Website flipping is a Business activity where existing web properties are purchased to scale them further up. Similar to real estate flipping, where a physical property is bought to resold at a premium after having repurposed it for the market. Website flipping, therefore, enables to scale existing web properties, thus generating a profit by scaling them up further.

Related Articles

Why it makes sense to buy existing websites?

All things considered, it’s a pretty great time to be an entrepreneur. The concept of the self-made millionaire used to be something of a joke, with those singled out as success stories generally coming from wealthy backgrounds or having benefited from great fortune in some other sense — today, though there’s still some fortune required, it’s relatively minimal.

In fact, let’s run through the basic things you need to pursue your entrepreneurial ambitions (aside from food and water, naturally): a computer, a smartphone, and internet access. You could work solely through a smartphone in a pinch, and use Starbucks Wi-Fi if necessary. So there’s no reason why one person with a decent smartphone couldn’t hit it big.

Throughout the rich digital world, there are numerous options for the aspiring entrepreneur (you can read about a decent selection of them here), but in this piece, we’re going to look at one in particular: website flipping.

Much akin to a cross between stock trading and real-estate investment, website flipping provides the convenience of the former with the reassuring reliability of the latter. Instead of buying and selling conventional assets, you buy and sell entire websites, sprucing them up and moving them along at a profit.

So if you’re interested in giving it a try, how should you go about it? Where should you shop, and how should you choose the websites to buy? Let’s go through it all.

Where can you buy or sell a website?

While of course, you can independently arrange the purchase or sale of a website (as we’ll see understanding the deal flow, and how the private market works, beyond marketplaces is critical). We’re going to list a few market places, as it’s generally easiest to get started from there. However, over time, it’s best developing your own sense of business, by either developing a private network that informs you when good deals are out there.

Or, perhaps identifying opportunities through market research, and contacting directly potential sellers.

Let’s see some options out there.

Empire Flippers

Despite the name, Empire Flipping isn’t about flipping empires — just websites. All sellers are vetted to ensure that their stores have stable and verified histories, and their sites are initially listed by average monthly profit to give you an idea of possible performance. You don’t need to speak to buyers or sellers directly, because the site staff will handle it for you, and each buyer must first make a deposit to demonstrate commitment. There’s even a valuation tool if you want to get an idea of what your site may be worth.

Flippa

As the marketplace with the most awareness in the field of website flipping, Flippa is an extremely popular choice, and for a good reason. The selection is strong, website sales hit around $5m each month, and you can even dip your toe into the app world since that’s also an option. And with a success fee of between 12 and 15 percent, it’s often cheaper than Empire Flippers (with a set fee of 15 percent).

Exchange Marketplace

A relatively-new contender, Exchange Marketplace has some notable characteristics that set it apart from the other marketplaces. Two in particular: it only accepts or offers stores running on Shopify, and it doesn’t charge any fees. Because it’s a Shopify project, the profit comes from keeping people on the Shopify platform. No further charge required. Something useful about Exchange is that it allows the narrowing of the selection by type or even location (e.g., profitable Nevada businesses for sale) — it might not seem significant where a store is supposedly based, but it is, particularly given the impending changes to state-determined sales tax regulations.

eBay

Yes, it’s true — you can buy or sell a website through eBay. Should you, though? Well, if you’ve ruled out the three previous options for whatever reason, it might be worth a look before you start checking out more niche marketplaces. That’s because eBay might be full of spam but that’s really because it’s full of everything. Given its broad inventory, it certainly warrants a glance before you rule it out entirely.

If none of these marketplaces seems a good fit for your needs, it’s best to consult entrepreneurs who operate in your preferred niche. Where do they buy/sell sites? Look for relevant subreddits, Facebook groups, and Twitter conversations — make some online connections and start asking questions. You’ll find that people will be happy to help.

What makes a website worth buying?

