Second-degree price discrimination, a sophisticated Pricing strategy employed by businesses across diverse industries, involves offering different prices to customers based on the quantity or volume of goods or services purchased rather than individual characteristics or willingness to pay.

Understanding Second-Degree Price Discrimination

Second-degree price discrimination, also known as nonlinear pricing, entails offering Tiered Pricing Structures or volume discounts to incentivize customers to purchase larger quantities or higher-value packages of goods or services. Unlike first-degree price discrimination, which tailors prices to individual customers’ willingness to pay, second-degree price discrimination targets variations in demand elasticity across different customer segments or purchasing behaviors. By leveraging economies of scale and demand variability, businesses can capture additional revenue from price-sensitive customers while maximizing profitability.

Key Components Driving Second-Degree Price Discrimination

Implementing second-degree price discrimination relies on several key components and methodologies:

- Price Differentiation: Businesses offer tiered pricing structures, quantity discounts, or bundling options to encourage customers to purchase larger volumes or higher-value packages.

- Segmentation Analysis: Segmentation analysis identifies customer segments with varying levels of price sensitivity or purchasing behavior, allowing businesses to tailor pricing strategies to target different segments effectively.

- Demand Forecasting: Accurate demand forecasting and analysis enable businesses to anticipate fluctuations in customer demand and adjust pricing strategies accordingly to maximize revenue and profitability.

The Value Proposition of Second-Degree Price Discrimination

Second-degree price discrimination offers several compelling benefits for businesses seeking to optimize revenue and market segmentation:

- Revenue Optimization: Tiered pricing structures and volume discounts allow businesses to capture additional revenue from price-sensitive customers or high-volume purchasers, maximizing overall revenue and profitability.

- Customer Segmentation: By offering different pricing options based on customers’ purchasing behavior or volume preferences, businesses can segment the market effectively and tailor marketing strategies to target specific customer segments.

- Competitive Advantage: Second-degree price discrimination enables businesses to differentiate themselves in the market by offering flexible pricing options and value-added incentives that attract and retain customers while deterring competitors.

Challenges and Considerations

Despite its potential benefits, second-degree price discrimination presents several challenges and considerations for businesses:

- Complexity of Implementation: Implementing tiered pricing structures and volume discounts requires careful analysis of customer data, demand patterns, and competitive dynamics, as well as robust pricing models and systems to execute effectively.

- Customer Perception: Customers may perceive tiered pricing structures or volume discounts as unfair or discriminatory if not implemented transparently or if pricing strategies disproportionately benefit certain customer segments over others.

- Risk of Cannibalization: Offering volume discounts or bundling options may risk cannibalizing sales of higher-margin products or services if customers substitute lower-priced options for premium offerings.

Strategies for Successful Implementation

Achieving success with second-degree price discrimination entails adopting effective strategies and best practices:

- Data-Driven Decision Making: Leveraging customer data, market research, and demand forecasting tools enables businesses to develop pricing strategies that align with customer preferences and market dynamics.

- Value-Based Pricing: Aligning pricing strategies with the perceived value of products or services to different customer segments allows businesses to justify tiered pricing structures and volume discounts effectively.

- Continuous Monitoring and Optimization: Regularly monitoring sales data, customer feedback, and competitive pricing trends allows businesses to fine-tune pricing strategies and adapt to changing market conditions.

Real-World Applications

Second-degree price discrimination finds application across various industries and sectors, including:

- Telecommunications: Telecom providers offer tiered pricing plans and volume discounts for voice, data, and messaging services to cater to different usage patterns and customer preferences.

- Subscription Services: Streaming platforms and subscription-based businesses offer tiered pricing options or volume discounts for premium memberships or bundle packages, encouraging customers to upgrade or purchase higher-value subscriptions.

- Retail: Retailers employ volume discounts, bulk pricing, or bundle offers to incentivize customers to purchase larger quantities or higher-value packages of products, driving sales and increasing average transaction values.

