Junior Mining Networ… · 21:40 17 Apr 2024

Cal State University… · 21:20 17 Apr 2024

Image Source: https://www.pexels.com/photo/corn-field-1382102/ Plant Phenomics, an interdisciplinary field at the intersection of plant biology, genetics, and environmental scien… Read More

Jordan Tours · 21:19 17 Apr 2024

The Cabinet has decided to extend the decision granting tourist transport vehicles customs and tax exemptions and incentives for three months, ending in mid-June. The decision was made based… Read More

Bama Huskies · 21:01 17 Apr 2024

Today our oldest litter of husky puppies from Ice went to the vet. They had their final health exam before they will be released to go home with families in a couple weeks. They were all fo… Read More

Traffic Bot

Bespoke Yacht Charter

Online wholesale shops from China

eMAG BLACK FRIDAY

420 Coupon Codes

Gardening, Home & Wellness

Casino Backlinks

Actors' day

Digital Marketing Blog | Solkri Design | Full Serv

I migliori casino online con slot gratis

SMM Panel

Rent a yacht for Cannes Festivals and Events

London Escorts

Longevity Review

FireStorm Webhosting | Schweizer Webhosting mit Webshop, Mailhosting, vServer und Rootserver Provider | Schnelle schweizer Cloud Server

สมัคร gclub เว็บตรง, สมัครจีคลับ, gclub เว็บตรง

สมัคร gclub เว็บตรง, สมัครจีคลับ

Tem Teknoloji - Online Alışveriş Platformu

Best Printers Under 10000 in India

Bespoke Yacht Charter

Online wholesale shops from China

eMAG BLACK FRIDAY

420 Coupon Codes

Gardening, Home & Wellness

Casino Backlinks

Actors' day

Digital Marketing Blog | Solkri Design | Full Serv

I migliori casino online con slot gratis

SMM Panel

Rent a yacht for Cannes Festivals and Events

London Escorts

Longevity Review

FireStorm Webhosting | Schweizer Webhosting mit Webshop, Mailhosting, vServer und Rootserver Provider | Schnelle schweizer Cloud Server

สมัคร gclub เว็บตรง, สมัครจีคลับ, gclub เว็บตรง

สมัคร gclub เว็บตรง, สมัครจีคลับ

Tem Teknoloji - Online Alışveriş Platformu

Best Printers Under 10000 in India

Bible Questions Blog · 21:00 17 Apr 2024

Acts 1:12 Then returned they unto Jerusalem from the mount called Olivet, which is from Jerusalem a sabbath day’s journey. 13 And when they were come in, they went up into an upper roo… Read More

Bible Verse Topics · 20:55 17 Apr 2024

What does the Bible say about sickness? Many people believe as Christians, they will no longer endure hardship and illness despite the Bible never making such a claim. While God can heal peo… Read More

1Stkare Blog · 20:37 17 Apr 2024

Join the bargNhunt Beta Program and elevate your brand with our unique digital platform! Amplify visibility, enhance customer interaction, and lead the retail revolution. Sign up now to tran… Read More

Bespoke Yacht Charte… · 20:27 17 Apr 2024

The post MRS GREY appeared first on Bespoke Yacht Charter Read More

The Natchez Trace Tr… · 20:22 17 Apr 2024

Whether you're navigating dense foliage, tracking prey in low-light conditions or honing your shooting skills in an open field, the sights you choose will play an important role in your outc… Read More

Miami Condos Blog | … · 20:16 17 Apr 2024

Una Residences, Brickell's first waterfront residential development in over a decade, has reached its full height at 47 stories, offering breathtaking views of the Atlantic Ocean and Downtow… Read More

Lifebei: Your Source… · 20:11 17 Apr 2024

Tourism in Vietnam

Vietnam is one of the most popular tourist destinations in Southeast Asia, attracting many visitors with its mysterious charm and amazing natural beauty. This charming… Read More

Fakaza: South Africa… · 20:09 17 Apr 2024

TNK MusiQ – Porry’s View Mix (BY DJ Maphorisa) Mp3 Download

Kunye JHB VI Mix song by TNK MusiQ: Stream, Listen, and Play Datafilehost Music Tubidy Mp3juice fresh hit Songs uploa… Read More

Fix And Flippers · 20:09 17 Apr 2024

Embarking on a journey back to college as an adult is a commendable endeavor that requires courage and financial planning. Amid the myriad funding options available, flipping homes emerges a… Read More