Whichever marketplace you ultimately decide to use, the hardest part is choosing a website to buy. You want something that already works well enough can be updated somewhat to drive up the sales and is likely to hold its value (at least for a little while). Let’s look at some examples of how you can get this wrong:

- If you buy a website that hasn’t been set up correctly, then you’ll need to fix it before you even think about making other alterations. Once you reach that point, you might as well have built a new site from scratch and saved the purchase money.

- If you buy a website that is already optimized, you won’t have much room to improve it — and if you can’t make improvements, you can’t sell it on for a healthy profit.

- If you buy a website that’s focussed on a fad or something seasonal, its value is likely to diminish over time (or by the month) regardless of what you do. Think about how much money there was in fidget spinners when they first hit the market, and how profitable they are today — still performing, but not even close to that massive level.

If you’ve selected one of the top marketplaces we looked at (the first three, really), then you can trust in the accuracy of the financial information provided for a listing — but interpreting it is up to you. You may be familiar with the warning of “past performance is not a guarantee of future success,” as some version of it will crop up for any trading advice service, and it certainly applies here.

It isn’t enough simply to know that a website has been successful before. If you don’t know how that success was achieved, you might struggle to replicate it. Sometimes people sell websites because they just want to move on to pastures new, but sometimes they’re fortunate enough to luck into some early success and try to exploit that success to pass their sites off as being more stable as they really are.

Ideally, each site you buy should offer each of the following:

- An up-to-date platform. There’s the aforementioned Shopify, or WooCommerce (on WordPress), or BigCommerce, or Magento, or… well, there are numerous viable options. It just isn’t a good idea to buy a site that runs on old software, because you might have issues updating.

- Historic transparency. Can you see what the revenue has been for at least the last year (or the entire lifetime of the site, whichever is shorter)? And has the seller commented on why they’re selling? Do you believe their explanation?

- Evergreen relevance. Cosmetics will sell at any time of year, but Halloween masks won’t. Unless you plan on waiting for 12 months, it isn’t too sensible to buy a Halloween store at the beginning of November.

- A thriving industry. You don’t want to grab a website that operates in a niche that’s losing ground, because the value is inevitably going to decline. Pick something solid.

- No operational demands. Turnkey sites that use dropshipping for any product sales might have low-profit margins, but they’re easy to keep running. Getting something with an actual inventory would likely end up being more trouble than it was worth.

If you can pick up a suitable site, you’ll have a great foundation upon which to build. What comes after that is up to you. You can focus on driving some sales to improve the record and raise the value, or you can adjust the style and product range to make it a more well-rounded site for whichever person ends up buying it from you.

Become an acquisition entrepreneur

When I interviewed Walker Deibel, an entrepreneur, investor, advisor and the author of the book “Buy Then Build” he told me that to be a successful acquisition entrepreneur you needed to avoid these pitfalls:

- Lack of urgency: As he explained “the number one reason in my view, why that never ends up working out is because they don’t work with a sense of urgency. They believe that everyone who is selling, they know something destructive to the business and they’re trying to unload it really quickly.”

- Accusatory mindset: and he also emphasized “nine times out of ten (businesses on sale are not getting unloaded). Usually, someone who has built something ofvaluethey eventually want to sell it. And so a lot of times you get the first question from a first-time buyer, and that’s “Well, why are they selling?” And it’s this sort of accusatory question.”

Walker Deibel explained:

The truth is that if you’re an entrepreneur and you start abusiness, and you start this thing from scratch. It’s hard, its hard work and then the second year if you’re one of the lucky ones, yourbusinessgrows, whatever, 200% over the year before.

The next year it grows another 200% the following year it grows 100%. The year after that it grows 50%, the year after that it grows like 20%, and you’re like “I don’t even know what to do with this anymore.”

Right? It sort of “I’ve done with it all that I can.” And I’ve run my course and not only that, but I’m an entrepreneur.

So, I need to kind of move on and do my next thing, and it’s a great opportunity for an acquisition entrepreneur to come in. Presumably, use a bit of leverage to get an outstandingROIon it.

