In the meticulously woven fabric of life's grand pursuits, homeownership stands as a beacon of achievement, symbolizing stability, prosperity, and the realization of personal dreams. The journey toward acquiring a place to call one's own is often fraught with complexities, requiring a blend of Financial acumen, strategic foresight, and an unwavering commitment to one's goals. It is within this challenging yet rewarding quest that the tale of John, a 35-year-old IT consultant from Manchester, unfolds, offering a vivid illustration of the intricacies involved in navigating the UK Mortgage landscape.

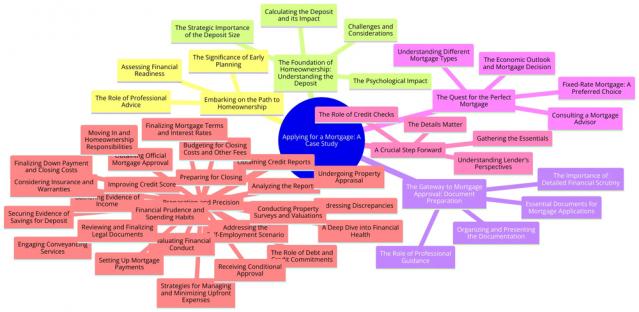

John's story, as detailed in "Applying for a Mortgage: A Case Study - A Journey Through Mortgage Application Stages," encapsulates a comprehensive exploration of the steps, considerations, and strategic decisions integral to securing a mortgage in the UK.

Embarking on this significant journey, John represents the aspirations of many who seek to transition from the uncertainties of renting to the stability and pride of homeownership. With a stable career and a clear vision for his future, John's initial endeavor to assess his financial readiness marks the commencement of a detailed and often challenging journey toward purchasing his first home.

The narrative meticulously delineates the importance of early planning and financial assessment, highlighting John's methodical approach to evaluating his annual income, monthly expenses, and financial commitments. This rigorous scrutiny enables him to estimate a realistic figure he could afford for mortgage repayments each month, utilizing online tools to gauge his borrowing capacity. Yet, John is acutely aware that these estimations are but the first step in a complex process that requires a deeper understanding of the mortgage landscape and the myriad products available.

As the case study unfolds, it delves into the strategic significance of the deposit in the mortgage application process. John's dedication to saving a substantial deposit not only exemplifies his fiscal discipline but also underscores the pivotal role of this financial prerequisite in enhancing his appeal to lenders and aligning with his long-term financial planning. The narrative further explores the challenges and psychological impacts of accumulating a significant deposit, offering insights into John's journey of careful budgeting, sacrifice, and strategic market timing.

The preparation of necessary documentation emerges as a critical phase in John's journey, demanding meticulous attention to detail and a comprehensive compilation of financial records. This stage is pivotal, as any oversight could potentially delay or hinder his chances of mortgage approval. The case study emphasizes the importance of presenting a clear, organized, and current set of documents to facilitate a smooth review process, reflecting John's seriousness and readiness as a borrower.

Exploring mortgage options presents John with a critical decision-making juncture, where understanding the nuances of different mortgage types and consulting with a mortgage advisor becomes invaluable. The narrative artfully navigates through John's contemplation of fixed-rate, tracker, and interest-only mortgages, ultimately leading to his strategic choice that best suits his financial situation and future goals.

The case study also addresses the crucial steps of identity and residency verification and the demonstration of financial stability and income, highlighting the thoroughness required in the mortgage application process. Furthermore, it delves into the review of John's credit history, a vital aspect that significantly influences his eligibility and the terms of the mortgage offer.

