Dow sank 524 with buying into the close, only 222 stocks on the NYSE were gainers & NAZ tumbled 285 The MLP index was off 2+ to the 259s & the REIT index retreated a very big 7+ to 370. Junk bond funds were not in demand & Treasuries had very heavy selling, raising yields sharply. Oil was up nearly 1 to the 78s & gold dropped 27 to 2005 (more on both below).

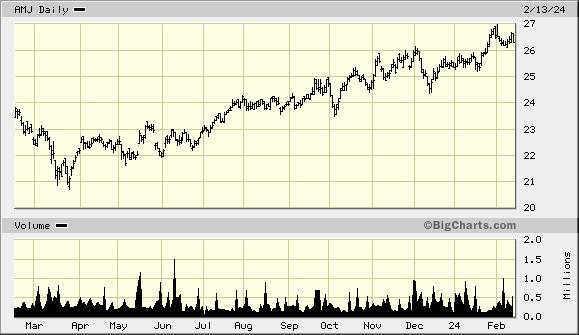

AMJ (Alerian MLP Index tracking fund)

Lael Brainard slams food companies for ‘shrinkflation’ as White House attacks price gouging

Boeing (BA), a Dow stock, aircraft orders & deliveries fell in Jan as the company

grappled with the fallout from a midflight blowout of a fuselage panel

on one of its 737 Max 9s, an accident that overshadowed the

manufacturer's strong finish in 2023. The

company handed over 27 planes last month, its lowest tally since

Sep, compared with 67 deliveries in Dec. It sold 3 BA

737 Max planes, but also logged 3 cancellations. The

deliveries were roughly in line with what was expected. The 3 gross orders come after a big Dec when BA sold 371

planes. BA rival Airbus handed over 30 planes in Jan. BA

execs have been scrambling to persuade airline customers,

investors & regulators that it will find more reliable footing after

the Jan 5 accident, when a door plug blew out on an Alaska Airlines (ALK) flight at 16K feet shortly after it left Portland, Oregon. No one

was seriously injured on Flight 1282, but the violent detachment ripped

off headrests & exposed travelers to a gaping hole in the 26th row. BA declined 4.96.

Boeing plane orders, deliveries dry up in January amid latest Max crisis

Toy company Hasbro (HAS) reported a more than 20% hit to its 4th-qtr revenue & issued a downbeat 2024 forecast. For the last 3 months of 2023, HAS lost $7.64 per share, drastically wider than losses than 93¢ a year earlier. After major adjustments related to goodwill &

intangible assets, the company reported adjusted EPS of

38¢, still well below estimates. For the full year

2023, revenue declined 15% to $1.3B, including double-digit

sales drops in its consumer products & entertainment segments. The company

did see an increase in revenue, however, in its Wizards of the Coast &

digital gaming segment, primarily due to licensing revenue related to

Baldur's Gate 3 & Monopoly Go. The company reduced its inventory by more than 50% compared to the year prior. “2023

was a productive year for Hasbro, although not without some

challenges,” CFO Gina Goetter said. “As we navigated the current environment, we took aggressive steps to

optimize our inventory, reset the cost structure, and sharpen our

portfolio focus on play with the eOne film and TV divestiture.” HAS

expects further revenue declines in the year ahead. In the Wizards of

the Coast segment, the company expects a 3-5% revenue dip, coupled

with a 7-12% hit to the consumer products business. The company

expects overall adjusted earnings before interest, taxes, depreciation & amortization of $925M to $1B. It now

expects to cut $750M in costs by the end of 2025, up from a

previous target of $350-400M. In Dec, the toymaker laid off 1100 employees after it had already cut 15% of its workforce earlier in the year. The stock fell 69¢.

Hasbro reports 20% revenue drop, issues downbeat 2024 outlook

Gold Closes Lower as the Dollar and Yields Jump After US Inflation Rose More than Expected Last Month

WTI Crude Closes Higher Again on Mideast Worries

Treasury yields rose to roughly a 10 week high after hotter-than-expected CPI inflation. The Fed will have an exciting meeting in Mar when it has to decide how to adjust to the latest rise. That assumes rates do not fall from these levels. While inflation is below its recent highs, prices remain elevated which pinches budgets of consumers. Meanwhile oil is up to a 10 week high, partially related to the war in the MidEast. The bulls will need to examine their rosy outlook for the economy.Dow Jones Industrials