A Risk Register, also known as a Risk Log, is a document or database used in project management and risk management to identify, assess, and manage risks associated with any project or operation. It serves as a central tool to document potential risks, their severity, impact, and the actions required to mitigate them. The register helps in tracking risks over the life of a project and ensuring that risk management remains a continual process.

- Purpose and Scope: The main goal of a risk register is to provide a systematic approach to identifying, quantifying, and managing risks, ensuring that all project stakeholders have a clear understanding of each risk and its potential impacts.

- Principal Concepts: Involves risk identification, risk analysis, risk prioritization, and tracking of mitigation efforts.

Theoretical Foundations of Risk Register

The Risk Register is grounded in risk management theory, which is a branch of project management focused on identifying possible future events that may negatively impact the project and devising strategies to manage these risks appropriately.

- Uncertainty and Project Management: Recognizes that all projects inherently contain uncertainty and risks which need to be managed proactively.

- Preventive Action: Emphasizes taking preventive actions rather than reactive measures, aligning with the adage “prevention is better than cure.”

Methods and Techniques in Risk Register

Creating and maintaining an effective risk register involves several key practices:

- Risk Identification: Documenting all potential risks that could affect the project, sourced from brainstorming sessions, historical data, industry insights, and stakeholder input.

- Risk Analysis: Assessing each risk in terms of likelihood and impact to determine its priority. This often involves qualitative techniques like risk matrices or quantitative methods like Monte Carlo simulations.

- Risk Prioritization: Ranking risks to focus efforts on the most critical ones that could have the greatest impact on the project.

- Mitigation Strategies: Developing actionable strategies to mitigate risks, assigning responsibilities, and setting deadlines for risk response actions.

Applications of Risk Register

The risk register is a versatile tool used across various fields to manage project risks effectively:

- Construction and Engineering: Managing risks related to costs, timelines, labor, materials, and environmental impacts.

- IT and Software Development: Addressing risks such as scope creep, technology changes, and cybersecurity threats.

- Healthcare: Identifying risks associated with patient care, data privacy, regulatory compliance, and technology implementations.

Industries Influenced by Risk Register

- Financial Services: Used to manage risks in investments, credit, market changes, and compliance with regulations.

- Event Planning: Helps in managing risks related to vendor reliability, weather conditions, and logistical challenges.

Advantages of Using Risk Register

Implementing a risk register provides several benefits:

- Enhanced Preparedness: Improves the organization’s preparedness for potential risks, minimizing impacts on project objectives.

- Improved Communication: Facilitates better communication among team members and stakeholders about risks and their management.

- Documentation and Compliance: Provides documented evidence of risk management efforts, useful for audits and compliance with industry regulations.

Challenges and Considerations in Risk Register

Despite its benefits, maintaining a risk register presents challenges:

- Dynamic Updating: Risks change as projects progress; keeping the risk register updated requires constant attention and systematic review.

- Stakeholder Engagement: Ensuring all relevant stakeholders are engaged in the risk management process and understand their responsibilities.

Integration with Broader Project Management

To maximize its effectiveness, the risk register should be integrated into the organization’s broader project management and governance frameworks:

- Regular Reviews: Incorporating regular risk review meetings into project schedules to assess and update the risk register.

- Integrated Project Tools: Linking the risk register with other project management tools, such as project scheduling, to ensure that risk mitigation is part of the overall project plan.

Future Directions in Risk Register

As project environments and technologies evolve, so too will the methodologies for risk management:

- AI and Machine Learning: Future risk registers might utilize AI to predict risks based on historical data and ongoing project metrics.

- Real-time Risk Management: Advancements in project management software could allow for real-time risk tracking and management, enhancing responsiveness and adaptability.

Conclusion and Strategic Recommendations

A Risk Register is an essential tool for effective risk management in any project, providing a structured approach to identifying, analyzing, and mitigating risks:

- Stakeholder Training: Ensuring all project stakeholders are trained in risk management practices and understand how to use and contribute to the risk register.

- Technology Utilization: Leveraging advanced project management and risk analysis tools to enhance the effectiveness and accuracy of the risk register.