Index

Introduction to Homeownership and Initial Financial Assessment

- Embarking on the Path to Homeownership

- Assessing Financial Readiness

- The Significance of Early Planning

Navigating the Mortgage Landscape

- The Role of Professional Advice

The Role of Savings and Deposit in Mortgage Applications

- The Foundation of Homeownership: Understanding the Deposit

- Calculating the Deposit and its Impact

- The Strategic Importance of the Deposit Size

- Challenges and Considerations

- The Psychological Impact

Preparing Necessary Documentation for the Mortgage Application

- The Gateway to Mortgage Approval: Document Preparation

- Essential Documents for Mortgage Applications

- The Importance of Detailed Financial Scrutiny

- Organizing and Presenting the Documentation

- The Role of Professional Guidance

Exploring Mortgage Options

- The Quest for the Perfect Mortgage

- Understanding Different Mortgage Types

- Consulting a Mortgage Advisor

- Fixed-Rate Mortgage: A Preferred Choice

- The Economic Outlook and Mortgage Decision

The Importance of Identity and Residency Verification

- A Crucial Step Forward

- Gathering the Essentials

- The Details Matter

- Understanding Lender's Perspectives

- The Role of Credit Checks

- Preparation and Precision

Demonstrating Financial Stability and Income

- A Deep Dive into Financial Health

- Gathering Evidence of Income

- Addressing the Self-Employment Scenario

- Financial Prudence and Spending Habits

- The Role of Debt and Credit Commitments

Credit History Review

- Evaluating Financial Conduct

- Obtaining Credit Reports

- Analyzing the Reports

- Addressing Discrepancies

- Improving Credit Score

Proof of Deposit and Anticipating Upfront Costs

- Securing Evidence of Savings for Deposit

- Budgeting for Closing Costs and Other Fees

- Strategies for Managing and Minimizing Upfront Expenses

Finalizing the Mortgage Offer

- Receiving Conditional Approval

- Undergoing Property Appraisal

- Finalizing Mortgage Terms and Interest Rates

Legal Processes and Property Valuation

- Engaging Conveyancing Services

- Conducting Property Surveys and Valuations

- Reviewing and Finalizing Legal Documents

Mortgage Approval and Closing

- Obtaining Official Mortgage Approval

- Preparing for Closing

- Finalizing Down Payment and Closing Costs

Post-Closing Considerations

- Setting Up Mortgage Payments

- Considering Insurance and Warranties

- Moving In and Homeownership Responsibilities

How Can We Help

Introduction to Homeownership and Initial Financial Assessment

Embarking on the Path to Homeownership

John, a 35-year-old IT consultant living in Manchester, has embarked on a significant journey towards achieving homeownership, a milestone many aspire to. With a stable career and a clear vision for his future, John's first step was to assess his financial readiness, a crucial determinant in navigating the complexities of the mortgage application process in the UK. This decision marked the beginning of a detailed and often challenging journey toward purchasing his first home.

Assessing Financial Readiness

Understanding the gravity of financial commitment involved in buying a home, John began by evaluating his annual income, which stood at £50,000 before taxes. This assessment was not just about gauging his current financial status but also about planning for future obligations that come with owning a home. John meticulously scrutinized his monthly expenses and financial commitments, aiming to determine a realistic figure he could afford to allocate towards mortgage repayments each month.

Using an online mortgage calculator, John estimated that with a monthly repayment budget of £1,000, he could potentially secure a mortgage of around £200,000 over a 25-year term, assuming an interest rate of 3.5%. However, he was cognizant of the fact that these figures were estimations and that actual terms could vary significantly based on the lender's assessment and the prevailing market interest rates.

The Significance of Early Planning

John's early planning and financial assessment underscore the importance of being financially prepared before embarking on the mortgage application process. It highlights the need for potential homebuyers to have a clear understanding of their financial health and to approach the mortgage journey with realistic expectations.

Navigating the Mortgage Landscape

As John delved deeper into his financial readiness, he also began to familiarize himself with the mortgage landscape in the UK. He learned about the various types of mortgage products available, including fixed-rate mortgages, variable-rate mortgages, and tracker mortgages, each offering different terms and conditions that could impact his monthly repayments and overall loan cost.

The Role of Professional Advice

Recognizing the complexity of the mortgage market and the importance of making informed decisions, John considered seeking advice from a mortgage advisor. A professional advisor could offer insights into the best mortgage products suited to his financial situation and long-term goals, providing clarity and direction in a market filled with numerous options and variables.

John's journey towards applying for a mortgage in the UK is a testament to the importance of thorough financial preparation and understanding of the mortgage market. As he moves forward, the lessons learned during this initial phase will serve as a foundation for the subsequent steps in the mortgage application process. John's experience highlights the value of early planning, financial assessment, and the potential benefits of professional advice in navigating the path to homeownership.