Conclusion

In conclusion, second-degree price discrimination stands as a powerful pricing strategy for businesses seeking to optimize revenue, maximize profitability, and segment the market effectively in today’s dynamic and competitive landscape. By leveraging tiered pricing structures, volume discounts, and bundling options, businesses can capture additional revenue from price-sensitive customers while tailoring pricing strategies to target specific customer segments. While challenges exist in implementation and customer perception, the potential benefits of second-degree price discrimination make it a compelling strategy for businesses looking to gain a competitive edge and achieve long-term success in an increasingly complex and evolving marketplace.

Expanded Pricing Strategies Explorer

| Pricing Strategy | Description | Key Insights |

|---|---|---|

| Cost-Plus Pricing | Markup added to production cost for profit | Ensures costs are covered and provides a predictable profit margin. |

| Value-Based Pricing | Prices set based on perceived customer value | Aligns prices with what customers are willing to pay for the product or service. |

| Competitive Pricing | Pricing in line with competitors or undercutting | Helps maintain competitiveness and market share. |

| Dynamic Pricing | Prices adjusted based on real-time demand | Maximizes revenue by responding to changing market conditions. |

| Penetration Pricing | Low initial prices to gain market share | Attracts price-sensitive customers and establishes brand presence. |

| Price Skimming | High initial prices gradually lowered | Capitalizes on early adopters’ willingness to pay a premium. |

| Bundle Pricing | Multiple products or services as a package | Increases the perceived value and encourages upselling. |

| Psychological Pricing | Pricing strategies based on psychology | Leverages pricing cues like $9.99 instead of $10 for perceived savings. |

| Freemium Pricing | Free basic version with premium paid features | Attracts a wide user base and converts some to paying customers. |

| Subscription Pricing | Recurring fee for ongoing access or service | Creates predictable revenue and fosters customer loyalty. |

| Skimming and Scanning | Continually adjusting prices based on market dynamics | Adapts to changing market conditions and optimizes pricing. |

| Promotional Pricing | Temporarily lowering prices for promotions | Encourages short-term purchases and boosts sales volume. |

| Geographic Pricing | Adjusting prices based on geographic location | Accounts for variations in cost of living and local demand. |

| Anchor Pricing | High initial price as a reference point | Influences perception of value and makes other options seem more affordable. |

| Odd-Even Pricing | Prices just below round numbers (e.g., $19.99) | Creates a perception of lower cost and encourages purchases. |

| Loss Leader Pricing | Offering a product below cost to attract customers | Drives traffic and encourages additional purchases. |

| Prestige Pricing | High prices to convey exclusivity and quality | Appeals to premium or luxury markets and enhances brand image. |

| Value-Based Bundling | Combining complementary products for value | Encourages customers to buy more while receiving a perceived discount. |

| Decoy Pricing | Less attractive third option to influence choice | Guides customers toward a preferred option. |

| Pay What You Want (PWYW) | Customers choose the price they want to pay | Promotes customer goodwill and can lead to higher payments. |

| Dynamic Bundle Pricing | Prices for bundled products based on customer choices | Tailors bundles to customer preferences. |

| Segmented Pricing | Different prices for the same product by segments | Considers diverse customer groups and willingness to pay. |

| Target Pricing | Prices set based on a specific target margin | Ensures profitability based on specific financial goals. |

| Loss Aversion Pricing | Emphasizes potential losses averted by purchase | Encourages decision-making by highlighting potential losses. |

| Membership Pricing | Exclusive pricing for members of loyalty programs | Fosters customer loyalty and membership growth. |

| Seasonal Pricing | Price adjustments based on seasonal demand | Matches pricing to fluctuations in consumer behavior. |

| FOMO Pricing (Fear of Missing Out) | Limited-time discounts or deals | Creates urgency and encourages purchases. |

| Predatory Pricing | Low prices to deter competitors or drive them out | Strategic pricing to gain market dominance. |