Jump in, take over, and create thebusinessthat they want intending to take thatbusinessto the next level — all the while getting theROI of the equity build up as well. So,number one is that they put way too much weight on the reason for selling.

One thing, of course, is to make sure you do your homework and due diligence:

You need to understand the due diligencemodel; you need to understand why it’s working. You need to figure out if this is the right fit for you, but be patient.The negatives will turn up because there is an appropriate time, and that’s immediately following the letter of intent.

Once done that, these are the primary steps:

- Create a sense of urgency.

- Pitch the seller.

- Go after a great opportunity

- Develop a growth mindset.

- Do not start from the marketplaces.

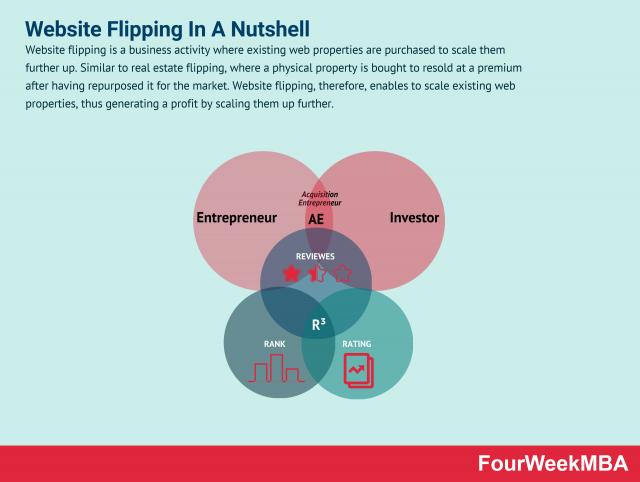

The R Cubed Acquisition Model

Another option to become good at acquiring businesses is to leverage on the Thras.io R Cubed model.

This is well suited for those that want to buy FBAs (third-party stores on top of Amazon), and as Thras.io explains it’s based on a few key steps:

As Ken Kubec from the Thras.io team highlighted, the company starts with a broad research approach, and it starts narrowing it down to what they call the R Cubed (Reviews, Rating and Rank).

And from there, they start asking questions with a drill down approach, starting from the reviews:

Do they have reviews that should establish them as a leadership position?

If so, it goes a level down and look at product/rating:

Do they have their rating, the product quality to back up and sustain their position?

And lastly, about ranking:

...and then rank: are they ranking organically on high keyword volume?

Thras.io looks at what they call “simple everyday hard-good objects.”

The buying process is primarily focused on businesses which revenues span from 1-30 million dollars, and that are private labels.

Thras.io also looks for Amazon businesses with a lower amount of SKUs (fewer products but more sales). Indeed, for Thras.io the most valuable businesses are those that hit over a million in sales with the fewer SKUs.

Do you need other ideas to make money? Below a list of ideas with low cost and high profit we found for you:

- Become a blogger

- Become an online instructor

- Become a professional photographer

- Become a ghostwriter

- Become a Chatbots maker

- Become an affiliate marketer

- Become a career coach, resume writer or LinkedIn profile writer

- Become a business development contractor

- Become an infopreneur

- Become an SEO consultant

- Become a contractor headhunter

Resources for your business:

-

- Business Models

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

Handpicked popular case studies from the site:

- The Power of Google Business Model in a Nutshell

- How Does Google Make Money? It’s Not Just Advertising!

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

- How Amazon Makes Money: Amazon Business Model in a Nutshell

- How Does Netflix Make Money? Netflix Business Model Explained

- How Does Spotify Make Money? Spotify Business Model In A Nutshell

- The Trillion Dollar Company: Apple Business Model In A Nutshell

- DuckDuckGo: The [Former] Solopreneur That Is Beating Google at Its Game

The post Website Flipping: A Comprehensive Guide appeared first on FourWeekMBA.