The Role of Savings and Deposit in Mortgage Applications

The Foundation of Homeownership: Understanding the Deposit

In the quest for homeownership, one of the most pivotal steps for John, and indeed for any potential homeowner, is the accumulation and presentation of a substantial deposit. For John, a 35-year-old IT consultant from Manchester, this meant dedicating years of savings towards fulfilling his dream of buying a home. With an annual income of £50,000, John had managed to save £30,000, targeting it as a deposit for his future home. This deposit is not just a financial prerequisite; it's a testament to John's fiscal discipline and commitment to his goal of homeownership.

Calculating the Deposit and its Impact

John's deposit plays a crucial role in several aspects of the mortgage application process. Firstly, it directly influences the Loan-to-Value (LTV) ratio, a metric lenders use to assess the risk associated with the mortgage. A lower LTV ratio, achieved by offering a larger deposit, generally secures more favorable mortgage terms and interest rates. In John's case, his £30,000 deposit against a property worth £200,000 targets an LTV ratio of 85%, significantly reducing his risk profile in the eyes of potential lenders.

The Strategic Importance of the Deposit Size

Furthermore, the size of John's deposit can affect the affordability of the mortgage. By reducing the amount he needs to borrow, John can lower his monthly repayments, making the mortgage more manageable within his budget. This strategic move not only enhances his appeal to lenders but also aligns with his long-term financial planning, ensuring that he can comfortably meet his mortgage obligations without compromising his standard of living.

Challenges and Considerations

However, accumulating a substantial deposit is no small feat. It requires foresight, sacrifice, and sometimes, creative financial solutions. For John, this meant years of careful budgeting, cutting unnecessary expenses, and prioritizing his savings goals. It also involved staying informed about the housing market and mortgage trends, allowing him to strategically time his entry into the homeownership journey.

The Psychological Impact

Beyond its financial implications, the process of saving for a deposit also has a psychological aspect. For John, each contribution to his savings not only brought him closer to his financial target but also reinforced his commitment to achieving homeownership. This psychological investment in his future home added an additional layer of motivation, driving him to maintain his savings discipline even when faced with financial temptations.

In conclusion, the deposit is much more than just the first financial hurdle in the journey towards homeownership. For John, it represented a significant milestone, reflecting years of financial discipline and planning. The process of saving for a deposit underscored the importance of strategic financial management, patience, and perseverance.

As John moves forward in his journey, the lessons learned and the discipline demonstrated in accumulating his deposit will serve him well. The next steps of his journey will involve navigating the complexities of the mortgage application process, where his savings, financial stability, and the strategic use of his deposit will play crucial roles in securing his first home.

Preparing Necessary Documentation for the Mortgage Application - Mortgage Case Study

The Gateway to Mortgage Approval: Document Preparation

As John advances in his journey toward securing a mortgage for his first home, he encounters a critical phase: the preparation of necessary documentation. This stage is pivotal as it involves gathering and organizing a suite of documents that lenders require to assess his mortgage application. John's understanding of this process is crucial, as any oversight could potentially delay or hinder his chances of approval.

Essential Documents for Mortgage Applications

John's checklist includes several key documents, each serving a specific purpose in demonstrating his financial health and eligibility for a mortgage:

- Proof of Identity and Legal Residency: John begins with his current passport and recent utility bills. These documents are indispensable in verifying his identity and residency, a fundamental step to ensure compliance with UK financial regulations. Aware of the alternatives, John opts for his passport due to its universal acceptance among lenders.

- Proof of Income: To convincingly demonstrate his earnings, John compiles his latest P60 form, which outlines his annual income and taxes paid. Additionally, his last three months' payslips provide a snapshot of his regular income, a crucial factor in determining his repayment capacity.

- Bank Statements: Recent bank statements are gathered to evidence John's financial habits and saving consistency. These statements offer lenders a window into his financial management, showcasing his readiness to undertake the financial responsibility of a mortgage.

- Additional Documentation for Self-Employed Individuals: While John benefits from a straightforward proof of income due to his employment status, he acknowledges the complexities faced by self-employed applicants. They are typically required to provide at least two to three years of certified accounts, a requirement that underscores the lender's need for assurance on income stability.

The Importance of Detailed Financial Scrutiny

John understands that lenders will meticulously analyze both his income and outgoings to assess his affordability. This includes a thorough review of his spending habits, existing financial commitments, and his approach to savings. The comprehensiveness of the bank statements and payslips is therefore crucial, as they collectively paint a detailed picture of his financial discipline and stability.