| Price Discrimination | Different prices to different customer segments | Capitalizes on varying willingness to pay. |

| Price Lining | Different versions of a product at different prices | Catering to various customer preferences. |

| Quantity Discount | Discounts for bulk or volume purchases | Encourages larger orders and repeat business. |

| Early Bird Pricing | Lower prices for early adopters or advance buyers | Rewards early commitment and generates initial sales. |

| Late Payment Penalties | Additional fees for late payments | Encourages timely payments and revenue collection. |

| Bait-and-Switch Pricing | Attracting with a low-priced item, then upselling | Uses attractive deals to lure customers to higher-priced options. |

| Group Buying Discounts | Discounts for purchases made by a group or community | Encourages collective buying and customer loyalty. |

| Lease or Rent-to-Own Pricing | Lease with an option to purchase later | Provides flexibility and ownership choice for customers. |

| Bid Pricing | Customers bid on products or services | Prices determined by customer demand and willingness to pay. |

| Quantity Surcharge | Charging a fee for purchasing below a certain quantity | Encourages larger orders and higher sales. |

| Referral Pricing | Discounts or incentives for customer referrals | Leverages word-of-mouth marketing and customer networks. |

| Tiered Pricing | Multiple price levels based on features or benefits | Appeals to customers with varying needs and budgets. |

| Charity Pricing | Donating a portion of sales to a charitable cause | Aligns with corporate social responsibility and attracts conscious consumers. |

| Behavioral Pricing | Price adjustments based on customer behavior | Customizes pricing based on customer interactions and preferences. |

| Mystery Pricing | Prices hidden until the product is added to the cart | Encourages customer engagement and commitment. |

| Variable Cost Pricing | Prices adjusted based on variable production costs | Reflects cost changes and maintains profitability. |

| Demand-Based Pricing | Prices set based on demand patterns and peak periods | Maximizes revenue during high-demand periods. |

| Cost Leadership Pricing | Competing by offering the lowest prices in the market | Focuses on cost efficiencies and price competitiveness. |

| Asset Utilization Pricing | Pricing based on the utilization of assets | Optimizes revenue for assets like rental cars or hotel rooms. |

| Markup Pricing | Fixed percentage or dollar amount added as profit | Ensures consistent profit margins on products. |

| Value Pricing | Premium pricing for products with unique value | Attracts customers willing to pay more for exceptional features. |

| Sustainable Pricing | Pricing emphasizes environmental or ethical considerations | Appeals to conscious consumers and supports sustainability goals. |

Read Next: Pricing Strategies, Dynamic Pricing.

Connected Business Concepts

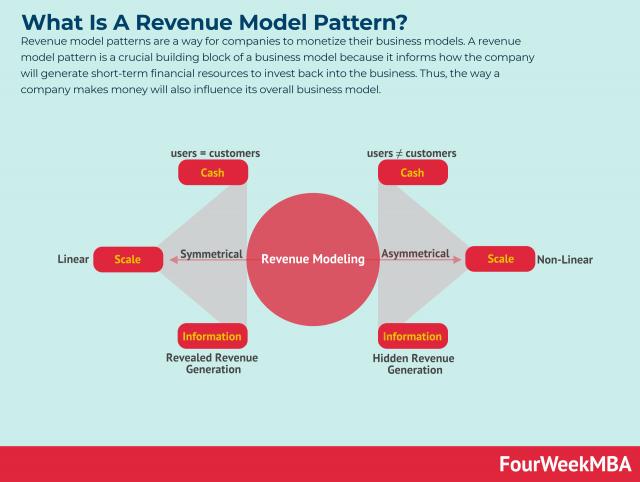

Revenue Modeling

Pricing Strategies

Dynamic Pricing

Price Sensitivity

Price Elasticity

Premium Pricing

Price Skimming

Productized Services

Menu Costs

Price Floor

Predatory Pricing

Price Ceiling

Bye-Now Effect

Anchoring Effect

Pricing Setter

Economies of Scale