Personal Development · 20:00 17 Apr 2024

If you want a thing done well, do it yourself. Napoleon Bonaparte Read more at https://www.brainyquote.com/topics/wisdom-quotes https://www.cnn.com/cnn-underscored/money/how-to-file-taxes?ii… Read More

Dancehallmag · 19:54 17 Apr 2024

Jamaican-born R&B artist Davo has released a new track titled On The Run. The artist, whose real name is David Kerr, decided it was the perfect time to release a single while he sti… Read More

Bobbacraft · 19:35 17 Apr 2024

Here’s a version of Atlas Client that supports all versions in 1.20.7x (including 1.20.73) Changelog:

Command Hotkey

Text Hotkey

Snaplook option in quick perspective Read More

Helping You Choose T… · 19:34 17 Apr 2024

Embarking on a family camping adventure is an exciting opportunity to bond with loved ones, immerse yourself in nature, and create cherished memories that last a lifetime. To ensure a succes… Read More

Atoz Healthy Benefit… · 19:30 17 Apr 2024

Know The Power of Green Tea! Strengthen Your Heart, and Sharpen Your Mind With This Antioxidant-Rich Beverage.Introduction to Green TeaA. What is Green Tea? (Background and History)Green tea… Read More

Hindu God And Goddes… · 19:26 17 Apr 2024

Tithi in Panchang – Hindu Calendar on Thursday, April 25 2024 – It is Krishna Paksha Pratipada tithi or the first day during the waning or dark phase of moon in Hindu calendar an… Read More

World Music Views® · 19:20 17 Apr 2024

“Bam Bam: The Sister Nancy Story” will be among the 9 Spotlight documentaries having their world premiere at the 2024 Tribeca Film Festival taking place in New York from June 5-1… Read More

Next Big Idea Club · 19:13 17 Apr 2024

Modern life is morally puzzling.

Ethics in the Age of Catastrophe: Navigating Tough Choices - Next Big Idea Club Read More

Akinpedia · 19:03 17 Apr 2024

The marketing landscape is undergoing a revolution. Artificial intelligence (AI) rapidly transforms how businesses reach Read More

Rangeinn · 18:57 17 Apr 2024

For the first time in over a year, US Defense Secretary Lloyd Austin and his Chinese colleague Dong Jun held a video teleconference on Tuesday, according to the Pentagon.

Pentagon press secr… Read More

Andy's Blog · 18:56 17 Apr 2024

Situated along Spain's stunning Costa Dorada, Salou is a charming beach town that has become an increasingly popular destination for holidaymakers seeking sun, sea, and plenty of attractions… Read More

Exploring Caribbean · 18:47 17 Apr 2024

Bermuda is a beautiful island with a rich history, famous for its pink beaches. Many people see pictures and wonder, is Bermuda in the Caribbean? This article will answer that question, as w… Read More

Roverpass · 18:41 17 Apr 2024

RV travel has gained immense popularity in recent years, offering a unique blend of adventure, comfort, and flexibility for those seeking to explore the great outdoors. Whether you’re… Read More

Schoolpursuit · 18:36 17 Apr 2024

The National Open University of Nigeria graduates can now be mobilized for the National Youth Service ... Read More »

The post NOUN Law Graduates Can Now Go for NYSC and Law school app… Read More

Amw Blog · 18:32 17 Apr 2024

The concept of a User-Generated Content (UGC) agency is great for brands looking to forge deeper connections with their audience.

But what exactly is a UGC agency?

Simply p… Read More

Margarite Elaine · 18:25 17 Apr 2024

If you're struggling with rusty-looking stains on your sinks, a metallic taste in your water, or concerns about the safety of your well, the culprit is likely excess iron. Several proven met… Read More

Defend-A-Bull Blog · 18:25 17 Apr 2024

If you're struggling with rusty-looking stains on your sinks, a metallic taste in your water, or concerns about the safety of your well, the culprit is likely excess iron. Several proven met… Read More

Atleticanotizie - · 18:14 17 Apr 2024

A poco più di cento giorni dalle Olimpiadi, il mondo della marcia si riunisce ad Antalya, in Turchia, per i Mondiali di marcia a squadre di domenica 21 aprile. Quest&rsq… Read More

The Baseball Continu… · 18:12 17 Apr 2024

Head over to Pickin’ Splinters to read about what happened to today’s Red Wings game… before the rain intensified Read More

Helder Barros · 18:00 17 Apr 2024

«FERNANDO SÁ RENOVA ATÉ 2026 17 DE ABRIL DE 2024 15:00Treinador da equipa de basquetebol do FC Porto prolongou o vínculo que o liga ao clube.Fernando Sá… Read More

Viaggrego - Rassegne… · 17:58 17 Apr 2024

Poe è una soluzione che consente, in un'unica chat, di interrogare ChatGPT, Claude 3, Gemini (e altri LLM...) tutto contemporaneamente, senza dover avviare una nuova chat, mantenendo… Read More

Fiction From K Brown · 17:54 17 Apr 2024

Well ... I don't know what to say. I saw this image on DeviantArt.

