I have a soft spot in my heart for PennantPark Investment (NYSE: PNNT).

A long time ago, when I was in my 20s, I was taking the train home and noticed that someone had left an investment newsletter behind. I don’t remember which newsletter it was (maybe it was from one of my predecessors here at The Oxford Club), but it featured an article on Pennantpark.

I don’t recall the details of the article, but I was enticed by the stock’s high yield and bought some shares. It was one of the first stocks I ever bought. I sold it a few years later at around breakeven.

Today, the stock yields a giant 12.3% and pays a $0.07 per share monthly Dividend. Let’s take a look to see whether investors can rely on that strong dividend in the future.

PennantPark issues loans and provides occasional equity financing to middle-market companies, which are businesses that are valued at between $10 million and $1 billion.

Its investments include…

- American Insulated Glass, a 34-year-old company with offices in seven states

- Comodo, a provider of secure sockets layer (SSL) certificates, which allow websites to be more secure

- Ox Engineered Products, a Northville, Michigan-based provider of foam, sheathing and wrap to builders.

PennantPark also has an outstanding loan to Cano Health, an operator of primary healthcare clinics in South Florida that filed for Chapter 11 bankruptcy protection last month.

PennantPark did not mention or allude to Cano’s situation on its conference call for the first quarter of fiscal 2024 or in its earnings release that was issued three days after the bankruptcy filing. I’m not too concerned about it, though. Cano represents only a very small portion of the portfolio.

Because PennantPark is a lender, we look at net interest income (NII) to determine whether the company generates enough cash to pay its dividend.

Last year, NII surged from $59 million to $99 million, and this year, it is forecast to grow another 13% to $112 million.

Meanwhile, the company paid out $49.6 million in dividends last year for a payout ratio of just 50%. This year, the payout ratio is expected to drop to 49%, so PennantPark can still easily afford its dividend.

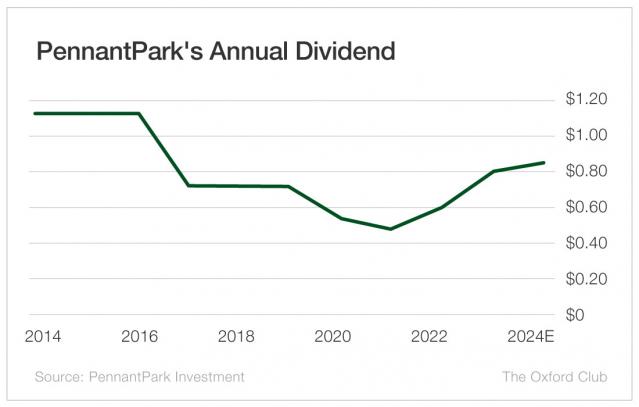

Here’s where it gets tricky, though. The company has cut the dividend three times in the past 10 years, and the dividend is still below where it was a decade ago. That is something Safety Net does not like to see.

The company can easily afford its dividend right now. But PennantPark has made it very clear it will cut the payout when it needs to. For that reason alone, this dividend cannot be considered safe.

Dividend Safety Rating: D

If you have a stock whose dividend safety you’d like us to analyze, leave the ticker symbol in the comments section below.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds or closed-end funds.

The post Can Pennantpark Investment Avoid Another Dividend Cut? appeared first on Wealthy Retirement.