Organizing and Presenting the Documentation

With the documents in hand, John's focus shifts to organizing them effectively. He ensures that each document is current, accurately filled out, and clearly legible. Knowing the importance of first impressions, John arranges the documents systematically, aiming to facilitate a smooth review process for the lender. This level of organization not only reflects his seriousness about the application but also minimizes the chances of delays related to document clarifications or requests for additional information.

The Role of Professional Guidance

At this juncture, John considers the value of professional advice. Consulting with a mortgage advisor, he verifies that his documentation aligns with the lender's requirements. This step is instrumental in identifying any potential gaps or areas for improvement in his application, thereby enhancing his chances of a favorable assessment.

The preparation of necessary documentation is a testament to John's meticulous approach to the mortgage application process. By carefully compiling and organizing his financial records, John lays a solid foundation for his application, demonstrating his reliability and readiness as a borrower.

As John moves forward, the insights gained from this preparation phase will be invaluable. The next part of his narrative will delve into exploring mortgage options, where John's financial readiness, as evidenced by his diligently prepared documentation, will play a crucial role in determining the best mortgage product for his needs.

Exploring Mortgage Options

The Quest for the Perfect Mortgage

With his documentation meticulously prepared, John's journey now leads him to one of the most critical decisions in the home-buying process: selecting the right mortgage. In the vast sea of mortgage options available in the UK, finding a mortgage that perfectly aligns with his financial situation and future goals is paramount. This part of his journey is characterized by research, comparison, and strategic decision-making.

Understanding Different Mortgage Types

John starts by familiarizing himself with the different types of mortgages available:

- Fixed-Rate Mortgages: These mortgages lock in an interest rate for a set period, providing stability and predictability in repayments. John considers this option for its protection against potential interest rate increases, which could be particularly advantageous in an unpredictable economic climate.

- Tracker Mortgages: These are variable-rate mortgages that track the Bank of England's base rate, meaning the interest rate (and therefore, John's repayments) could go up or down. While potentially offering lower rates initially, they introduce a level of uncertainty that John is cautious about.

- Interest-Only Mortgages: Here, monthly payments only cover the interest on the loan, not the principal amount borrowed. While the lower monthly payments are appealing, John is aware that he would need a robust repayment plan for the loan's balance at the end of the term.

Consulting a Mortgage Advisor

Recognizing the complexities involved and the long-term implications of his choice, John decides to consult a mortgage advisor. The advisor provides clarity on the pros and cons of each mortgage type, tailored to John's financial landscape. This professional guidance is invaluable, as it brings to light considerations John hadn't fully appreciated, such as the long-term cost implications of each mortgage type and the flexibility each option offers in terms of overpayments or early repayment.

Fixed-Rate Mortgage: A Preferred Choice

After thorough consideration and discussions with his mortgage advisor, John is leaning towards a fixed-rate mortgage. The certainty it offers in terms of monthly repayments gives him the financial stability he desires, especially in the initial years of homeownership when he anticipates other significant adjustments and expenses. The idea of being shielded from interest rate fluctuations, particularly in an uncertain economic environment, solidifies his preference for this mortgage type.

The Economic Outlook and Mortgage Decision

John's decision is also influenced by the broader economic outlook, including potential impacts of Brexit on interest rates and the housing market. The fixed-rate mortgage appears to be a safer bet against the backdrop of economic uncertainty, providing a sense of security that variable-rate options cannot match.

The exploration of mortgage options is a pivotal phase in John's home-buying journey, demanding a balance between financial wisdom and foresight. By consulting with a mortgage advisor and carefully considering his long-term financial stability, John has navigated through the complexities of mortgage selection with a strategic approach.

As he settles on a fixed-rate mortgage, John moves closer to realizing his dream of homeownership, armed with the knowledge and confidence that he has chosen a mortgage product that best suits his needs and circumstances.

The Importance of Identity and Residency Verification - Mortgage Case Study

A Crucial Step Forward

As John progresses in his mortgage application process, he reaches a critical juncture: verifying his identity and legal residency. This step is not merely a formality but a cornerstone of the mortgage approval process, ensuring compliance with legal requirements and safeguarding against fraud. For John, this phase underscores the meticulous nature of preparing a successful mortgage application.