Its title was: "Bloe job eyes."I looked at the image closely, and all I could see was a pretty, blue-eyed girl… Read More

Prevuze · 17:37 17 Apr 2024

When defrocked priest Eric married Sloan he didn't realize he'd be taking another vow of poverty. #DAYSPaulina can definitely help with the search for Chanel. When night falls, she's so irra… Read More

Socraticgadfly · 17:23 17 Apr 2024

Harris County Attorney Christian Menafee is ready to take on Kenny Boy Paxton in a legal battle

over the county's guaranteed income. (Kenny Boy should just leave well

enough alone; if Harr… Read More

James Doan - My Corn… · 16:47 17 Apr 2024

Orangeville, ON (Britain on Broadway) Welcome to Britain on Broadway, your one-stop destination for all things British right in the heart of Orangeville, Ontario. Nestled at 318 Broadway, ou… Read More

Nancy, The Avon Lady… · 16:42 17 Apr 2024

Avon Lady NJ

Anew Platinum is infused with Patented Paxillium Technology to help boost skin’s natural renewal process so skin looks lifted, smoother and redefined, even down to your ne… Read More

Spiritual Prozac · 16:29 17 Apr 2024

Spheres—or cicles apply to those great belts of spiritual matter, which encircle the earth and other planets.It is likewise applied to those still vaster, more extended thought-waves… Read More

Gaceta Guia Inmobili… · 16:16 17 Apr 2024

El presidente Luis Abinader y el ministro de Medio Ambiente y Recursos Naturales, Miguel Ceara Hatton indicaron que el daño ambiental producido en Las Dunas de Baní, y evidenci… Read More

Grammaticus · 16:16 17 Apr 2024

Published by Thomas Nelson, this commentary is not designed to be neutral: its target audience is pretty narrow and specific, and the theological framework behind its scholarship precisely d… Read More

Thoughts About God · 16:05 17 Apr 2024

If God is good, why does He allow evil (pain and suffering)? This is the age-old question and the reason many give on why they don't trust God.But could it be God allows it to humble us and… Read More

Verysmartinvesting · 15:39 17 Apr 2024

Dow slid 23, advancers over decliners about 2-1 & NAZ was off 24. The MLP index added 1+ to 273 & the REIT index fell another 2 to the 352s on rising interest rates. Junk… Read More

Misteri Dunia Unik A… · 15:08 17 Apr 2024

5 keutamaan Persia dalam Islam. Foto/Ilustrasi: futuretreehealthSetidaknya ada 5 keutamaan Persia dalam Islam.1. Persia tersirat dalam Al-Quran Surat Al-Jum’ah ayat 3 dan Surat Muhamma… Read More

Art+Science Designs … · 15:00 17 Apr 2024

Vintage Paw Hillbilly Coffee Muggrandparent. Come Git Yer Coffee. Retro. Novelty. Kitsch. Mid Century. Collectible. Drink. Gift For Him Follow Art+Science Designs On Social Media Too!

Relat… Read More

Handbook Of The Bill… · 15:00 17 Apr 2024

(About the author) At it’s most basic, the pool table is a small battlefield. An excerpt from “The Art of War” is provided with how it applies to the competition between op… Read More

Kurier Ratuszowy Ole… · 14:51 17 Apr 2024

Kandydat na burmistrza Oleśnicy, Michał Kołaciński, napisał na swoim profilu na Facebooku: "Drodzy Oleśniczanie, w związku z odrzuceniem zaprosze… Read More

Headline News Online · 14:50 17 Apr 2024

Here’s a look back on who was on ‘Global News Morning Saskatoon’ for Wednesday, April 17.