Related Business Matrices

Connected Analysis Frameworks

Failure Mode And Effects Analysis

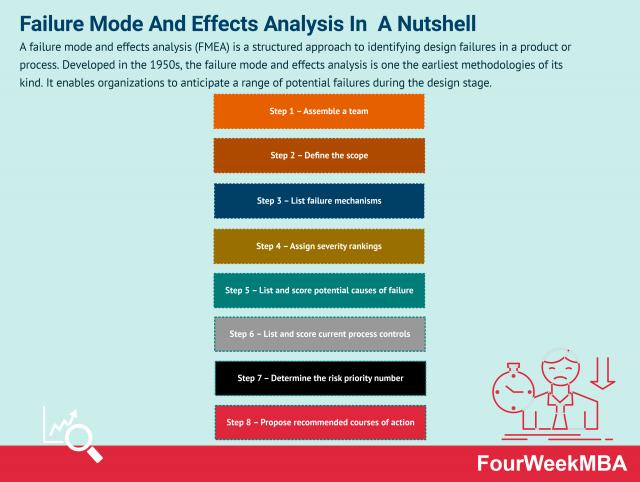

A failure mode and effects analysis (FMEA) is a structured approach to identifying design failures in a product or process. Developed in the 1950s, the failure mode and effects analysis is one the earliest methodologies of its kind. It enables organizations to anticipate a range of potential failures during the design stage.

Agile Business Analysis

Agile Business Analysis (AgileBA) is certification in the form of guidance and training for business analysts seeking to work in agile environments. To support this shift, AgileBA also helps the business analyst relate Agile projects to a wider organizational mission or strategy. To ensure that analysts have the necessary skills and expertise, AgileBA certification was developed.

Business Valuation

Business valuations involve a formal analysis of the key operational aspects of a business. A business valuation is an analysis used to determine the economic value of a business or company unit. It’s important to note that valuations are one part science and one part art. Analysts use professional judgment to consider the financial performance of a business with respect to local, national, or global economic conditions. They will also consider the total value of assets and liabilities, in addition to patented or proprietary technology.

Paired Comparison Analysis

A paired comparison analysis is used to rate or rank options where evaluation criteria are subjective by nature. The analysis is particularly useful when there is a lack of clear priorities or objective data to base decisions on. A paired comparison analysis evaluates a range of options by comparing them against each other.

Monte Carlo Analysis

The Monte Carlo analysis is a quantitative risk management technique. The Monte Carlo analysis was developed by nuclear scientist Stanislaw Ulam in 1940 as work progressed on the atom bomb. The analysis first considers the impact of certain risks on project management such as time or budgetary constraints. Then, a computerized mathematical output gives businesses a range of possible outcomes and their probability of occurrence.

Cost-Benefit Analysis

A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives.

CATWOE Analysis

The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.

VTDF Framework

It’s possible to identify the key players that overlap with a company’s business model with a competitor analysis. This overlapping can be analyzed in terms of key customers, technologies, distribution, and financial models. When all those elements are analyzed, it is possible to map all the facets of competition for a tech business model to understand better where a business stands in the marketplace and its possible future developments.

Pareto Analysis

The Pareto Analysis is a statistical analysis used in business decision making that identifies a certain number of input factors that have the greatest impact on income. It is based on the similarly named Pareto Principle, which states that 80% of the effect of something can be attributed to just 20% of the drivers.

Comparable Analysis

A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.

SWOT Analysis

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.

PESTEL Analysis

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.

Business Analysis

Business analysis is a research discipline that helps driving change within an organization by identifying the key elements and processes that drive value. Business analysis can also be used in Identifying new business opportunities or how to take advantage of existing business opportunities to grow your business in the marketplace.

Financial Structure

In corporate finance, the financial structure is how corporations finance their assets (usually either through debt or equity). For the sake of reverse engineering businesses, we want to look at three critical elements to determine the model used to sustain its assets: cost structure, profitability, and cash flow generation.

Financial Modeling

Financial modeling involves the analysis of accounting, finance, and business data to predict future financial performance. Financial modeling is often used in valuation, which consists of estimating the value in dollar terms of a company based on several parameters. Some of the most common financial models comprise discounted cash flows, the M&A model, and the CCA model.

Value Investing

Value investing is an investment philosophy that looks at companies’ fundamentals, to discover those companies whose intrinsic value is higher than what the market is currently pricing, in short value investing tries to evaluate a business by starting by its fundamentals.

Buffet Indicator