Gathering the Essentials

John begins by gathering his identification documents. His current passport, a universally accepted form of identification, and recent utility bills for proof of address are at the top of his list. These documents serve dual purposes: establishing his identity and confirming his legal residency in the UK. Aware that lenders might also accept a driver’s license, John opts for his passport for its wide acceptance and the additional security it offers in the verification process.

The Details Matter

John is cognizant that the smallest discrepancy in his documentation could lead to delays or complications in his application. He meticulously checks that his name, date of birth, and address details are consistent across all documents. This consistency is crucial for passing through lenders' verification processes smoothly.

Understanding Lender's Perspectives

The verification of identity and residency is a critical component for lenders, aimed at mitigating risk. By thoroughly validating the identities and residential statuses of applicants, lenders protect themselves against fraud and ensure compliance with anti-money laundering regulations. For John, presenting clear and unambiguous documentation is not just about fulfilling a requirement; it's about demonstrating his reliability and straightforwardness as a borrower.

The Role of Credit Checks

In addition to identity and residency checks, lenders will conduct credit checks to assess John's financial history and creditworthiness. This involves querying John's credit records with credit reference agencies to get a comprehensive view of his financial behavior, including past loans, credit card usage, and repayment history. John understands that his financial conduct, as reflected in his credit report, will significantly influence the lender's decision.

Preparation and Precision

John's preparation for this verification process is meticulous. He ensures that every document is current, accurately reflecting his personal details, and he prepares explanations for any potential queries lenders might have. For instance, if there were any recent changes in his address or personal circumstances, John is ready to provide context and additional documentation to clarify these changes.

The verification of identity and legal residency is a testament to the thoroughness required in the mortgage application process. For John, this step is about more than just submitting documents; it's a demonstration of his attentiveness and commitment to the process. By providing clear, consistent, and current documentation, John aims to facilitate a smooth review by the lender, minimizing the potential for delays or questions.

As John moves beyond this phase, he inches closer to making his dream of homeownership a reality. The next part of this series will delve into demonstrating financial stability and income, where John will need to showcase his financial health and readiness to take on the responsibilities of a mortgage.

Demonstrating Financial Stability and Income - Mortgage Case Study

A Deep Dive into Financial Health

Having navigated the identity and residency verification phase, John now faces a critical aspect of the mortgage application process: demonstrating his financial stability and income. This step is paramount, as lenders meticulously analyze applicants' financial backgrounds to gauge their ability to sustain mortgage payments over the long term. John's approach to this phase is characterized by thorough preparation and transparency, aimed at showcasing his financial reliability and readiness for homeownership.

Gathering Evidence of Income

John begins by compiling a comprehensive set of documents to evidence his income:

- Payslips and Employment Details: John collects his most recent payslips, covering the last three months, to provide a snapshot of his regular income. These payslips detail his gross salary, tax deductions, and net income, offering a clear view of his earning capacity. Additionally, he includes a letter from his employer confirming his employment status and annual salary, further solidifying his financial stability.

- P60 Form: As a testament to his annual earnings and taxes paid, John also prepares his latest P60 form. This document is crucial for lenders to assess his yearly financial performance and tax contributions, serving as an official summary of his income.

- Bank Statements: To complement his income documentation, John includes recent bank statements that reflect his monthly income deposits and consistent saving habits. These statements are instrumental in demonstrating his financial management skills, showing not only his ability to save but also his prudence in handling financial commitments.

Addressing the Self-Employment Scenario

While John benefits from a straightforward employment scenario, he is aware of the additional challenges faced by self-employed individuals in demonstrating income stability. For those in self-employment, the requirement often extends to providing at least two to three years of certified accounts and tax returns, underscoring the need for a stable income history. John's preparation acknowledges the diverse requirements applicants may face based on their employment status.

Financial Prudence and Spending Habits

Beyond just proving income, John understands that lenders will scrutinize his outgoings, spending habits, and overall financial prudence. His bank statements serve a dual purpose here, not only verifying his income but also illustrating his responsible spending and saving patterns. This level of detail is vital for lenders conducting affordability assessments, ensuring that applicants can comfortably manage their mortgage repayments alongside their existing financial commitments.

The Role of Debt and Credit Commitments

An integral part of demonstrating financial stability involves addressing any existing debts or credit commitments. John prepares documentation related to his car loan, credit card balances, and any other financial obligations. He ensures that these documents reflect timely payments and a manageable level of debt, reinforcing his capability to take on a mortgage without jeopardizing his financial health.