* This article was originally published here

The post Saskatoon morning news rewi… Read More

Phase 3 Marketing An… · 14:45 17 Apr 2024

We are thrilled to announce we've been named to Wide-Format Impressions’ 2023 Wide-Format 150, moving up from the previous years to the #32 ranking. The sixth annual… Read More

Queens Voice · 14:40 17 Apr 2024

Attacker Spits, Punches 71-Year-Old Man The NYPD is searching for this man in connection with a random attack on a 71-year-old man getting o Read More

Mundo Do Boso · 14:23 17 Apr 2024

Tiago 1:27 NVTA religião pura e verdadeira aos olhos de Deus, o Pai, é esta: cuidar dos órfãos e das viúvas em suas dificuldades e não se deixar cor… Read More

..::that Grape Juice… · 14:20 17 Apr 2024

Zendaya delivers a championship performance in her brand new movie, ‘Challengers.’

Set for release on April 26, the daring drama sees the multihyphenate take the lead as Tashi D… Read More

Capeia Arraiana · 14:15 17 Apr 2024

Maria Teresa Horta poetisa, escritora, jornalista e ativista dos direitos da mulher é um expoente vivo da cultura portuguesa. MARIA TERESA HORTA nasceu alfacinha de gemaé poeti… Read More

The Movie Waffler · 13:44 17 Apr 2024

First look at the inspired by true events western.Read more >>> Read More

Shoeography · 13:43 17 Apr 2024

Dream Pairs, the Amazon footwear brand, is effecting change and inspiring hope in The Bronx through its groundbreaking "Dream Pairs Loves The Bronx" campaign. This heartening initiative tran… Read More

Heavy Metal Rarities · 13:39 17 Apr 2024

Posted by porosimetal — Today, 13:39 — Replies 0 — Views 133Artist: Dogs?Rel

►Read More Read More

Topic News - News Bl… · 13:36 17 Apr 2024

NSF Regional Innovation Engines Opportunity Source: NSF News Read More

Profitfromai - Unloc… · 13:13 17 Apr 2024

The Free Fire new update OB44 ushers in the Villain Conquest in the BR-Ranked Bermuda map, promising players enhanced engagement with new rewards from defeating villains alongside … Read More

Derelictmanchester · 13:11 17 Apr 2024

Deep beneath the unassuming landscape of St. Helens, and south of the village of Crank, Merseyside, England, lies a labyrinthine network known as Crank Caverns. Thes… Read More

Coisas Judaicas · 12:53 17 Apr 2024

Israel decidiu claramente retaliar contra o Irã por causa dos ataques com mísseis e drones, disse o ministro das Relações Exteriores do Reino Unido, David Cameron… Read More

Navigamus Blog A Vel… · 12:44 17 Apr 2024

Torna a Genova il Classic Boat

Show, la mostra-mercato dedicata alla nautica tradizionale e alle barche

d’epoca. Dal 17 al 19 maggio 2024, a Marina Genova, il porto turistico a Sestri… Read More

Not In Hall Of Fame · 12:43 17 Apr 2024

We have a new add-on on the Notinhalloffame.com site in the Hockey Futures as we have opened up the 2026 Eligible players. These hockey players will first be eligible for the Hockey Ha… Read More

Stupid Boy Think Tha… · 12:41 17 Apr 2024

Do You Believe in Magic Lyrics by The Lovin’ Spoonful.Do you believe in magic in a young girl’s heart.How the music can free her whenever it starts? Do You Believe in Magic Lyric… Read More

Updated Daily Free H… · 11:50 17 Apr 2024

The post Wordscapes Answers Daily Puzzle April 18 2024 (4/18/24) appeared first on Your Crossword Answers Read More

Libertad, Preciado T… · 11:21 17 Apr 2024

Al hablar de física, pocos dudan de la

veracidad de una de las leyes promulgadas por Isaac Newton: «a toda

acción corresponde una reacción en igual magnitud pero… Read More

Think · 11:15 17 Apr 2024

The company reported results of clinical trials involving Zepbound, an obesity drug in the same class as Novo Nordisk’s Wegovy.

