Dow went down 68 near session lows, advancers over decliners 5-4 & NAZ gave back 188. The MLP index was off 1+ to the 278s & the REIT index added 4+ to the 392s. Junk bond funds were slightly higher & Treasuries remained essentially even. Oil fell 1+ to the 77s & gold rose again, up 13 to 2178 (more on both below).

Related Articles

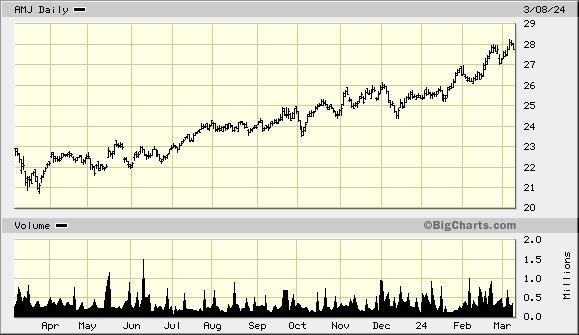

AMJ (Alerian MLP Index tracking fund)

Novo Nordisk (NOVO) CEO Lars Fruergaard Jørgensen said its experimental weight loss pill, amycretin, could eventually become a best-in-class treatment for obesity. The Danish drugmaker is racing to capitalize on the runaway success of its blockbuster weight loss drug Wegovy by developing a new generation of treatments for obesity, including more convenient & potentially cheaper pills. His

remarks came one day after NOVO impressed investors with

early-stage trial data on amycretin. Patients on the pill lost about

13.1% of their weight after 12 weeks, Jørgensen said. That surpasses the 6% weight loss seen in those who took

Wegovy after the same time period. It also adds to the growing

enthusiasm around the potential of weight loss pills. Along with convenience for patients, pills could help alleviate some

of the supply constraints plaguing weight loss injections. Wegovy, along

with similar drugs, has soared in demand & slipped into intermittent

shortages over the past year due to its ability to help patients shed

significant weight over time. “We believe in the future there’ll

be different segments of anti-obesity treatments, with different

patients having different preferences,” Jørgensen said. “Some will

prefer an injectable and we really believe that once we can take a pill,

it’s a very convenient offering.” But those pills won’t join the

market any time soon. A midstage trial on amycretin will begin in the 2nd ½ of this year, with results expected in early 2026, the

company said. The stock fell 2.46.

Novo Nordisk CEO says weight loss pill could become a best-in-class drug

Gap holiday earnings blow past estimates, Old Navy returns to growth

Wages grow 4.3% in February but still outpaced by rising home prices

Gold Rises to Another Record as the Dollar Drops Following a Bigger than Expected Rise in US Employment

West Texas Intermediate (WTI) crude oil closed lower on robust supply, even as demand remains solid as the US added more new jobs than expected last month, showing its economy remains robust despite high interest rates. WTI crude for Apr closed down 92¢ to settle at $78.01 per barrel, while May Brent crude, the global benchmark, was last seen down 96¢ to $82.00. The drop comes as global supply remains adequate, even as OPEC+ this week agreed to extend 2.2M barrels per day of production cuts thru Jun, countering rising supply outside the cartel with production in the US near a record, while Guyana & Canada also add new output. After a relatively weak year for Canada's oil producers, output growth in 2024 could amount to a significant 300-500K/barrels per day, putting the nation in the running to be the largest source of global oil supply growth. Still, demand remains robust as data from China showed imports remain robust, while US inventories rose less than expected last week & gasoline demand remains high amid a robust economy. The US added 275K new jobs in Feb, well above the estimate for a rise of 198K, showing the US economy is still running hot despite high interest rates.

WTI Crude Oil Closes Lower Despite Robust Demand as the US Economy Continues to Run Hot

The stock market began trading strong. Enthusiasm faded later on uncertainty about interest rate cuts giving the Dow a finish in the red & down 365 for the week. It's interesting that earnings from retailers have been choppy while the economy is viewed strong by many traders. Meanwhile gold is having one impressive rally.

Dow Jones Industrials