Arbitrage opportunities involve capitalizing on price differences in assets or securities due to Market inefficiencies. Characteristics include risk minimization and quick execution. Types include spatial, temporal, and statistical Arbitrage. Hedge funds and professional traders often engage in arbitrage, applying it in financial markets and cryptocurrency exchanges. Examples include merger and triangular arbitrage, allowing traders to profit from mispriced assets.

Characteristics of Arbitrage Opportunities:

- Market Inefficiencies: The fundamental characteristic of arbitrage opportunities is the existence of market inefficiencies. These inefficiencies occur when asset prices deviate from their intrinsic or fundamental values. Such deviations can be caused by various factors, including information asymmetry, market sentiment, or temporary supply and demand imbalances.

- Risk Minimization: Arbitrageurs are motivated by profit opportunities while seeking to minimize or eliminate risks associated with their trades. They aim to create a risk-free or low-risk position by simultaneously buying and selling related assets. This risk reduction is a key feature of arbitrage strategies.

- Quick Execution: Timing is critical in arbitrage. Prices deviate from their equilibrium values for only short periods, so arbitrageurs must act swiftly to exploit these discrepancies before they normalize. Rapid execution often involves leveraging technology and automation to execute trades with minimal delay.

Types of Arbitrage Opportunities:

- Spatial Arbitrage:

- Geographic Disparities: Spatial arbitrage involves exploiting price differences in the same asset between different geographic locations or markets. These disparities can arise due to transportation costs, taxes, regulatory differences, or other local factors.

- Examples: Arbitrageurs might buy a commodity in a region where it’s cheaper, such as due to lower production costs, and sell it in a region where it commands a higher price due to increased demand.

- Temporal Arbitrage:

- Time-Based Differences: Temporal arbitrage capitalizes on price variations in the same asset at different points in time. These price disparities can result from events, news, or other factors affecting market sentiment.

- Examples: Traders may purchase a security when its price is temporarily depressed due to a negative news event and sell it once the market sentiment recovers.

- Statistical Arbitrage:

- Quantitative Models: Statistical arbitrage, often employed by hedge funds and algorithmic traders, utilizes quantitative models and algorithms to identify mispriced assets for arbitrage opportunities. This approach relies on statistical relationships between assets.

- Examples: Algorithmic trading strategies may identify price discrepancies in correlated assets, such as pairs of stocks, and execute trades based on statistical models.

Participants in Arbitrage:

- Hedge Funds:

- Arbitrage Strategies: Hedge funds frequently employ skilled arbitrageurs who specialize in executing various arbitrage strategies, such as merger arbitrage, pairs trading, or statistical arbitrage. These professionals aim to generate consistent returns by capitalizing on market inefficiencies.

- Risk Management: Hedge funds use arbitrage as part of their risk management strategies. By engaging in diverse arbitrage opportunities, they can diversify their portfolios and reduce exposure to market risks.

- Professional Traders:

- Expertise: Experienced professional traders with in-depth knowledge of financial markets often engage in arbitrage to profit from market inefficiencies. They use their expertise to identify and execute arbitrage opportunities effectively.

- Specialization: Some traders specialize in specific arbitrage strategies, becoming experts in areas such as options arbitrage, currency arbitrage, or fixed-income arbitrage. This specialization allows them to develop a deep understanding of the intricacies of their chosen strategy.

Applications of Arbitrage Opportunities:

- Financial Markets:

- Stock Market: Arbitrage is commonly used in stock markets to capitalize on price differences between different stock exchanges. This practice is especially prevalent in the trading of cross-listed securities.

- Bond Market: Traders may engage in yield curve arbitrage by exploiting discrepancies in bond yields at different maturities. This strategy involves buying and selling bonds to profit from differences in interest rates.

- Currency Market (Forex): Forex traders utilize arbitrage to profit from currency exchange rate divergences between markets. Currency arbitrage can involve triangular arbitrage, covered interest rate parity arbitrage, or interest rate arbitrage.

- Cryptocurrency Exchanges:

- Arbitrage Bots: Cryptocurrency traders employ automated trading bots to identify and execute arbitrage opportunities across different cryptocurrency exchanges. These bots can execute trades within milliseconds, taking advantage of price differences between platforms.

- Volatility: The high volatility of cryptocurrencies makes them fertile ground for arbitrageurs. Rapid price fluctuations create opportunities for traders to profit from price disparities between exchanges.

Examples of Arbitrage Opportunities:

- Merger Arbitrage:

- Deal Announcements: In merger arbitrage, traders buy shares of a target company after a merger or acquisition announcement. They aim to profit from the price difference between the current stock price and the offer price made by the acquiring company.

- Risks: Merger arbitrage involves risks, such as deal failures or regulatory hurdles, which can impact the profitability of the arbitrage trade.

- Triangular Arbitrage (Forex):

- Forex Market: In the foreign exchange (Forex) market, traders engage in triangular arbitrage by converting one currency into another through multiple exchange rates. This strategy takes advantage of pricing inefficiencies in currency pairs.

- Example: Suppose a trader observes that the exchange rates for three currency pairs—USD/EUR, EUR/GBP, and GBP/USD—result in an opportunity to make a risk-free profit. By executing a sequence of trades, the trader can exploit these pricing inefficiencies and profit from the arbitrage opportunity.

Key Highlights

- Characteristics: Arbitrage opportunities arise from market inefficiencies, and they involve minimizing risks and quick execution to profit from price disparities.

- Types: Arbitrage comes in various forms, including spatial, temporal, and statistical arbitrage, each targeting different types of market inefficiencies.

- Arbitrageurs: Hedge funds and professional traders are common arbitrageurs who use specialized strategies to generate returns.

- Applications: Arbitrage is widely applied in financial markets, cryptocurrency exchanges, and various asset classes, including stocks, bonds, and currencies.

- Examples: Merger arbitrage and triangular arbitrage are practical examples illustrating how arbitrageurs capitalize on pricing differences for profit.

Connected Financial Concepts

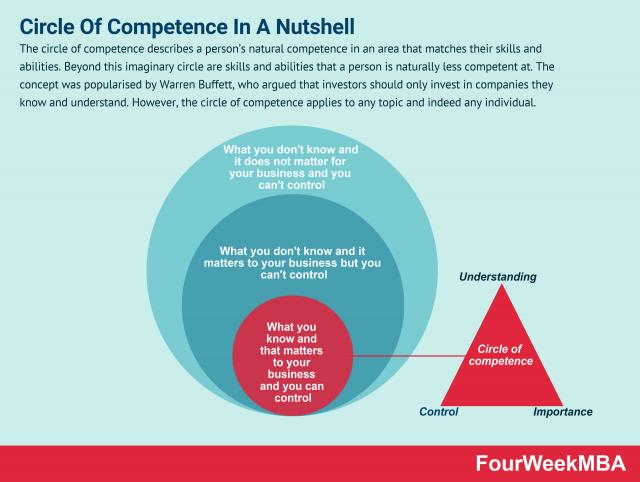

Circle of Competence

What is a Moat

Buffet Indicator

Venture Capital

Foreign Direct Investment

Micro-Investing

Meme Investing

Retail Investing

Accredited Investor

Startup Valuation

Profit vs. Cash Flow

Double-Entry

Balance Sheet

Income Statement

Cash Flow Statement

Capital Structure

Capital Expenditure

Financial Statements