We’re launching a new series of articles, drawing from our personal journey as part of forex brokers' teams. First off, you’ll hear direct stories from the inside, showcasing our experiences and the unique insights we've gained. Now, we're delving into something quite interesting from the trading world—the MetaTrader 4 Expert Advisor known as Phoenix. Indeed, at some point, online forums were full of stories of big wins everywhere you looked. It almost felt like we'd all stumbled upon the ultimate trading secret. However, not everything was as perfect as it seemed. At first, it was thrilling, like watching a high-stakes poker game, but then the excitement didn't last. Subsequently, losses mounted, turning what many hoped would be a game-changer into a hard lesson learned. Ultimately, the Phoenix Expert Advisor's journey from the spotlight to a cautionary tale reminds us to be wary of things that seem too perfect.

*A MetaTrader 4 Expert Advisor (EA), also known as a trading bot, is software that automates trading strategies on the MetaTrader 4 (MT4) platform. Traders program Expert Advisors using the MQL4 language, which enables them to implement their trading strategies without manually executing trades. This article will use EA, trading bot, and bot interchangeably.

WAS THE PHOENIX EXPERT ADVISOR THE ULTIMATE JACKPOT FOR FOREX TRADERS?

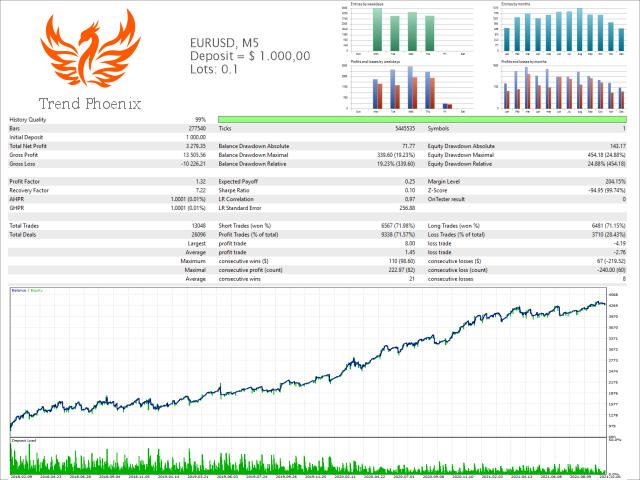

From 2019 to 2022, the Phoenix Expert Advisor generated a massive buzz within the trading community. The expert advisor’s distinguishing feature was a comment it added to every trade it made (“Phoenix[tp]”). Everyone on Forex forums talked about it, with many thinking they’d hit the jackpot because the EA was making serious money. The distributor even shared some pretty impressive results, like the image below.

This is the profile of one of the EAs from the Phoenix family.

The success stories were everywhere. To back up these claims, people started sharing links to their trading accounts on the myfxbook website, where you could see the EA’s track record. We found one of those accounts and even plotted some orders on a chart to show you how the EA traded.

H1 chart (one candlestick equals one hour), EURUSD, June 18 – July 7, 2020.

Do you see the dotted blue and red lines? This is where the Phoenix EA opened and closed orders. The blue lines represent the buy and red ones the sell orders.

Can you guess the strategy this trading bot was using? Spoiler alert! It turned out to be a good old Martingale strategy. It’s pretty standard for expert advisors, but it’s always a surprise when you see it in action.

How Did Phoenix EA Trade?

The way the Phoenix EA worked was pretty straightforward but risky. It would place a buy or sell order based on some signal. Let’s call it the trading bot’s hunch. If it guessed the market’s direction correctly, all was well. But if it guessed wrong, the EA would double down, placing another order in the same direction but with a bit more volume, much like how you might decide to keep betting on red or black at a roulette table, hoping the next spin goes your way.

This strategy could work out. For example, there was a stretch from June 18 to July 7, 2020, where it did just that, closing out losing positions at a slight profit once the market finally swung in its favor (as you can see on the screenshot below). This seemed to work best in the spring and summer. However, come fall and winter, or when the markets moved sharply due to political events, the bot’s strategy often backfired spectacularly.

November 3, 2020 – January 20, 2021, four-hour chart, EURUSD.