The process of demonstrating financial stability and income is a meticulous one, requiring applicants to provide a holistic view of their financial health. For John, this phase is about more than just meeting documentation requirements; it's an opportunity to showcase his financial readiness and reliability as a potential homeowner.

Credit History Review - Mortgage Case Study

Evaluating Financial Conduct

Following the demonstration of his financial stability and income, John embarks on the next crucial step in the mortgage application process: reviewing his credit history. This phase is vital as lenders use credit history to assess an applicant's reliability in managing credit and making timely repayments. A positive credit history can significantly enhance John's chances of securing a favorable mortgage offer.

Obtaining Credit Reports

John begins by requesting his credit reports from the three major credit bureaus in the UK: Experian, Equifax, and TransUnion. These reports provide a comprehensive overview of his financial behavior, including credit accounts, loan history, payment punctuality, and any financial issues such as defaults or County Court Judgments (CCJs). John understands that discrepancies in these reports can adversely affect his mortgage application, making this review an essential step in identifying and rectifying any inaccuracies.

Analyzing the Reports

With the credit reports in hand, John meticulously analyzes each one, comparing the recorded information against his own records. He checks for:

- Accuracy of Personal Information: Ensuring that his personal details, such as name, address history, and financial associations, are correctly listed without any errors.

- Account Details: Verifying that all credit accounts, both open and closed, are accurately reported, including credit limits, balances, and payment history.

- Discrepancies or Errors: Identifying any inaccuracies or outdated information that could negatively impact his credit score, such as incorrectly listed missed payments or accounts that he does not recognize.

Addressing Discrepancies

Upon discovering discrepancies in his credit report, John takes immediate action. He gathers relevant documentation, such as bank statements or correspondence with credit institutions, to dispute inaccuracies. John contacts the credit bureaus to rectify the errors, providing evidence to support his claims. This proactive approach is crucial, as unresolved discrepancies can lead to unfavorable mortgage terms or even application rejection.

Improving Credit Score

In addition to rectifying inaccuracies, John explores ways to improve his credit score. He ensures that all his current accounts are in good standing, makes timely payments, and reduces outstanding credit card balances. John also considers registering on the electoral roll if he hasn't already, as this can positively impact his credit score by verifying his residency and stability.

The Impact of Credit History on Mortgage Applications

John is aware that a strong credit history not only improves his eligibility for a mortgage but can also affect the interest rates offered by lenders. A higher credit score often translates to lower interest rates, reducing the overall cost of the mortgage. Therefore, John's diligence in reviewing and improving his credit history is a strategic move towards securing the best possible mortgage deal.

The credit history review is a critical component of the mortgage application process, offering John an opportunity to ensure that his financial behavior is accurately represented. By addressing discrepancies and improving his credit score, John enhances his appeal to lenders, positioning himself as a reliable and creditworthy borrower.

Proof of Deposit and Anticipating Upfront Costs

Securing the Foundation with a Solid Deposit

After meticulous preparation of his financial documentation and a thorough review of his credit history, John's journey towards homeownership progresses to proving his deposit and anticipating the upfront costs associated with purchasing a property. This stage is crucial as it involves showcasing his financial readiness not just for the monthly mortgage repayments but also for the initial costs of buying a home.

Demonstrating the Deposit

John has diligently saved £30,000 for his deposit, a significant sum that demonstrates his commitment and financial discipline. To present this to the lenders, he prepares:

- Bank statements showing the accumulation of his savings over time.

- Documentation or a letter explaining the source of the deposit, especially if part of it comes from a gift or an inheritance, to ensure transparency and compliance with anti-money laundering regulations.

Understanding the Loan-to-Value Ratio

The deposit plays a critical role in determining the loan-to-value (LTV) ratio, a key factor lenders consider when setting the interest rate of the mortgage. John's substantial deposit aims to lower the LTV ratio, potentially qualifying him for more favorable mortgage rates. This strategic move underscores the importance of a significant deposit in the home buying process.

Anticipating Upfront Costs

Beyond the deposit, John prepares for additional upfront costs, including:

- Stamp Duty Land Tax (SDLT): Understanding the current stamp duty thresholds and rates to estimate how much he will need to pay, if applicable.

- Valuation Fees: Budgeting for the cost of a property valuation, required by the lender to ensure the property's price matches its actual value.

