Dow went up 125, advancers over decliners better than 3-1 & NAZ slid back 48. The MLP index rose 3+ to the 262s & the REIT index was off fractionally to the 377s. Junk bond funds remained slightly higher & Treasuries had minimal buying, reducing yields. Oil remained flattish in the high 76s & gold was off 5 to 2033 (more on both below).

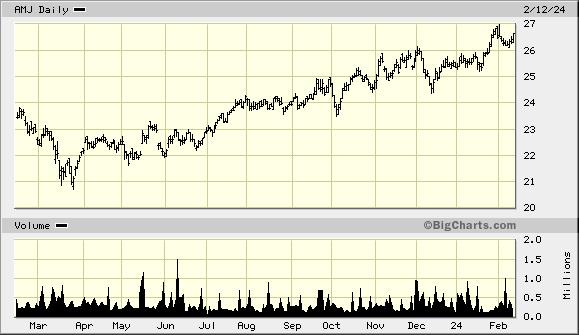

AMJ (Alerian MLP Index tracking fund)

Monetary, fiscal policy divide pose risks: NABE

ARM (ARM) rose again, extending last week's rally as investors continue to applaud the chipmaker’s better-than-expected 3rd-qtr earnings & its position in the artificial intelligence boom. Arm

is now up over 90% since it reported quarterly financials on Feb 8,

though without any clear catalyst for today's move. The stock is up

142% since its IPO in Sep & is now worth

about $148B. Last

week, ARM said it could charge twice as much for its latest instruction

set, which accounts for 15% of the company's royalties, suggesting it

can expand its margin & make more money off new chips. It also said it

was breaking into new markets, such as cloud servers & automotive,

due to AI demand. Its royalty strength combined with ARM's optimistic growth forecast has made the company the latest AI darling among investors, despite a higher earnings multiple than Nvidia (NVDA) or AMD (AMD). However, its value may become clearer next month when a 180-day lockup

expires. SoftBank (SFBQF) still owns 90% of the outstanding stock, meaning its

stake in ARM has increased more than $61B since the company's

report last week & is now worth upward of $131B. ARM stock surged 33.76 (29%).

Arm shares jump 25% as post-earnings rally extends to second week

In the 24 years since JetBlue Airways's (JBLU) first flight, the New York-based airline has pushed the envelope for a

carrier of its size. Now, with some veteran exec hires &

cost-cutting, it's trying to get back to basics. JBLU was a pioneer in seat-back entertainment, free Wi-Fi, good snacks & a

business-class cabin with lie-flat seats that debuted at lower prices

than rivals. More recently, it's ventured across the Atlantic with

flights to London, Paris, Amsterdam & Dublin. While

JetBlue has never lacked big ideas, it has come up short on profits,

cost control & reliability. Those challenges will be top of mind for

incoming CEO Joanna Geraghty when she takes the helm today,

succeeding Robin Hayes. Geraghty, 51, has been at JBLU for nearly 2

decades, most recently as pres & COO. By

naming her CEO, the company is promoting an insider who knows the

complexities of running an airline with quirks like New York's congested

airspace. She's the first woman to lead a US passenger airline. The stock rose 13¢.

JetBlue resets with new CEO, industry veterans to run on time, and profitably

Gold Closes Lower Ahead of Key US Inflation Data

WTI Crude Oil Closes With a Small Gain on Mideast Concerns

The CPI report tomorrow will give investors a first insight into how cool inflation is running in 2024 &, alongside an update on consumer spending, will set expectations for the timing & pace of Federal Reserve interest rate cuts this year. Dow's rise today to a new record, suggests the market is betting on favorable reports.Dow Jones Industrials