lowered their price targets. Linnartz is the 2nd CEO the company has cycled thru in less than 2 years. Former Aldo Group CEO Patrik Frisk replaced Plank as US's chief exec in Jan 2020 only to suddenly announce plans to resign a little over 2 years later, in May 2022. Last Dec, UA announced plans to hire Linnartz on a bet that her experience would offset her lack of experience in the retail industry. Since she started at UA, Linnartz had been focused on rehauling the company's C-suite, building out its loyalty program, UA Rewards, & pivoting the brand's assortment to a more athleisure-focused offering that had more stylish options for women. The stock fell 4¢ following recent selling.

Wall Street isn’t pleased that Kevin Plank is returning as Under Armour’s CEO, shares plunge 12%

Apple (AAPL), a Dow stock, reached a $490M settlement to resolve a class-action lawsuit

that alleged Chief Exec Tim Cook defrauded shareholders by

concealing falling demand for iPhones in China. A preliminary

settlement was filed today with the US District Court in Oakland,

California, & requires approval by US District Judge Yvonne Gonzalez

Rogers. It

stemmed from AAPL's unexpected announcement on Jan 2, 2019, that the

iPhone maker would slash its quarterly revenue forecast by up to $9B, blaming US-China trade tensions. Cook had said in Nov 2018, that although AAPL faced

sales pressure in markets such as Brazil, India, Russia & Turkey,

where currencies had weakened, “I would not put China in that category.” AAPL told suppliers a few days later to curb production. The lowered revenue forecast was its first since the iPhone launch in 2007. Shawn Williams, a lawyer for the shareholders, called the settlement

an “outstanding result” for the class, which includes shareholders who

bought AAPL shares in the 2 months between Cook's comments & the

revenue forecast. AAPL posted $97B of net income in its latest fiscal year, & its payout equals a little under 2 days of profit. The stock was off 1.28.

Apple reaches $490 million settlement over Tim Cook’s China sales comments

Gold Closes Lower as Hopes for Interest Rate Cuts Wane, Pushing the Dollar Higher

WTI Crude Oil Closes Down From a Four-Month High on Profit Taking

The chart below shows Dow has pretty much been going sideways in Feb & Mar. That has happened on growing awareness that rate cuts will be postponed to Jun, if not later. At the same time the economy is getting soggier. The latest forecast from the Atlanta Fed: The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first qtr of 2024 is 2.3% on Mar 14, down from 2.5% from Mar. And after a major rally, gold is still being bought in record territory by nervous investors. Dow fell all of 8 last week.

Dow Jones Industrials