As you can see in the screenshot above, this trading bot kept placing sell orders while the market was on an uptrend. Essentially, it kept betting against the market, hoping it would turn. The trader behind it had to have nerves of steel (and deep pockets) to wait out the market’s eventual shift. Imagine the stress of watching your losses pile up for nearly six months. It’s enough to age anyone prematurely!

Imagine a trader, once youthful and vibrant, suddenly looking years older with stress-induced grey hair or perhaps even losing it altogether. The tension of constantly checking the trading terminal and watching the numbers fluctuate could send anyone’s adrenaline skyrocketing.

“Want to watch a horror movie tonight?” might be met with a weary, “No thanks, I’ve seen enough scary stuff for one day.”

Then, moving into the next chapter of the Phoenix Expert Advisor saga in January 2021.

January – March 2021, hourly chart EURUSD.

How Did Phoenix EA Lose It All?

As you can see, the bot faces a downturn after a lucky streak. It stubbornly clung to losing “BUY” orders for four long months. By February 23, the situation had grown dire. The Phoenix Expert Advisor bled the account dry. As a result, It was no longer able to open any new positions. In these moments, a trader’s only option is to hope desperately for a market reversal, a scenario fraught with stress that can genuinely affect one’s health. As you can imagine, with vast sums of money on the line, the pressure is immense.

Remarkably, fortune smiled on the trader once more. The market shifted in late March, turning a potential disaster into profit. Yet, despite this close call, the trader pressed on with the Phoenix bot, continuing the trading journey until October 2021:

Change in account balance.

Looking at the balance chart, it’s clear the robot lost it all in the end.

Notice how the chart shows those dramatic drops? That’s why they called it Phoenix – after those steep declines, which were usually because of forced stops when losses got too big, the bot would somehow find a way to rise again, at least for a while. The cycle of crashing down and scrambling back up was its hallmark, but success was never guaranteed. It was all down to luck.

Conclusions

The story of the Phoenix Expert Advisor ended as you might expect – it wiped out every single trading account. The losses started piling up in late 2021, and by spring 2022, whatever was left had vanished, too. Despite catching a few good breaks, nearly everyone who had put their faith (and funds) into this bot came up empty-handed. You’d think there would have been a lot of talk about it, but instead, there was just silence. Perhaps embarrassment or the sting of loss kept everyone silent, unwilling to admit they fell for the hype.

After that, talking about the Phoenix EA became taboo, as if even mentioning it was in poor taste. Yet, the quest for that elusive trading “Holy Grail” continues.

Surprisingly, about a year and a half later, there’s talk of the Phoenix EA “rising” from the ashes again, with traders looking to draw in investors with promises of profits.

There are even traders showing off their latest Phoenix results and hoping to lure investors with their “success” story to copy their signals for a fee. Just look at this pure, unadulterated “awesomeness“. But as history has shown, caution might be the wisest approach.

Trades executed by Phoenix.

Take a closer look at how the volume of trades goes up with each level. That’s a dead giveaway you’re dealing with a Martingale bot. Their signature is stacking up losing trades, then closing them all off at once in hopes of recovering.

By spring 2022, it was clear that only a handful of traders had the sense (and nerve) to pull the plug on the bot and cut their losses. Sure, they still took a hit but avoided a complete disaster and kept some of their investment intact.

CONCLUSION

If something seems to good to be true, it usually is. Here’s some advice, if someone pitches you a “winning” trading bot that smells of Martingale strategies, say No. It might look good for a while, but the endgame usually loses more of your deposit, slowly or all at once.

We’ve got a whole series coming up on the Forex world, tales of wins and losses that’ll keep you hooked for a long time.

Next, we’ll dive into trading strategies popular among retail Forex traders. Keep an eye out for that.

Happy trading, everyone!

DISCLAIMER! The contracts for difference (CFDs) we discuss come with high risks, and you could lose all the money you put in. Make sure you understand all the risks involved before you dive in.

Do The Smart Thing. Subscribe!

Get notified about our new articles and insights.

The post Story 1: The Rise and Fall of the Phoenix Expert Advisor appeared first on Finansified.

This post first appeared on An Educational Blog By Forex Veterans For Forex Enthusiasts., please read the originial post: here