Mr. Market, a concept introduced by Benjamin Graham in his book “The Intelligent Investor,” represents the whimsical and emotional nature of the stock market.

Significance of Mr. Market

1. Psychological Dynamics

- Mr. Market personifies the emotional and irrational behavior exhibited by market participants.

- Understanding Mr. Market’s mood swings is crucial for investors to make informed decisions and avoid succumbing to market euphoria or panic.

2. Volatility and Uncertainty

- Mr. Market’s unpredictable nature contributes to market volatility and uncertainty.

- Investors must navigate fluctuations in stock prices driven by Mr. Market’s emotions, news events, and investor sentiment.

3. Investment Opportunities

- Mr. Market’s irrational behavior creates opportunities for value investors to capitalize on mispriced stocks.

- By remaining rational and disciplined, investors can exploit Mr. Market’s mood swings to buy undervalued stocks and sell overvalued ones.

Key Principles of Mr. Market

1. Bipolar Behavior

- Mr. Market alternates between periods of exuberance and pessimism, driving stock prices to extremes.

- Investors must recognize and capitalize on Mr. Market’s mood swings by buying low and selling high.

2. Market Inefficiency

- Mr. Market’s irrationality leads to market inefficiencies, where stock prices deviate from intrinsic value.

- Value investors seek to exploit these inefficiencies by identifying undervalued or overvalued stocks based on fundamental analysis.

3. Emotional Intelligence

- Successful investors cultivate emotional intelligence to remain rational and disciplined in the face of Mr. Market’s irrationality.

- They avoid succumbing to fear or greed and instead focus on long-term value creation and wealth preservation.

Implications for Investors

1. Patience and Discipline

- Investors must exercise patience and discipline when dealing with Mr. Market’s fluctuations.

- Rather than reacting impulsively to short-term market movements, they focus on the underlying fundamentals of their investments.

2. Contrarian Investing

- Contrarian investors capitalize on Mr. Market’s mood swings by going against the crowd.

- They buy when others are selling in panic and sell when others are buying in euphoria, seeking to profit from market mispricing.

3. Margin of Safety

- Mr. Market’s irrationality underscores the importance of investing with a margin of safety.

- By purchasing stocks at prices significantly below their intrinsic value, investors protect themselves from permanent capital loss in the event of market downturns.

Practical Strategies for Investors

1. Value Investing

- Value investors focus on buying undervalued stocks with strong fundamentals and competitive advantages.

- They conduct thorough research and analysis to identify opportunities that Mr. Market has overlooked or undervalued.

2. Dollar-Cost Averaging

- Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions.

- This strategy helps investors mitigate the impact of Mr. Market’s volatility by averaging out the purchase price of their investments over time.

3. Long-Term Perspective

- Investors adopt a long-term perspective to weather Mr. Market’s short-term fluctuations.

- By focusing on the intrinsic value of their investments and ignoring transient market noise, they position themselves for sustainable wealth creation over time.

Conclusion

Mr. Market serves as a metaphor for the unpredictable and emotional nature of the stock market. While his mood swings may create short-term volatility and uncertainty, they also present opportunities for astute Investors to profit from market inefficiencies. By remaining rational, disciplined, and focused on long-term value creation, investors can navigate Mr. Market’s fluctuations and achieve financial success in the dynamic world of investing. Embracing the principles of value investing and maintaining a contrarian mindset allows investors to capitalize on Mr. Market’s irrationality and build wealth over time.

Connected Thinking Frameworks

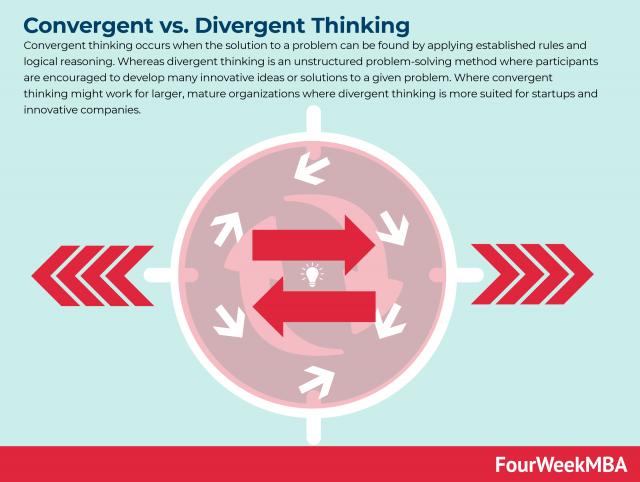

Convergent vs. Divergent Thinking

Convergent thinking occurs when the solution to a problem can be found by applying established rules and logical reasoning. Whereas divergent thinking is an unstructured problem-solving method where participants are encouraged to develop many innovative ideas or solutions to a given problem. Where convergent thinking might work for larger, mature organizations where divergent thinking is more suited for startups and innovative companies.