- Survey Costs: Considering the price of a homebuyer's report or a full structural survey, which, although not mandatory, is advisable for peace of mind about the property's condition.

- Legal Fees: Estimating the conveyancing fees for a solicitor or conveyancer to handle the legal aspects of the property purchase.

- Mortgage Arrangement and Broker Fees: If applicable, preparing for any fees charged by the lender or a mortgage broker for arranging the mortgage.

A Comprehensive Financial Plan

John compiles a detailed breakdown of these costs, ensuring he has the necessary funds in addition to his deposit. This forward-thinking approach highlights his thorough preparation and understanding of the financial responsibilities involved in purchasing a home.

The proof of deposit and anticipation of upfront costs mark a pivotal phase in John's path to homeownership, demonstrating his financial readiness to proceed with the property purchase. This meticulous planning and budgeting for both the deposit and additional purchase costs illustrate his prudent approach to financial management and his readiness for the commitments of home buying.

Finalizing the Mortgage Application and Property Valuation - Mortgage Case Study

After John has diligently prepared his financial documentation, reviewed his credit history, and accounted for his deposit and upfront costs, he moves on to finalizing his mortgage application and preparing for the property valuation. This stage is crucial as it involves the lender's assessment of both John's financial eligibility and the property's value to ensure it matches the loan amount.

Finalizing the Mortgage Application

John meticulously reviews his mortgage application one last time before submission, ensuring all information is accurate and complete. This includes:

- Personal and financial details.

- Proof of income and employment.

- Documentation of his deposit and evidence of savings.

- Detailed information on the property he intends to buy.

- Any other required documents by the lender, tailored to John's specific circumstances.

Understanding the Property Valuation Process

As part of the mortgage application process, the lender arranges for a property valuation. This step is essential for the lender to confirm that the property's value is appropriate for the amount John wishes to borrow. The valuation helps protect the lender's interests by ensuring the loan is secured against a property worth the investment.

John prepares for this by:

- Providing detailed information about the property, including its size, condition, and any improvements made.

- Being ready for possible outcomes of the valuation, which could impact the loan terms or require renegotiation of the property price.

Anticipating the Mortgage Offer

Upon successful application and property valuation, John awaits the mortgage offer. This document formalizes the lender's proposal, including the loan amount, interest rate, and terms and conditions of the mortgage. John knows this offer's acceptance is a significant commitment and plans to review it thoroughly with a legal or financial advisor before agreeing.

Finalizing the mortgage application and undergoing property valuation are critical steps in securing a mortgage. For John, these steps represent the culmination of his careful planning and preparation, bringing him one step closer to homeownership. His attention to detail and proactive approach in these phases are crucial for a smooth transition to the next stages of purchasing his home.

The Final Step - Getting the Mortgage Approved

After meticulously preparing his application, evaluating his financial standing, and considering the property's value, John approaches the final hurdle in his home-buying journey: obtaining mortgage approval. This critical phase is the culmination of all his efforts, where his financial diligence and strategic planning are put to the ultimate test.

Awaiting Approval

With his mortgage application submitted, including all necessary documentation and the property valuation report, John enters a period of anticipation. During this time, the lender conducts a final review of John's financial background, the property details, and the valuation to make an informed decision on the mortgage application.

Addressing Lender Queries

It's not uncommon for lenders to have additional questions or require further clarification on certain aspects of the application. John remains proactive, ready to provide any extra information or documentation needed. This responsiveness helps maintain the momentum of his application process, showcasing his commitment and seriousness about the purchase.

Receiving the Mortgage Offer

The moment John has been waiting for finally arrives: the mortgage offer. This official document from the lender outlines the terms of the mortgage, including the loan amount, interest rate, repayment period, and any conditions attached to the offer. Receiving this offer signifies that John's application has been approved, a milestone that brings him one step closer to homeownership.

Reviewing the Mortgage Offer

Understanding the gravity of this commitment, John takes time to carefully review the mortgage offer. He consults with a financial advisor to ensure that the terms are favorable and aligned with his financial goals and capabilities. This review process is crucial, as it's the last opportunity for John to negotiate terms or clarify any conditions before accepting the offer.

Accepting the Offer

Satisfied with the terms and confident in his decision, John formally accepts the mortgage offer. This acceptance is a significant legal and financial commitment, marking the beginning of his responsibilities as a homeowner with a mortgage.

