Fractional Reserve Banking is a fundamental concept in the world of finance that plays a crucial role in the functioning of modern economies. Understanding how this system works is essential for anyone looking to grasp the dynamics of money creation, banking practices, and the broader economic landscape. In this blog post, we will dive deep into the intricacies of Fractional Reserve Banking, exploring its history, mechanics, pros and cons, and its potential future implications.

What is Fractional Reserve Banking?

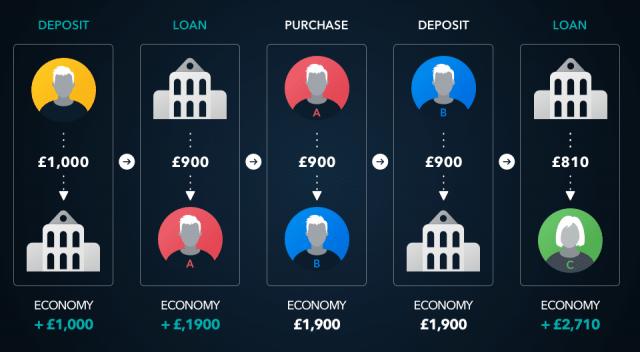

At its core, fractional reserve banking is a system in which banks are only required to hold a fraction of their total deposits as reserves. This means that when you deposit money in a bank, only a portion of that amount needs to be kept on hand, while the rest can be lent out to borrowers or invested in other assets. For example, if a bank has a reserve requirement of 10% and you deposit $100, the bank is only required to keep $10 in reserve and can use the remaining $90 for lending purposes.

The History of Fractional Reserve Banking

The concept of fractional reserve banking has been around for centuries, dating back to the medieval era when goldsmiths started issuing receipts for deposited gold that could be redeemed at a later date. Over time, this system evolved as banks began to realize the profit potential of lending out more money than they held in reserves, leading to the establishment of modern banking practices.

How Fractional Reserve Banking Works

In practice, banks leverage their reserve requirements to create money through the process of lending. When a bank issues a loan, it essentially creates new money out of thin air, as the borrower receives funds that were not previously in circulation. This process allows banks to expand the money supply and stimulate economic activity, but it also comes with risks, such as the potential for bank runs if depositors lose confidence in the bank’s ability to meet withdrawal demands.

Image courtesy of www.reddit.com via Google Images

Pros and Cons of Fractional Reserve Banking

There are several advantages to the fractional reserve banking system, including the ability to stimulate economic growth through increased lending and investment. Additionally, banks can earn interest on the loans they issue, generating revenue that can be used to cover operating expenses and provide returns to depositors. However, this system also has drawbacks, such as the risk of financial instability if banks are unable to meet withdrawal demands or if loan defaults lead to solvency issues.

The Future of Fractional Reserve Banking

As the banking industry continues to evolve, new technologies and regulations are reshaping the landscape of fractional reserve banking. Digital currencies, blockchain technology, and FinTech innovations are challenging traditional banking practices and raising questions about the future of money creation and financial intermediation. Policymakers and regulators are also considering reforms to the banking system to address concerns about risk management, transparency, and consumer protection.

Image courtesy of medium.com via Google Images

Conclusion

Understanding the intricacies of fractional reserve banking is crucial for anyone interested in economics, finance, or banking. By delving into the history, mechanics, pros and cons, and future implications of this system, we can gain a deeper appreciation for the role that banks play in the economy and the complexities of money creation. As we navigate a rapidly changing financial landscape, staying informed about the principles of fractional reserve banking will be essential for making informed decisions as consumers, investors, and policymakers.