Gina Kolata | NYTimes Health | Disclosure Read More

A Mind Occasionally … · 11:00 17 Apr 2024

You know, I rather liked Michael’s breakthrough last week that “twin moons” referred not to a planet with two moons, but a planet where two of its moons move… Read More

News24×7 · 10:48 17 Apr 2024

By Emily Schmall from NYT U.S. https://ift.tt/zMAgpOn Read More

Pinoybix Engineering · 10:16 17 Apr 2024

Problem Statement: Electrical Engineering Professional Subjects Electric Circuits: AC Circuits Problem Solving An R-L circuit has Z = (6 + j8) ohm. Its susceptance is ______ siemens. A. … Read More

Blog Info Jasa Revie… · 10:10 17 Apr 2024

Purbalingga - Polsek Kalimanah mengamankan seorang pria yang ditangkap warga setelah kepergok mencuri kotak amal di Masjid Baitu Salam Desa Klapasawit, Kecamatan Kalimanah, Kabupaten Purbali… Read More

Innovate · 10:08 17 Apr 2024

It doesn’t take a lot of work to keep copies of your phone’s photos, videos and other files stashed securely in case of an emergency.

J. D. Biersdorfer | NYTimes Technology | D… Read More

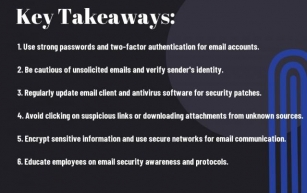

Cyber Safety Academy · 10:05 17 Apr 2024

Most businesses rely heavily on email for communication, making it crucial to prioritize email security. Implementing effective email security practices is crucial to protect sensitive infor… Read More

Escafandrista Musica… · 10:00 17 Apr 2024

@bleachersmusic Gènere: #popalternatiu #rockalternatiu #cançódeldia Bleachers han llançat el seu quart àlbum homònim. Un disc que exhibeix un

La ent… Read More

South African News · 09:52 17 Apr 2024

Kush: A sinister substance grips a West African nation. Laced with a blend of chemical compounds like marijuana, fentanyl, and tramadol, its ominous presence triggers a state of emergency in… Read More

Carl Jung Depth Psyc… · 09:39 17 Apr 2024

No matter how isolated you are and how lonely you feel: “No matter how isolated you are and how lonely you feel, if you do your work truly and conscientiously, unknown friends will com… Read More

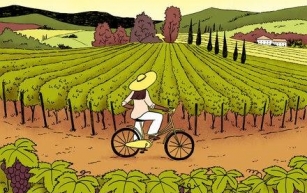

Discover · 09:38 17 Apr 2024

Mocktail trails, olive oil tours and elevated dining experiences are among the many ways the renowned wine-producing areas of Sonoma, Mendoza and Tuscany are appealing to sober or sober-cur… Read More

Ppq · 09:00 17 Apr 2024

Das "Ampelräuchermännchen 17 cm Annalena" ist aus einheimischem Laubbaum gefertigt.Eine erste Bresche in die jahrhundertealte Brandmauer rund um die erzgebirgische Räucherm&a… Read More

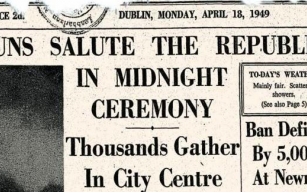

1169 And Counting...… · 08:52 17 Apr 2024

AT MIDNIGHT ON THE 17TH APRIL 75 YEARS AGO - UP THE REPUBLIC......UP THE YARD, THAT IS! Not that this (or this) couldn't happen in a proper 'Republic', just that instances like that happen… Read More

Chapter Chats With C… · 08:44 17 Apr 2024

As a dedicated reader and longtime reviewer, I’ve recently started book blogging and what better way to start than by sharing my all-time favorite reads? Here are my top 7 highly recom… Read More

Dog Blog - News, Tip… · 08:40 17 Apr 2024

Auch gesunde Hunde benötigen ihren guten Schlaf, am besten auf Anti-allergischen Hundedecken. Wir Menschen kennen das: Wenn wir in der Nacht keine Ruhe gefunden haben, dann will uns auc… Read More

Vlk Na Cestách · 08:18 17 Apr 2024

Predjamský hrad je důmyslná monumentální pevnost vestavěná do skály. Je to jedno z nejfotografovanějších míst Sl… Read More

The Computer Basics · 08:16 17 Apr 2024

Your ability to hop onto the internet or connect to other devices largely hinges on the magic of computer networking. This connectivity is all thanks to IP addresses and the Domain Name Syst… Read More

Paradise Break · 07:22 17 Apr 2024

Why go to St. Pete/Clearwater in 2024? It’s simple: the region’s beaches on Florida’s Gulf Coast are some of the best in America – St. Pete Beach, Clearwater Beach or… Read More

The Latest Popular C… · 07:21 17 Apr 2024

線上看: 皎月流火

主演: 胡亦瑤 / 林澤輝 / 吳添豪 / 袁梓銘 / &#… Read More