Preparing for Completion

With the mortgage offer accepted, John's focus shifts to the final stages of the home-buying process: the exchange of contracts and completion. He coordinates with his solicitor to ensure all legal paperwork is in order, ready for the exchange of contracts with the seller. This legal step solidifies the sale, making John legally committed to purchasing the property.

The Completion Day

Completion day is when the transaction is finalized. John transfers the remaining funds to the seller, and in return, receives the keys to his new home. This day marks the culmination of John's journey from a hopeful homebuyer to a homeowner, a dream realized through careful planning, perseverance, and strategic financial management.

Reflection and Forward-Looking

Reflecting on his journey, John appreciates the importance of each step he took, from assessing his financial readiness to navigating the mortgage application process. As he stands on the threshold of his new home, he looks forward to making it his own and building a future within its walls.

Securing mortgage approval and completing the purchase of a home is a complex process that requires diligence, financial acumen, and patience. For John, the journey from preparation to approval underscores the importance of thorough planning and proactive engagement with the process. His story serves as an insightful guide for others embarking on their path to homeownership, highlighting the steps, challenges, and triumphs involved in turning the dream of owning a home into reality.

How Pro Tax Accountant Can Help You With Securing a Mortgage

Securing a mortgage in the UK can often seem like navigating through a maze, especially for those unfamiliar with the intricacies of financial and tax regulations. This is where Pro Tax Accountant (PTA) steps in, offering a beacon of guidance and expertise. With a comprehensive suite of services tailored to meet the needs of individuals and businesses alike, PTA stands out as a pivotal ally in your journey to securing a mortgage. Let's delve into how they can make this process smoother and more accessible.

Understanding the Role of Pro Tax Accountant

PTA is not just any tax accounting firm; it's a hub of professional tax accountants and advisors based in the City of London, extending services across the UK. They specialize in a wide array of accounting services, including tax accounting, bookkeeping, VAT returns, self-assessment tax, payroll services, annual accounts, company formation, and more. Their expertise is not limited to just handling your taxes; they play a crucial role in ensuring that your financial affairs are in perfect order, which is a critical factor when applying for a mortgage.

Expertise in Tax and Financial Matters

One of the primary hurdles in securing a mortgage is proving your financial stability and reliability to lenders. PTA's expertise in tax and financial matters positions them as an invaluable asset in this regard. They ensure that your tax filings are up to date and accurately reflect your financial health, which lenders scrutinize closely. By managing your accounts, tax returns, and compliance with tax laws, PTA helps in painting a trustworthy financial picture to potential lenders.

Tailored Advice and Support

Every individual's financial situation is unique, and so are their mortgage needs. PTA understands this and offers tailored advice and support to match your specific circumstances. Whether you're a high-net-worth individual, a business director, an entrepreneur, or a sole trader, PTA's personalized approach ensures that your financial records and tax affairs are optimized to enhance your mortgage eligibility.

Utilizing Connections for Mortgage Approval

PTA's extensive network and professional relationships within the financial sector provide an added advantage. They can leverage these connections to facilitate the mortgage application process. Their understanding of the mortgage market, combined with their professional ties, can be instrumental in finding the right lenders who are more likely to approve your mortgage application based on your financial and tax standing.

Comprehensive Financial Health Check

Before applying for a mortgage, it's crucial to have a comprehensive review of your financial health. PTA offers a thorough assessment of your financial affairs, identifying any potential issues that could hinder your mortgage application. This preemptive approach ensures that you can address any concerns before they become obstacles, thereby increasing your chances of mortgage approval.

Streamlining the Mortgage Application Process

The mortgage application process involves a myriad of documentation and compliance requirements. PTA's expertise in financial documentation, tax compliance, and legal regulations streamlines this process. They can assist in preparing and organizing all necessary documents, ensuring that your application is complete, accurate, and presented in the best possible light to lenders.

In the complex landscape of mortgage applications in the UK, having Pro Tax Accountant by your side can be a game-changer. Their expertise in tax and financial matters, personalized advice, and ability to use their connections for mortgage approval significantly enhance your chances of securing a mortgage. Whether you're navigating the initial stages of considering a mortgage or are deep into the application process, PTA's comprehensive services and support system are designed to guide you every step of the way, making the dream of homeownership a tangible reality.