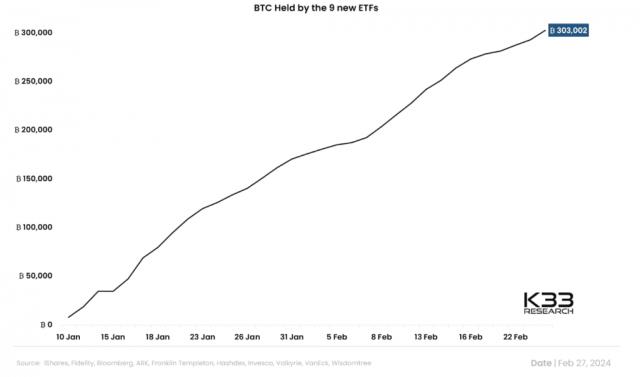

Bitcoin‘s remarkable rise continues as a spot Bitcoin exchange-traded fund (ETF) saw unprecedented growth, accumulating 300,000 BTC worth $17 billion in just two months of its public debut.

The surge in demand has pushed Bitcoin’s price above $57,000, a new two-year high, and its market capitalization to more than $1.1 trillion.

Introduced into the market on January 11, the nine-spot metric now accounts for about 1.5% of Reserve’s total supply, covering Lithuania’s interest in the staging area like fireworks.

The net investment of these e-tickets exceeded $6, listing a strong portfolio of investors to invest in.

Monday saw a significant milestone for the spot bitcoin ETF, with BlackRock emerging as the IBIT volume leader with net inflows of more than half a billion dollars and record-breaking trading volume of $2.4 billion.

Next, Fidelity’s FBTC underscored the growing acceptance of bitcoin investment products by traditional financial institutions

In contrast, Greyscale’s GBTC, the leading bitcoin investment trust, is experiencing a notable decline in outflows, indicating a possible change in investor sentiment.

GBTC saw outflows of $5.64 billion at the end of January, with February outflows falling $2 billion

The continued flow of funds into spot Bitcoin Etfs, coupled with declining GBTC outflows, could lead to further constriction of bitcoin supply dynamics due to the impending bitcoin semi-final event in less than two months, potentially increasing price upward pressure.

Currently, miners are adding 900 new BTC to the existing supply, but the Spot Bitcoin ETF sees a net inflow of about 8,000–9,000 BTC per day.

As supply dwindles and demand rises, the outlook for bitcoin remains highly bullish, setting the stage for further price appreciation in the near future.

Investors and market participants eagerly await emerging dynamics in the bitcoin ecosystem amid an emerging landscape of institutional approval and regulatory developments

What is a spot Bitcoin ETF?

The Spot Bitcoin ETF is an exchange-traded fund that allows investors to gain exposure to Bitcoin’s price movements without directly owning the cryptocurrency. These Etfs hold actual Bitcoin as their underlying asset.

How much BTC have spot Bitcoin ETFs accumulated since their launch?

Spot Bitcoin ETFs have accumulated 300,000 BTC worth $17 billion within two months of their public debut.

What effect have spot Bitcoin ETFs had on Bitcoin’s price and market cap?

The introduction of spot Bitcoin ETFs has coincided with a surge in Bitcoin’s price to over $57,000, reaching a new two-year high. Bitcoin’s market capitalization has also exceeded $1.1 trillion.

Which companies are leading in spot Bitcoin ETF trading volume?

BlackRock’s IBIT tops the volume charts with $1.29 billion, followed by Fidelity’s FBTC at $576 million.

How has the outflow trend of Grayscale’s GBTC changed recently?

The outflow trend of Grayscale’s GBTC has slowed down, with recent outflows totaling $22 million, marking its third consecutive trading day of decreasing net outflows.

Latest Post:-

- Bitcoin ETFs Accumulate 300,000 BTC as Demand Soars, Pushing Price to New Highs

- Bitcoin hits two-year 100% high amid surge in institutional buying

- Albert Einstein College of Medicine Receives a Historic $1 Billion Donation for Free Tuition

- latest technologies in software industry 2050

- Kyberswap hacker makes away with $46 million of digital assets amid ongoing fallout

This post first appeared on Bitcoin Supply Movement: 3.8% Moved At $30.2K, Opportunity For “Buying, please read the originial post: here