Critical Thinking

Critical thinking involves analyzing observations, facts, evidence, and arguments to form a judgment about what someone reads, hears, says, or writes.

Biases

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman in 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

Second-Order Thinking

Second-order thinking is a means of assessing the implications of our decisions by considering future consequences. Second-order thinking is a mental model that considers all future possibilities. It encourages individuals to think outside of the box so that they can prepare for every and eventuality. It also discourages the tendency for individuals to default to the most obvious choice.

Lateral Thinking

Lateral thinking is a business strategy that involves approaching a problem from a different direction. The strategy attempts to remove traditionally formulaic and routine approaches to problem-solving by advocating creative thinking, therefore finding unconventional ways to solve a known problem. This sort of non-linear approach to problem-solving, can at times, create a big impact.

Bounded Rationality

Bounded rationality is a concept attributed to Herbert Simon, an economist and political scientist interested in decision-making and how we make decisions in the real world. In fact, he believed that rather than optimizing (which was the mainstream view in the past decades) humans follow what he called satisficing.

Dunning-Kruger Effect

The Dunning-Kruger effect describes a cognitive bias where people with low ability in a task overestimate their ability to perform that task well. Consumers or businesses that do not possess the requisite knowledge make bad decisions. What’s more, knowledge gaps prevent the person or business from seeing their mistakes.

Occam’s Razor

Occam’s Razor states that one should not increase (beyond reason) the number of entities required to explain anything. All things being equal, the simplest solution is often the best one. The principle is attributed to 14th-century English theologian William of Ockham.

Lindy Effect

The Lindy Effect is a theory about the ageing of non-perishable things, like technology or ideas. Popularized by author Nicholas Nassim Taleb, the Lindy Effect states that non-perishable things like technology age – linearly – in reverse. Therefore, the older an idea or a technology, the same will be its life expectancy.

Antifragility

Antifragility was first coined as a term by author, and options trader Nassim Nicholas Taleb. Antifragility is a characteristic of systems that thrive as a result of stressors, volatility, and randomness. Therefore, Antifragile is the opposite of fragile. Where a fragile thing breaks up to volatility; a robust thing resists volatility. An antifragile thing gets stronger from volatility (provided the level of stressors and randomness doesn’t pass a certain threshold).

Systems Thinking

Systems thinking is a holistic means of investigating the factors and interactions that could contribute to a potential outcome. It is about thinking non-linearly, and understanding the second-order consequences of actions and input into the system.

Vertical Thinking

Vertical thinking, on the other hand, is a problem-solving approach that favors a selective, analytical, structured, and sequential mindset. The focus of vertical thinking is to arrive at a reasoned, defined solution.

Maslow’s Hammer

Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).

Peter Principle

The Peter Principle was first described by Canadian sociologist Lawrence J. Peter in his 1969 book The Peter Principle. The Peter Principle states that people are continually promoted within an organization until they reach their level of incompetence.

Straw Man Fallacy

The straw man fallacy describes an argument that misrepresents an opponent’s stance to make rebuttal more convenient. The straw man fallacy is a type of informal logical fallacy, defined as a flaw in the structure of an argument that renders it invalid.

Streisand Effect

The Streisand Effect is a paradoxical phenomenon where the act of suppressing information to reduce visibility causes it to become more visible. In 2003, Streisand attempted to suppress aerial photographs of her Californian home by suing photographer Kenneth Adelman for an invasion of privacy. Adelman, who Streisand assumed was paparazzi, was instead taking photographs to document and study coastal erosion. In her quest for more privacy, Streisand’s efforts had the opposite effect.

Heuristic

As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

Recognition Heuristic

The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not.

Representativeness Heuristic